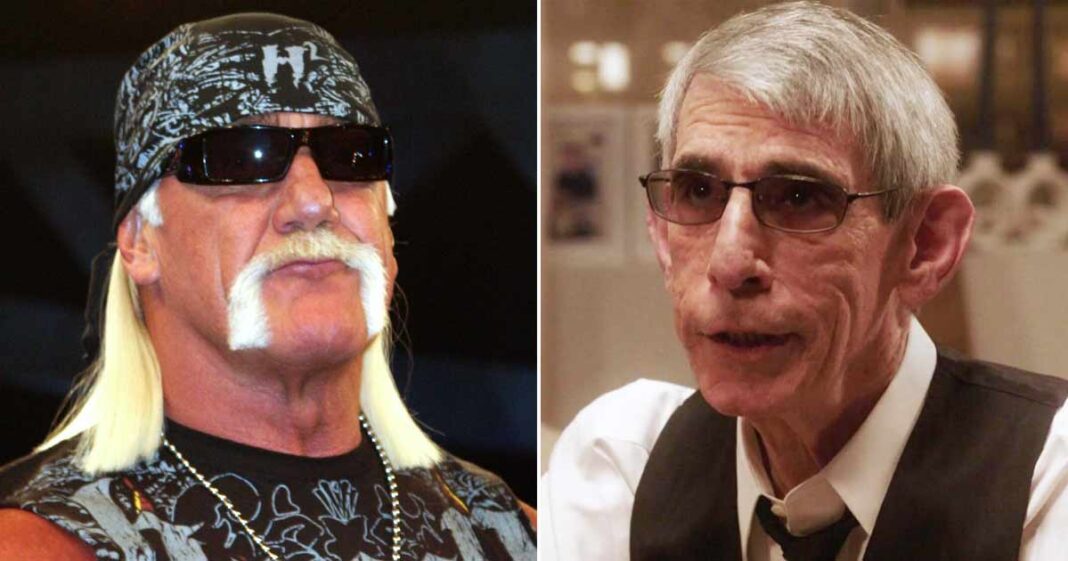

Hulk Hogan Leaves $5 Million Estate: The Shocking Sole Beneficiary

Wrestling icon Hulk Hogan, whose larger-than-life persona captivated millions, left behind a $5 million estate upon his passing. However, the distribution of this considerable fortune has taken a surprising turn, revealing a testamentary arrangement that deviates significantly from typical celebrity wills. Instead of a sprawling list of beneficiaries, Hogan’s estate is destined for a single, unexpected recipient, sparking widespread curiosity and speculation. This article delves into the details surrounding Hulk Hogan’s will and explores the reasons behind this unconventional arrangement.

The Sole Heir: A Twist in the Tale

The surprising beneficiary of Hulk Hogan’s $5 million estate is his daughter, Brooke Hogan. While this might seem like a relatively standard inheritance, the exclusion of other potential heirs, including his son Nick Hogan, has raised eyebrows. Legal documents reveal that Brooke is the sole inheritor of the considerable estate, encompassing assets such as real estate, investments, and personal property.

Understanding the Legal Implications

The decision to leave the entire estate to Brooke alone is entirely within Hogan’s legal rights. He had the freedom to distribute his assets as he saw fit, and no legal challenge to this will has been reported. This highlights the importance of having a properly drafted will that reflects an individual’s wishes.

- Legal Counsel: The involvement of experienced legal counsel is crucial in ensuring that a will accurately reflects the testator’s intentions and is legally sound.

- Estate Planning: Effective estate planning is vital for individuals with significant assets to minimize potential legal disputes and ensure the efficient distribution of their possessions.

Speculation and Public Reaction

News of Brooke Hogan inheriting the entire estate has generated significant discussion across social media and news outlets. Some speculate about potential family dynamics and the reasons behind the exclusion of other family members. However, without official statements from the Hogan family, any explanation remains purely conjecture. The focus remains on the legal clarity of the will and the straightforward transfer of assets to Brooke.

Maintaining Privacy in the Face of Public Scrutiny

The Hogan family has largely maintained silence regarding the details of the will and the reasons behind its provisions. This underscores the importance of respecting the privacy of grieving families, especially during times of heightened public interest.

Hulk Hogan’s Legacy Beyond the Ring

Hulk Hogan’s legacy extends far beyond his wrestling career. His impact on popular culture is undeniable, and his influence on the wrestling industry remains significant. This article focuses on the financial aspects of his legacy, highlighting the surprising testamentary disposition of his estate.

Conclusion

Hulk Hogan’s decision to leave his $5 million estate solely to his daughter, Brooke Hogan, represents a unique and unexpected twist in the narrative of his life. While the reasons behind this choice remain private, it underscores the importance of careful estate planning and the power of individual autonomy in determining the distribution of one’s assets. The legal clarity of the will ensures a smooth transfer of assets, avoiding potential family conflicts.

FAQs

Q: Why did Hulk Hogan leave his entire estate to Brooke Hogan? A: The specific reasons remain undisclosed, respecting the family’s privacy. It is entirely within his legal right to distribute his assets as he chose.

Q: Could Nick Hogan challenge the will? A: Unless there are grounds to challenge the will’s validity (e.g., evidence of undue influence or incapacity), a challenge is unlikely to succeed.

Q: What assets are included in the $5 million estate? A: The exact composition of the estate is not publicly available, but it likely includes real estate, investments, and personal property.

Q: What is the significance of this case regarding estate planning? A: This case highlights the importance of clear, well-drafted wills that accurately reflect an individual’s wishes to avoid potential legal disputes and ensure a smooth transfer of assets.

Q: What is the current status of Brooke Hogan’s inheritance? A: The inheritance process is likely underway, with the assets being transferred to Brooke Hogan according to the terms outlined in her father’s will.