The BIR Cash Receipts Journal Sample That Works: A Comprehensive Guide

Are you a business owner in the Philippines, struggling to manage your cash inflows efficiently and in compliance with the Bureau of Internal Revenue (BIR) regulations? Keeping accurate records of all cash receipts is crucial for tax compliance and financial health. This guide provides a comprehensive overview of the BIR Cash Receipts Journal (CRJ) sample, helping you understand its purpose, structure, and how to use it effectively. We’ll cover everything from the basics to practical application, ensuring you’re prepared to meet your financial obligations and track your revenue accurately.

Understanding the Importance of the Cash Receipts Journal (CRJ)

The Cash Receipts Journal (CRJ) is a fundamental accounting record used to document all cash received by a business. It serves as a primary source of information for:

- Tracking Revenue: Provides a detailed record of all income generated from various sources.

- Tax Compliance: Ensures accurate reporting of taxable income to the BIR.

- Financial Analysis: Allows for in-depth analysis of cash flow patterns and revenue trends.

- Internal Control: Helps prevent fraud and errors by providing an audit trail of all cash inflows.

Properly maintained CRJs are essential for a smooth BIR audit and can save you time and potential penalties.

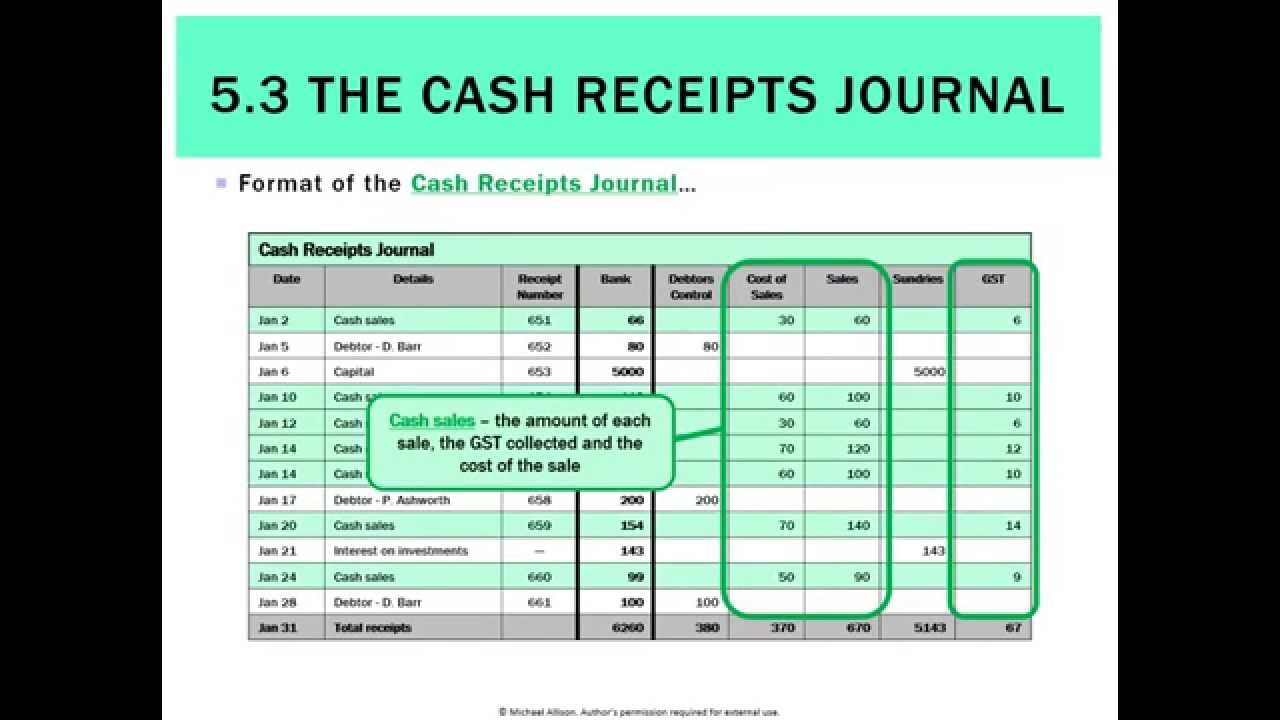

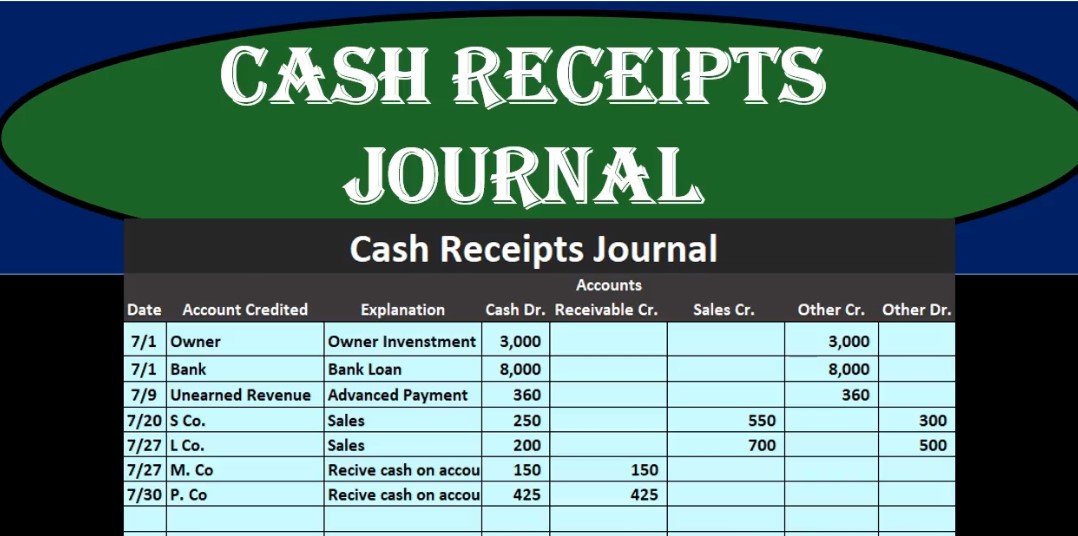

The Structure of a BIR-Compliant Cash Receipts Journal Sample

The standard BIR-compliant CRJ typically includes the following columns:

- Date: The date the cash was received.

- Receipt Number: The unique number assigned to the official receipt (OR) issued.

- Particulars: A description of the source of the cash (e.g., Sales, Accounts Receivable, Loan Proceeds).

- Debit: Typically, only the cash account is debited. The amount of cash received.

- Credit: This section will typically include the specific revenue or liability account being credited. (e.g., Sales Revenue, Accounts Receivable, Other Income)

- Amount: The monetary value of the transaction.

- VAT (if applicable): Separate columns for VATable Sales, Output VAT, and VAT-exempt Sales are often included.

- Non-VAT (if applicable): Separate columns for Non-VAT Sales.

- Total: The total amount of cash received for each transaction.

- Remarks: Optional column for additional notes or explanations.

Here’s a simplified example of a CRJ:

| Date | Receipt No. | Particulars | Debit (Cash) | Credit (Sales) | Amount | VATable Sales | Output VAT | Non-VAT Sales | Total | Remarks |

|---|---|---|---|---|---|---|---|---|---|---|

| 2024-10-27 | OR-001 | Sales - Product A | 11,200.00 | 10,000.00 | 11,200.00 | 10,000.00 | 1,200.00 | 11,200.00 | Cash Sale | |

| 2024-10-27 | OR-002 | Sales - Product B | 5,600.00 | 5,000.00 | 5,600.00 | 5,000.00 | 600.00 | 5,600.00 | Cash Sale | |

| 2024-10-28 | OR-003 | Payment - Accounts Receivable | 22,400.00 | 20,000.00 | 22,400.00 | 20,000.00 | 2,400.00 | 22,400.00 | Customer: ABC Corp | |

| 2024-10-28 | OR-004 | Loan Proceeds | 50,000.00 | Other Income | 50,000.00 | 50,000.00 | From Bank | |||

| Totals | 89,200.00 | 35,000.00 | 89,200.00 | 35,000.00 | 4,200.00 | 89,200.00 |

Note: This is a simplified example. The specific columns and details may vary depending on the nature of your business and the complexity of your transactions. Always consult with a tax professional for specific guidance.

Utilizing the CRJ Effectively: Best Practices

- Use Official Receipts: Always issue official receipts (ORs) for every cash transaction. The receipt number should correspond with the CRJ entry.

- Detailed Descriptions: Provide clear and concise descriptions in the “Particulars” column.

- Regular Updates: Update your CRJ daily or at least weekly to maintain accuracy.

- Reconcile with Bank Statements: Regularly reconcile your CRJ with your bank statements to ensure all cash receipts are accounted for.

- Maintain Proper Filing: Keep your CRJ, along with supporting documents (ORs, deposit slips, etc.), organized and accessible for BIR audits.

- Accuracy is Paramount: Ensure all figures entered are accurate and free from errors.

Key Considerations for VAT-Registered Businesses

If your business is VAT-registered, you must pay close attention to the VAT-related columns.

- VATable Sales: Record the value of goods or services subject to VAT.

- Output VAT: Record the 12% VAT collected on VATable sales.

- Non-VAT Sales: Record the value of goods or services that are exempt from VAT.

- Accurate Calculation: Ensure accurate calculation of VAT and its corresponding entries.

Choosing the Right CRJ Format

You can maintain your CRJ in several formats:

- Manual Journal: Using a physical ledger book. This is suitable for small businesses with a low volume of transactions.

- Spreadsheet (Excel, Google Sheets): Provides flexibility and ease of calculation. Offers features like auto-sum and formula-based calculations.

- Accounting Software: Provides automation, integration with other accounting functions, and enhanced reporting capabilities. Popular choices include Xero, QuickBooks, and MYOB.

Conclusion: Stay Compliant and Organized

Implementing a well-maintained Cash Receipts Journal is crucial for financial accuracy, tax compliance, and informed decision-making. By understanding the structure, following best practices, and choosing the right format, you can effectively manage your cash inflows and meet your obligations to the BIR. Remember to seek professional advice from a certified public accountant (CPA) or tax advisor to ensure you are fully compliant with all applicable regulations.

FAQs about the BIR Cash Receipts Journal

1. What is the purpose of the Cash Receipts Journal (CRJ)?

The CRJ serves as a detailed record of all cash received by a business, providing information for tracking revenue, tax compliance, financial analysis, and internal control.

2. What documents do I need to keep with my CRJ?

You should keep all supporting documents, including Official Receipts (ORs), deposit slips, bank statements, and any other documentation that supports the cash receipts recorded in the CRJ.

3. Is it mandatory to use a CRJ?

Yes, maintaining accurate records of cash receipts is a requirement for all businesses in the Philippines, and the CRJ is the standard method for documenting this information. It is used for BIR audits.

4. Can I use accounting software instead of a manual CRJ?

Yes, using accounting software is a perfectly acceptable and often recommended method. It can automate many processes, improve accuracy, and facilitate reporting. The software must be able to generate the necessary reports for BIR compliance.

5. What happens if I don’t keep a CRJ or have inaccurate records?

Failure to maintain accurate records, including the CRJ, can lead to penalties, fines, and potential tax audits by the BIR. It can also make it difficult to analyze your business’s financial performance and make informed decisions.