A Sample Offer Letter to Purchase Property Doc That Could Save You a Fortune

Buying a property is a massive financial undertaking. It’s a complex process, fraught with potential pitfalls. One of the most crucial steps, and the one that can significantly impact your final purchase price and protect your interests, is crafting a well-structured and legally sound offer letter. This document isn’t just a formality; it’s the foundation upon which your real estate transaction is built. In this article, we’ll dissect a sample offer letter, highlighting key components and demonstrating how a strong offer can potentially save you a fortune, both in upfront costs and long-term liabilities.

Understanding the Importance of a Detailed Offer Letter

Before diving into the specifics, let’s appreciate the offer letter’s significance. It’s the first formal communication you have with a seller, outlining your intent to purchase their property. A comprehensive offer letter serves several vital purposes:

- Sets the Tone: It demonstrates your seriousness and financial capability.

- Defines the Terms: It clearly states the purchase price, deposit amount, financing contingencies, and closing date.

- Protects Your Interests: It includes clauses that safeguard you against unforeseen issues like title problems or undisclosed defects.

- Initiates Negotiation: It’s the starting point for negotiations, allowing you to bargain for favorable terms.

- Creates a Legally Binding Agreement (upon acceptance): Once signed by both parties, it becomes a legally enforceable contract.

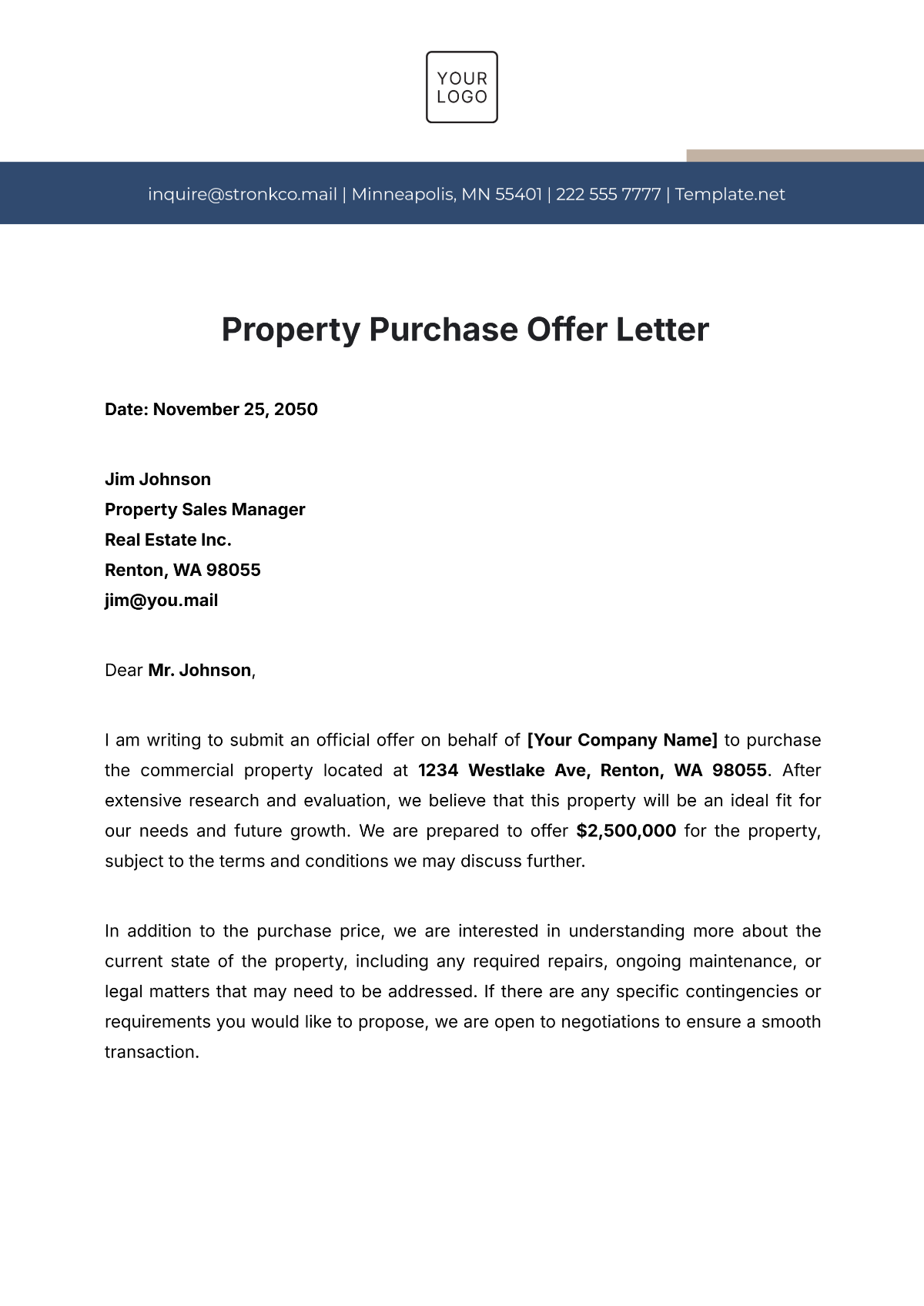

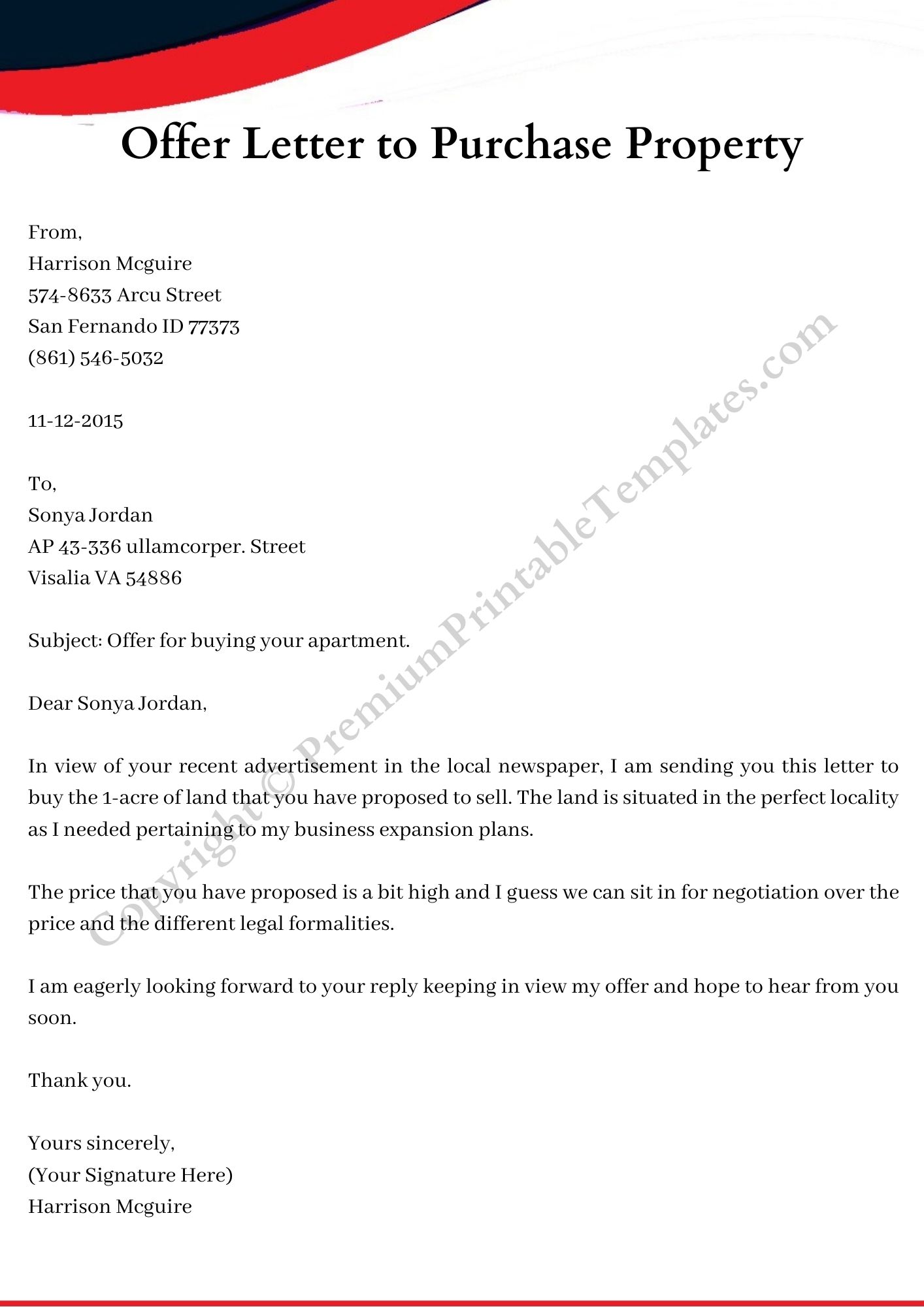

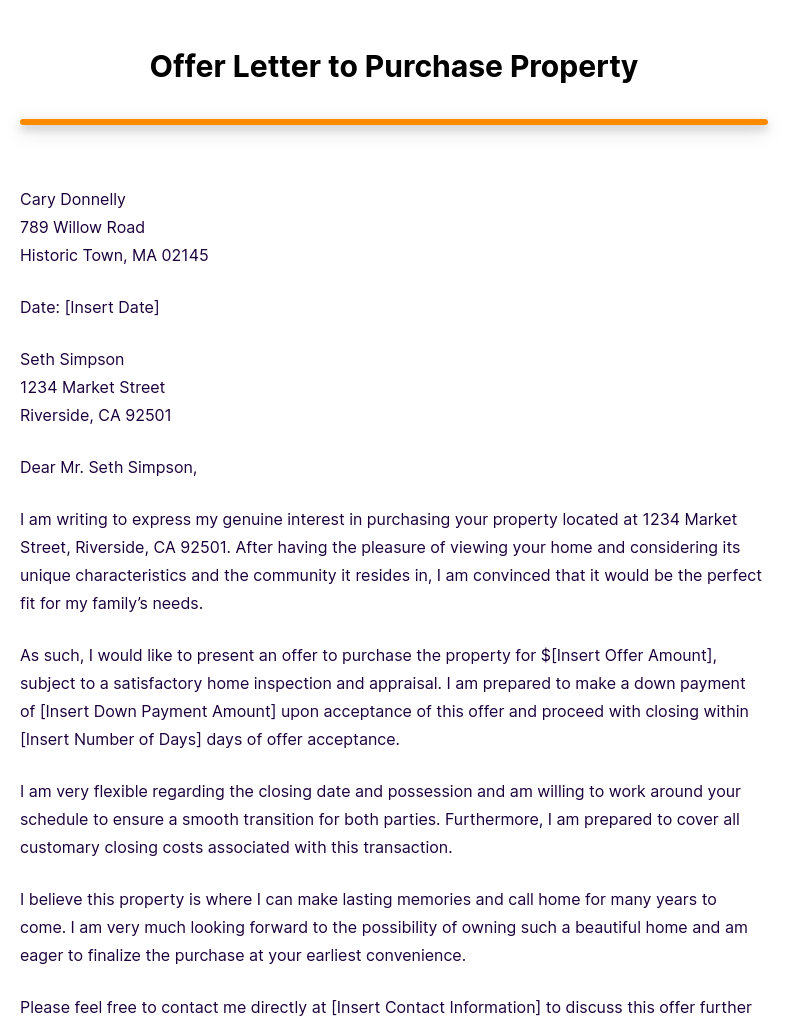

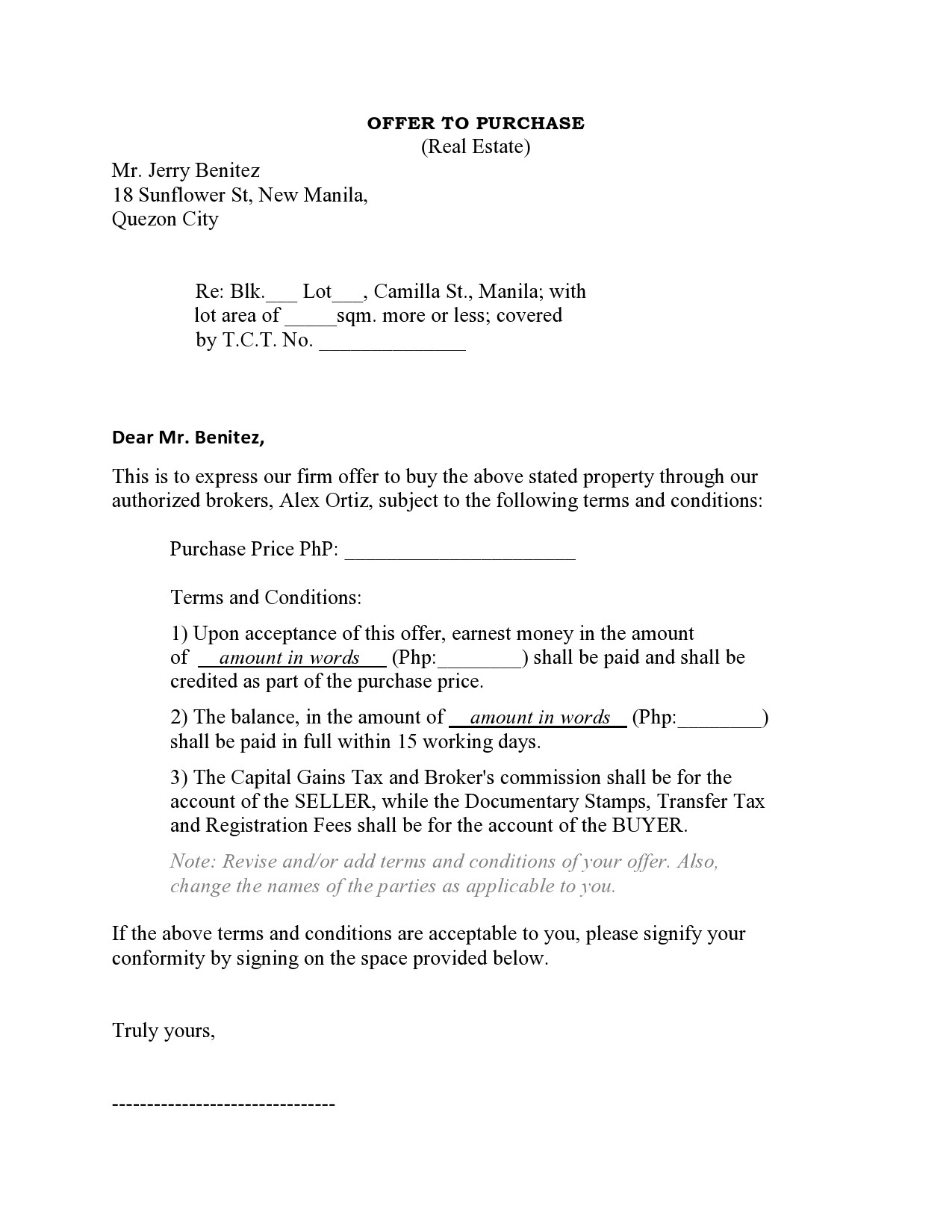

Sample Offer Letter Breakdown: Essential Components

While specific requirements vary by location, a well-structured offer letter typically includes the following key elements:

1. Heading and Identification:

- Your Information: Your full name(s), mailing address, phone number, and email address.

- Seller’s Information: The seller’s full name(s) and the property’s address.

- Date: The date the offer letter is written.

2. Property Description:

- Full Address: Include the complete street address, city, state, and zip code.

- Legal Description (If Available): This can be found on the property deed and provides a precise identification of the land.

3. Purchase Price and Payment Terms:

- Offered Purchase Price: Clearly state the amount you are offering to pay for the property.

- Earnest Money Deposit: Specify the amount of the deposit (usually a percentage of the purchase price) and where it will be held (e.g., escrow account).

- Method of Payment: Outline how the purchase will be financed (e.g., cash, conventional mortgage, FHA loan).

- Financing Contingency (if applicable): Include clauses that allow you to withdraw from the deal if you can’t secure financing within a specified timeframe.

4. Contingencies (Crucial for Protection):

- Inspection Contingency: This gives you the right to have the property inspected by a qualified professional and to negotiate repairs or withdraw from the deal if significant issues are found. This is arguably the most important contingency.

- Appraisal Contingency: Protects you if the property appraises for less than the purchase price. It allows you to renegotiate the price or withdraw from the deal.

- Title Contingency: Ensures the seller has clear title to the property and allows you to withdraw if title issues arise.

- Sale of Buyer’s Property Contingency (if applicable): This contingency allows you to make the offer contingent on the sale of your current property. (Be mindful, these make your offer less attractive.)

5. Closing Date and Possession:

- Proposed Closing Date: State the expected date for the transfer of ownership.

- Possession Date: Specify when you will take possession of the property (usually on the closing date).

6. Other Important Terms:

- Personal Property Included: List any personal property that will be included in the sale (e.g., appliances, window coverings).

- Seller Disclosures: Acknowledge the seller’s obligation to provide required disclosures (e.g., lead-based paint, property condition).

- Default Clause: Outlines the consequences if either party breaches the contract.

- Signatures: Both the buyer(s) and seller(s) must sign and date the offer letter to make it legally binding.

Example Excerpt (Purchase Price and Contingencies):

“Buyer offers to purchase the property for [Dollar Amount] (the “Purchase Price”). Buyer shall deposit [Dollar Amount] as earnest money with [Escrow Agent Name] within [Number] days of acceptance of this offer. This offer is contingent upon:

- Satisfactory Property Inspection: Buyer’s ability to obtain a satisfactory inspection report from a qualified inspector within [Number] days of acceptance.

- Appraisal: The property appraising for no less than the Purchase Price.

- Financing: Buyer obtaining a [Type of Loan] loan at an interest rate not to exceed [Percentage] within [Number] days of acceptance.”

How a Strong Offer Letter Can Save You Money

A well-crafted offer letter is more than just a formality; it’s a powerful tool for negotiation and risk mitigation. Here’s how it can save you money:

- Negotiating the Price: A strong offer, even if slightly below the asking price, can signal your seriousness and willingness to negotiate. This can lead to a lower final purchase price.

- Uncovering Hidden Defects: The inspection contingency allows you to discover potential problems before closing, giving you leverage to negotiate repairs or a price reduction.

- Protecting Against Title Issues: The title contingency safeguards you from inheriting liabilities associated with a faulty title, potentially saving you thousands in legal fees and property value loss.

- Avoiding Overpayment: The appraisal contingency prevents you from overpaying for a property, ensuring you’re not financing more than the property’s actual worth.

- Protecting Your Deposit: Well-drafted contingencies will allow you to back out of the deal and reclaim your earnest money if problems arise.

The Importance of Professional Advice

Disclaimer: This article provides general information about offer letters and is not a substitute for legal advice. Always consult with a real estate attorney and/or a qualified real estate agent before drafting or signing an offer letter. They can tailor the document to your specific situation and ensure it complies with local laws and regulations.

FAQs

1. Can I use a sample offer letter without modifying it?

No. A sample offer letter provides a template, but you must customize it to reflect the specific details of your transaction and local real estate laws.

2. How long is an offer letter valid?

The offer letter typically has an expiration date, giving the seller a deadline to respond. This timeframe is usually specified in the offer letter itself.

3. What happens if the seller rejects my offer?

The seller can reject your offer outright, make a counteroffer (which essentially creates a new offer), or simply let it expire. You can then choose to accept the counteroffer, make a new offer, or walk away from the deal.

4. Do I need a lawyer to write an offer letter?

While not always legally required, it’s highly recommended to have a real estate attorney review or assist in drafting your offer letter. They can ensure the document is legally sound and protects your interests.

5. What if the seller accepts my offer, but then I change my mind?

If you change your mind after the seller accepts, you could lose your earnest money and potentially face legal action, especially if you don’t have valid contingencies to protect you. That’s why thorough due diligence before submitting an offer is essential.

Conclusion

A well-crafted offer letter is a critical tool in the real estate buying process. By understanding its components, incorporating essential contingencies, and seeking professional guidance, you can significantly increase your chances of securing a favorable deal and protecting your financial interests. Don’t underestimate the power of a proactive and informed approach – it could be the key to saving you a fortune on your property purchase.