Is Medicare Insurance Certification Worth It? A Comprehensive Guide

Navigating the complexities of Medicare can be daunting, both for beneficiaries and those who assist them. This leads many to consider Medicare insurance certification. But is it truly worth the investment of time and money? This comprehensive guide explores the pros and cons, helping you determine if certification is the right choice for your career aspirations and goals.

Who Should Consider Medicare Insurance Certification?

Medicare insurance certification is beneficial for a variety of professionals who regularly interact with Medicare beneficiaries or handle Medicare-related claims. This includes:

- Insurance Agents and Brokers: Understanding Medicare intricacies is crucial for effectively advising clients on plan options and enrollment. Certification enhances credibility and expertise.

- Healthcare Professionals: Doctors, nurses, and other healthcare providers often need to navigate Medicare billing and reimbursement processes. Certification simplifies this.

- Financial Advisors: Medicare planning is a significant aspect of retirement financial planning. Certification allows advisors to provide more informed and comprehensive advice.

- Social Workers and Case Managers: Professionals assisting elderly individuals often need to understand Medicare benefits to advocate effectively for their clients.

- Anyone interested in a career in Medicare: Certification provides a strong foundation for building a career in this growing field.

Benefits of Medicare Insurance Certification

Obtaining Medicare insurance certification offers several compelling advantages:

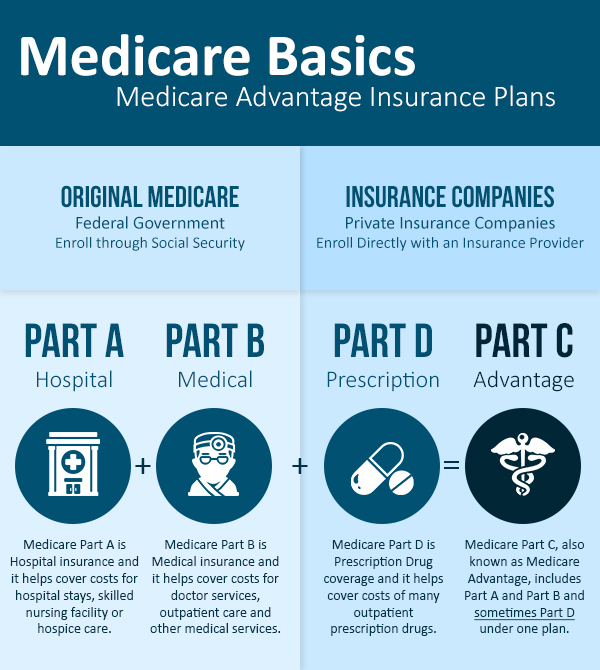

- Enhanced Knowledge and Expertise: Certification programs provide in-depth training on Medicare’s various parts (A, B, C, and D), eligibility requirements, coverage details, and enrollment procedures.

- Increased Credibility and Professionalism: Holding a certification demonstrates a commitment to professional development and a deep understanding of Medicare, building client trust and confidence.

- Improved Client Service: Certified professionals can provide more accurate and effective assistance to clients, navigating the complexities of Medicare with greater ease.

- Better Career Opportunities: Certification can open doors to higher-paying positions and advancement opportunities within the insurance and healthcare industries.

- Competitive Advantage: In a competitive market, certification distinguishes you from uncertified professionals, making you a more attractive candidate for employers and clients.

Drawbacks of Medicare Insurance Certification

While the benefits are significant, it’s essential to consider potential drawbacks:

- Cost: Certification programs involve fees for enrollment, materials, and exam preparation.

- Time Commitment: Successful completion requires dedicating time to study and prepare for exams.

- Ongoing Requirements: Some certifications require continuing education to maintain validity.

- Not a Guarantee of Success: While certification enhances your prospects, it doesn’t guarantee employment or immediate financial returns.

Choosing the Right Medicare Certification Program

Several organizations offer Medicare insurance certifications. Research different programs to find one that aligns with your needs and learning style. Consider factors like:

- Accreditation: Ensure the program is accredited by a reputable organization.

- Curriculum: Review the course content to ensure it covers the areas relevant to your career goals.

- Exam Format: Understand the exam structure and requirements.

- Cost and Duration: Compare the costs and time commitment of different programs.

Conclusion

The decision of whether or not to pursue Medicare insurance certification is a personal one. Weighing the benefits of enhanced knowledge, increased credibility, and improved career prospects against the costs and time commitment is crucial. For those working directly with Medicare beneficiaries or aiming for a career in this specialized field, the investment often pays significant dividends. However, careful consideration of individual circumstances and career goals is essential before embarking on this professional development path.

Frequently Asked Questions (FAQs)

Q1: How much does Medicare insurance certification cost?

A1: Costs vary significantly depending on the program and provider. Expect to pay anywhere from a few hundred to several thousand dollars.

Q2: How long does it take to obtain Medicare insurance certification?

A2: The duration depends on the program’s intensity and your study habits. Some programs can be completed in a few weeks, while others may take several months.

Q3: Are there different types of Medicare insurance certifications?

A3: Yes, various organizations offer different certifications with varying levels of specialization. Research different options to find the best fit.

Q4: Is Medicare insurance certification required for my job?

A4: Certification is not typically mandated by law, but it can be a significant advantage and even a requirement for some employers or roles.

Q5: How do I maintain my Medicare insurance certification?

A5: Many certifications require continuing education credits to maintain validity. Check your certification provider’s requirements for renewal.