The Best Certificate Interest Rates You’ll Find Today: Maximize Your Savings

Are you looking for a safe and reliable way to grow your savings? Certificates of Deposit (CDs) offer a secure investment option with fixed interest rates, making them a popular choice for those seeking predictable returns. But with a multitude of options available, finding the best certificate interest rates can feel overwhelming. This article provides a comprehensive overview of current CD rates, key factors to consider, and how to navigate the market to maximize your earnings.

Understanding Certificates of Deposit (CDs)

Before diving into the rates, let’s clarify what CDs are. A CD is a savings account that holds a fixed amount of money for a fixed period of time, and, in exchange, the issuing institution pays interest. The interest rate is typically higher than that of a traditional savings account, and the longer the term, the higher the rate usually goes. The most significant advantage of a CD is its security; your principal is insured by the Federal Deposit Insurance Corporation (FDIC) or the National Credit Union Administration (NCUA), up to $250,000 per depositor, per insured institution.

Factors Affecting CD Interest Rates

Several factors influence the interest rates offered on CDs. Understanding these can help you make informed decisions:

- Term Length: Generally, longer-term CDs (e.g., 3-year, 5-year) offer higher interest rates than shorter-term CDs (e.g., 3-month, 6-month).

- Current Market Interest Rates: The overall economic climate, particularly the federal funds rate set by the Federal Reserve, significantly impacts CD rates. When interest rates rise, CD rates tend to follow.

- The Financial Institution: Different banks and credit unions will offer varying rates. Online banks often offer more competitive rates due to lower overhead costs.

- Minimum Deposit Requirements: Some CDs require a minimum deposit to open the account. Higher minimums might sometimes unlock slightly better rates.

- Special Promotions: Banks sometimes run promotional offers on specific CD terms, providing temporarily higher rates.

Current CD Interest Rate Landscape: A Snapshot

Tracking the current CD market is crucial. While rates fluctuate regularly, here’s a general overview of what you might expect:

Note: These are general estimates and are subject to change. Always verify rates with the specific financial institution before making a decision.

- Short-Term CDs (3 months - 1 year): Rates often fluctuate with the market but generally provide a moderate return.

- Mid-Term CDs (1 year - 3 years): Typically offer higher rates than short-term CDs, balancing liquidity with yield.

- Long-Term CDs (3 years - 5 years): These CDs generally offer the highest rates, but your money is locked in for a longer period.

Where to Find Competitive Rates:

- Online Banks: Often offer higher rates due to lower operating costs.

- Credit Unions: Can offer competitive rates, especially if you meet their membership requirements.

- Local Banks: Check with your local banks for their offerings, especially if you prefer in-person service.

- Rate Comparison Websites: Use websites that compare CD rates from various institutions to find the best deals.

Choosing the Right CD for You

Selecting the best CD involves considering your individual financial goals and circumstances:

- Assess Your Liquidity Needs: How soon might you need access to your funds? If you anticipate needing the money soon, a shorter-term CD might be preferable. Remember, early withdrawals usually incur penalties.

- Determine Your Risk Tolerance: CDs are generally low-risk investments. However, if you are comfortable with more risk, other investment options may offer higher potential returns.

- Compare Rates and Terms: Don’t settle for the first rate you see. Shop around and compare rates, terms, and any associated fees or penalties.

- Consider Laddering: Laddering involves dividing your investment across multiple CDs with different terms. This strategy provides access to some funds at different intervals while still maximizing your earning potential.

Potential Downsides of Certificates of Deposit

While CDs are a safe investment, there are some potential drawbacks to consider:

- Early Withdrawal Penalties: Withdrawing funds before the CD matures typically results in a penalty, which can significantly reduce your interest earnings.

- Inflation Risk: If inflation outpaces your CD’s interest rate, the real value of your savings may decrease.

- Limited Liquidity: Your funds are locked in for the CD’s term, making them inaccessible without penalty.

Maximizing Your Returns: Tips for Success

- Shop Around: Don’t limit yourself to your current bank. Compare rates from multiple financial institutions.

- Negotiate: While less common with CDs, it’s worth asking if there’s any room for negotiation, especially with larger deposits.

- Consider Brokered CDs: These CDs are offered through brokerage firms and can provide access to a wider range of institutions and potentially more competitive rates.

- Stay Informed: Keep track of market trends and interest rate changes to make informed decisions when renewing your CD or opening a new one.

Conclusion: Secure Your Financial Future with CDs

Certificates of Deposit offer a secure and reliable way to grow your savings, especially in today’s volatile financial landscape. By understanding the factors that influence interest rates, comparing offers from different institutions, and considering your individual needs, you can find the best certificate interest rates to maximize your returns. Remember to stay informed about market trends and consider the risks and benefits before investing. With careful planning, CDs can be a valuable tool for achieving your financial goals.

Frequently Asked Questions (FAQs)

1. What happens if I withdraw my money before the CD matures?

You’ll typically incur an early withdrawal penalty. The penalty amount varies depending on the financial institution and the CD’s term. It often involves forfeiting a certain amount of interest earned.

2. Are CD interest rates fixed?

Yes, the interest rate on a CD is fixed for the entire term of the certificate. This provides predictability in your earnings.

3. Is my money safe in a CD?

Yes, your money is insured by the FDIC (for banks) or the NCUA (for credit unions) up to $250,000 per depositor, per insured institution.

4. How often is interest paid on a CD?

Interest can be paid out monthly, quarterly, semi-annually, or at maturity, depending on the terms of the CD and the issuing institution. You can usually choose how you want to receive the interest (e.g., reinvested into the CD or sent to your checking account).

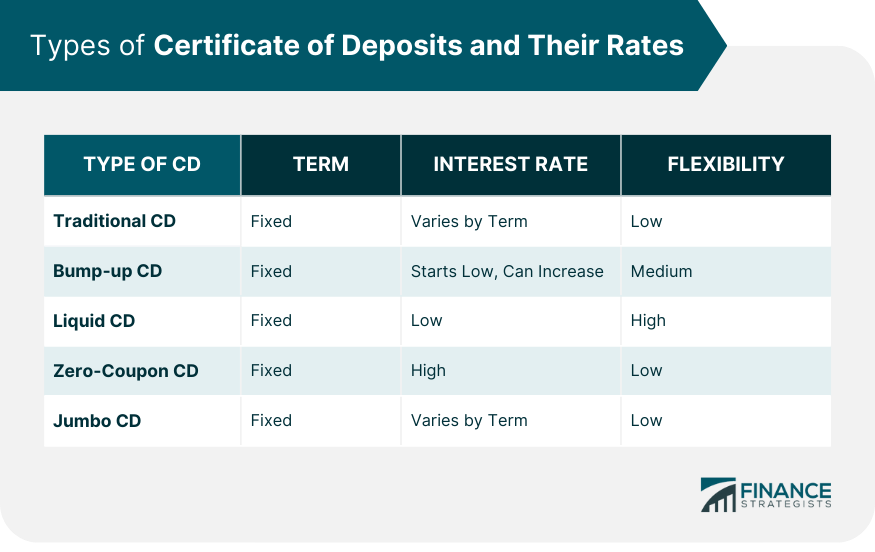

5. What is a “bump-up” CD?

A “bump-up” CD allows you to increase your interest rate once or twice during the CD’s term if interest rates rise in the market. This can be a beneficial feature if you anticipate rising rates.