The Business Letter of Intent to Purchase in PDF That Works: A Comprehensive Guide

In the complex world of business transactions, a Letter of Intent (LOI) serves as a crucial preliminary step, outlining the intent of one party to purchase the assets or equity of another. This document, often formalized as a PDF for ease of sharing and archiving, sets the stage for more detailed negotiations and a definitive purchase agreement. Understanding the intricacies of creating a compelling and legally sound LOI in PDF format is paramount to protecting your interests and ensuring a smooth transaction. This guide provides a comprehensive overview of crafting an effective business Letter of Intent to Purchase, specifically focusing on its PDF format and best practices.

What is a Letter of Intent to Purchase?

A Letter of Intent (LOI) to Purchase, sometimes called a “Term Sheet,” is a non-binding (in most cases) document that expresses a buyer’s intention to purchase a seller’s business, assets, or equity. It’s a vital tool for several reasons:

- Outlines Key Terms: It establishes the preliminary terms of the proposed deal, including the purchase price, payment structure, and assets/equity being acquired.

- Sets Expectations: It provides a clear understanding of the parties’ expectations and intentions, minimizing misunderstandings later in the process.

- Facilitates Due Diligence: It often grants the buyer an exclusive period to conduct due diligence, examining the seller’s financials, operations, and legal standing.

- Saves Time and Resources: It allows both parties to gauge the viability of the deal before investing significant resources in creating a full purchase agreement.

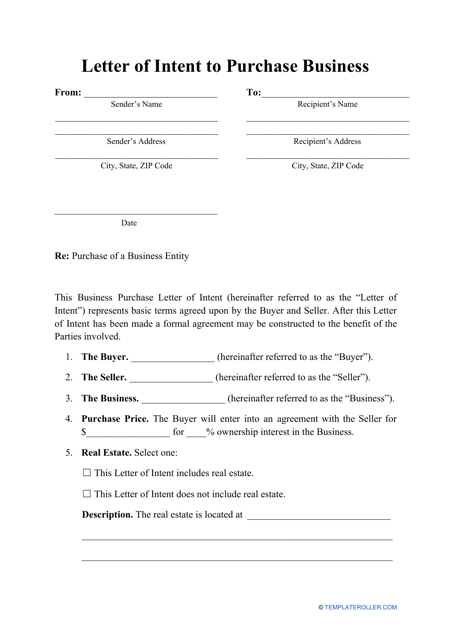

Key Components of a Strong Letter of Intent to Purchase in PDF

While the specific content will vary depending on the nature of the transaction, a well-crafted LOI in PDF format should generally include the following essential elements:

- Heading and Identification:

- Clearly identify the document as a “Letter of Intent” or “Letter of Intent to Purchase.”

- Include the date and the names and addresses of both the buyer and the seller.

- Recitals/Introduction:

- State the purpose of the LOI and the parties’ intent to negotiate a definitive purchase agreement.

- Briefly describe the business or assets to be acquired.

- Purchase Price and Payment Terms:

- Specify the proposed purchase price.

- Outline the payment structure (e.g., cash, installments, stock).

- Mention any earn-out provisions, if applicable.

- Assets/Equity Being Acquired:

- Clearly define the specific assets, equity, or business being purchased.

- Include a detailed description, if necessary.

- Due Diligence Period:

- State the length of time the buyer has to conduct due diligence.

- Specify the scope of the due diligence process (e.g., financial, legal, operational).

- Exclusivity:

- Often includes a clause granting the buyer exclusivity during the due diligence period. This prevents the seller from negotiating with other potential buyers.

- Confidentiality:

- Reiterate the importance of confidentiality regarding the terms of the LOI and the proposed transaction.

- Binding vs. Non-Binding Provisions:

- Clearly delineate which sections are legally binding (e.g., exclusivity, confidentiality) and which are non-binding (e.g., purchase price, payment terms).

- Governing Law:

- Specify the state or jurisdiction whose laws will govern the LOI.

- Expiration Date:

- Set a deadline for the LOI’s validity, ensuring that the parties move forward in a timely manner.

- Signatures:

- Include signature lines for both the buyer and the seller.

Creating a PDF-Ready Letter of Intent: Best Practices

Creating a professional-looking and easily shareable PDF LOI is crucial. Here’s how to ensure your document is effective:

- Use a Reputable Word Processor: Utilize software like Microsoft Word, Google Docs, or similar programs to draft the LOI.

- Formatting and Style:

- Use a clear and professional font (e.g., Arial, Times New Roman).

- Maintain consistent formatting throughout the document.

- Use headings and subheadings to organize the information.

- Include page numbers.

- Conversion to PDF:

- Use the “Save As” or “Export” function within your word processor to save the document as a PDF. This ensures compatibility across different platforms.

- Optional: Consider using PDF editing software to add security features, such as password protection or the ability to limit editing, especially if the document contains sensitive information.

- Review and Proofread: Before finalizing the PDF, carefully review the document for any errors in grammar, spelling, or formatting. Have another person review it as well.

- Secure Sharing: When sharing the PDF, consider using secure methods like encrypted email or secure file-sharing platforms.

Legal Considerations and Seeking Professional Advice

While a Letter of Intent is typically non-binding, certain clauses (like confidentiality and exclusivity) are legally enforceable. It’s highly recommended to consult with an attorney experienced in business law and mergers and acquisitions before drafting or signing an LOI. An attorney can:

- Ensure the LOI accurately reflects your intentions.

- Protect your legal interests.

- Help you understand the potential risks and liabilities.

- Provide guidance on negotiating the terms.

Conclusion: Solidifying Your Intent with a Well-Crafted PDF

A well-structured Letter of Intent to Purchase in PDF format is a critical tool for initiating and formalizing business acquisition discussions. By understanding its key components, best practices for creating a PDF, and the importance of legal counsel, you can significantly increase your chances of a successful transaction. Remember that this document sets the foundation for a complex process, so thoroughness and attention to detail are essential. By investing the time and effort to create a clear, concise, and legally sound LOI, you’re taking a crucial step toward achieving your business goals.

Frequently Asked Questions (FAQs)

1. Is a Letter of Intent legally binding?

Generally, a Letter of Intent is non-binding, except for specific clauses such as confidentiality, exclusivity, and governing law. The overall intent is to outline the preliminary terms and negotiate a definitive agreement.

2. What happens after the Letter of Intent is signed?

After signing the LOI, the buyer typically conducts due diligence. This involves reviewing the seller’s financial records, legal documents, and other relevant information. Simultaneously, the parties negotiate the terms of the definitive purchase agreement.

3. How long does a Letter of Intent typically last?

The duration of an LOI is determined by the expiration date specified within the document. The timeframe usually reflects the due diligence period and the anticipated negotiation timeline, ranging from a few weeks to several months.

4. Can the terms of the Letter of Intent be changed?

Yes, the terms of the LOI can be changed through mutual agreement. However, any changes should be documented in writing and signed by both parties to ensure clarity and enforceability.

5. What happens if the deal falls through after the Letter of Intent is signed?

If the deal falls through, the non-binding provisions of the LOI typically expire. However, the binding clauses, such as confidentiality, remain in effect. Each party is then free to pursue other opportunities.