The Financial Support Letter of Support Template You Need Right Now: Secure Your Financial Future

Life throws curveballs. Whether you’re applying for a loan, a visa, a grant, or simply navigating a difficult financial situation, having a strong financial support letter can make all the difference. This crucial document provides evidence of financial backing, offering reassurance to the recipient and bolstering your application. This article provides you with a comprehensive guide and a ready-to-use template, ensuring you can confidently craft a persuasive financial support letter. We’ll cover everything you need to know, from understanding the purpose of the letter to tailoring it to your specific needs.

What is a Financial Support Letter? Understanding Its Purpose

A financial support letter, often referred to as a letter of financial support, is a formal document written by an individual or entity to confirm their commitment to providing financial assistance to another person. It serves as proof of financial capacity and offers reassurance to the recipient, which might be a bank, government agency, educational institution, or immigration authority.

The letter’s primary purpose is to demonstrate:

- Financial Stability: Showing the ability to meet financial obligations.

- Commitment: Clearly stating the intention to provide financial aid.

- Transparency: Providing details about the support offered, including the amount and duration.

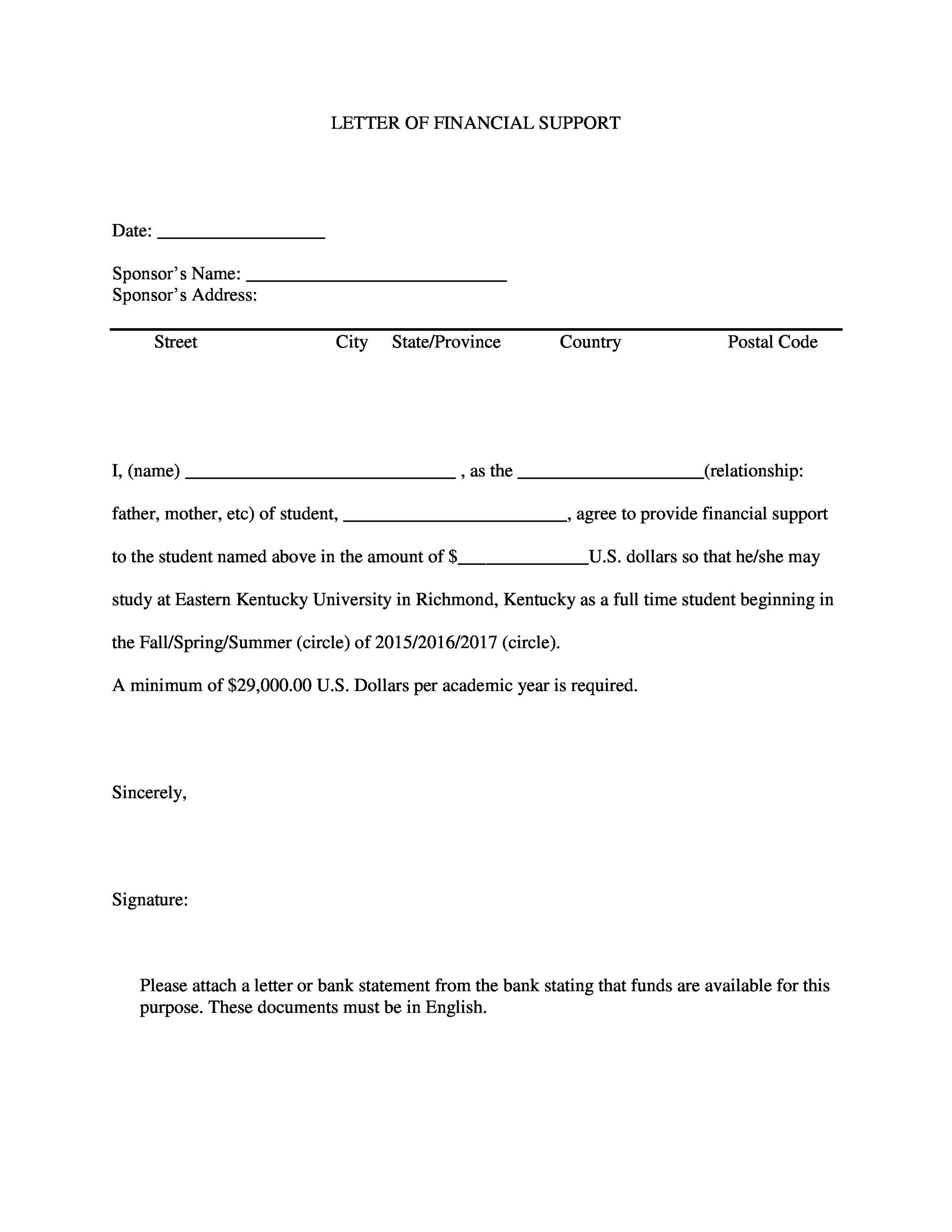

Key Components of a Powerful Financial Support Letter

Crafting an effective financial support letter requires attention to detail and clarity. Here’s a breakdown of the essential elements:

- Your Contact Information: Your full name, address, phone number, and email address.

- Recipient’s Contact Information: The name and address of the individual or entity to whom the letter is addressed (e.g., the bank, the school, the immigration office).

- Date: The date the letter is written.

- Salutation: A formal greeting, such as “Dear [Recipient’s Name/Title].”

- Introduction: Clearly state the purpose of the letter – to provide financial support. Identify yourself and your relationship to the individual receiving support.

- Details of Financial Support: This is the most critical section. Be specific and include:

- The exact amount of financial support you are providing (in words and numbers).

- The frequency of the support (e.g., monthly, annually, one-time).

- The duration of the support (e.g., for the next year, until a specific date).

- The method of providing support (e.g., bank transfers, cash, covering expenses).

- Proof of Funds (Optional, but Highly Recommended): Include documentation to back up your claims, such as:

- Bank statements (recent and showing sufficient funds).

- Pay stubs (to demonstrate income).

- Investment account statements.

- Statement of Intent: Reiterate your commitment to providing the support and your understanding of the recipient’s needs.

- Closing: A formal closing, such as “Sincerely,” or “Yours faithfully,” followed by your signature and printed name.

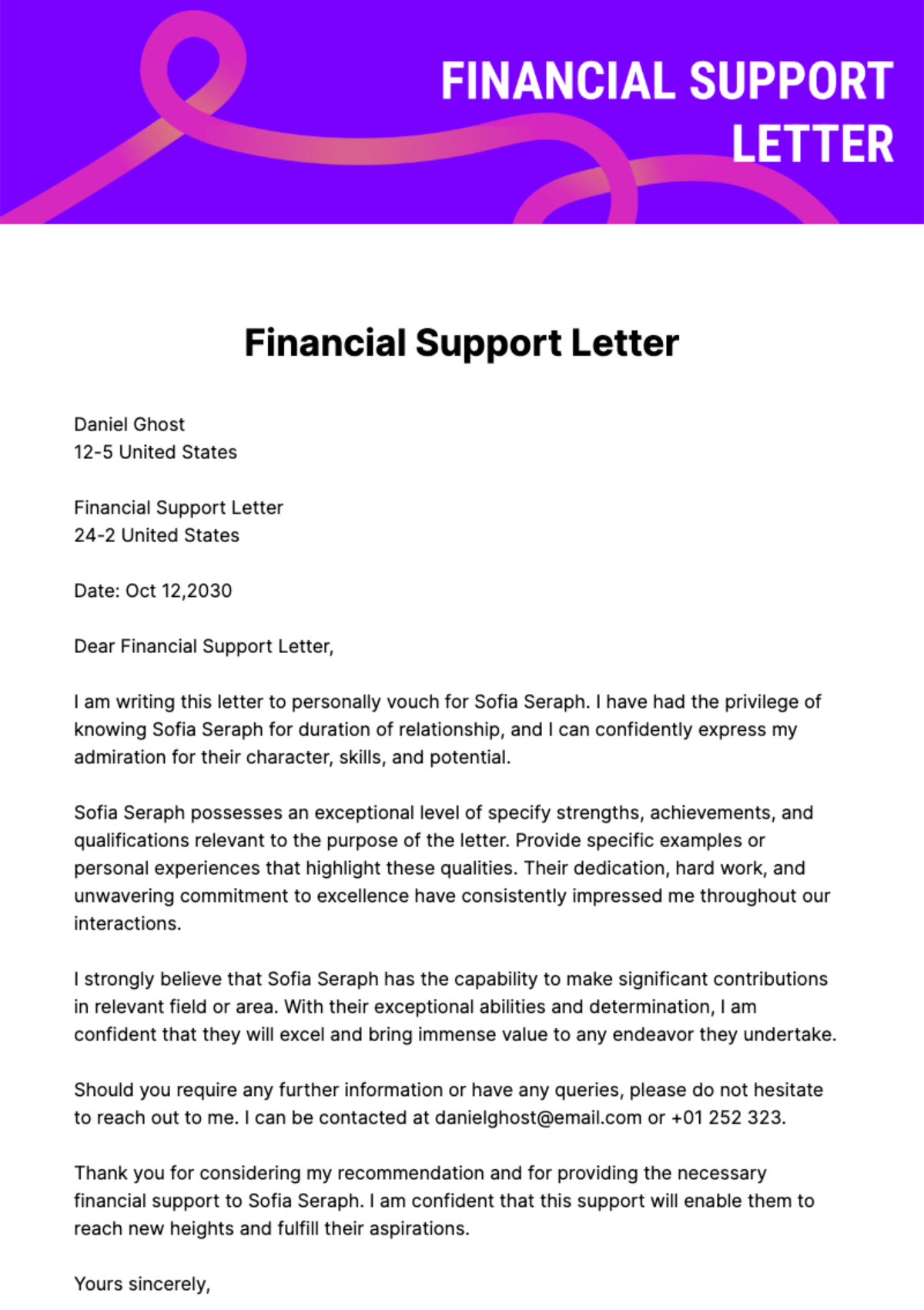

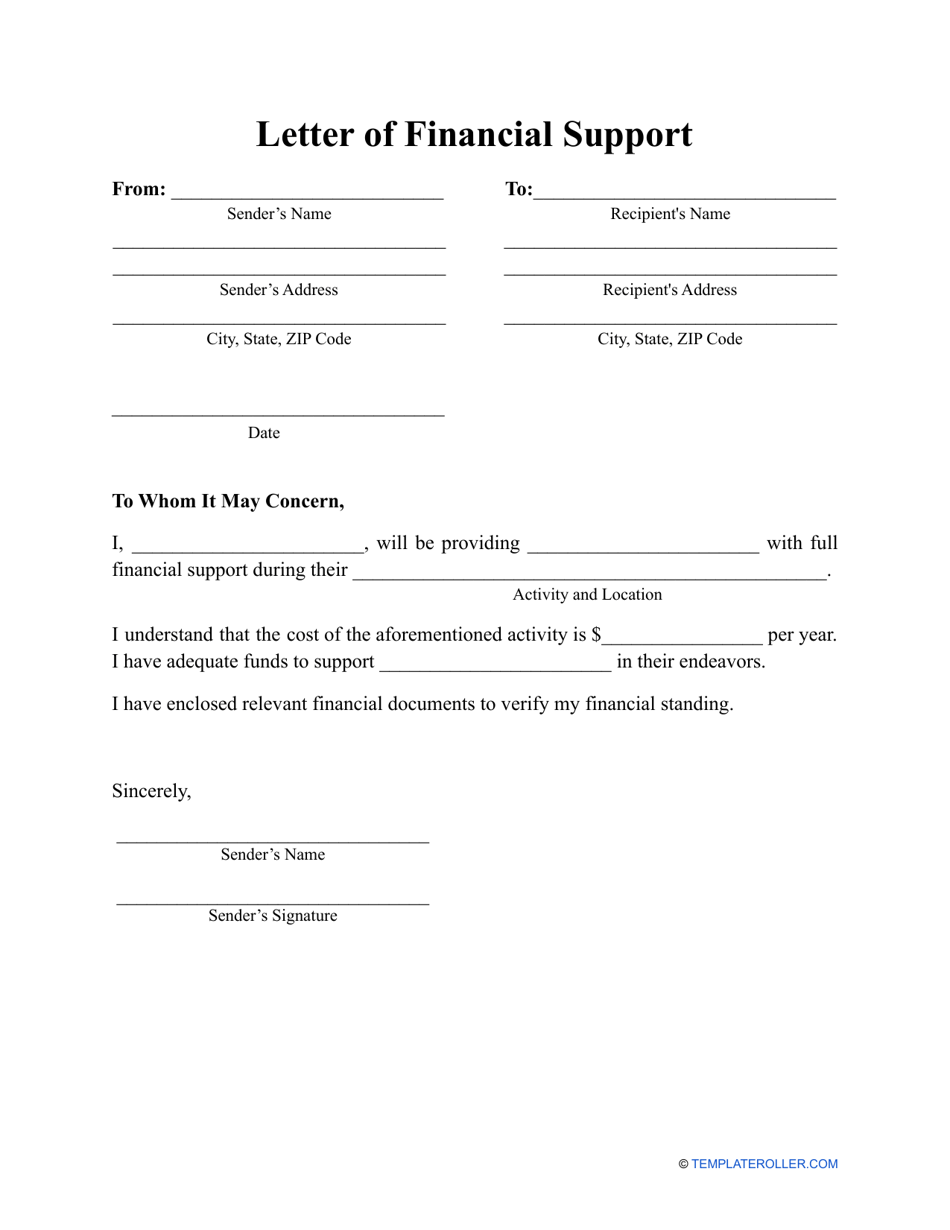

Financial Support Letter Template: Your Ready-to-Use Guide

Here’s a template you can adapt to your specific circumstances. Remember to customize it with your information and the details of your financial support.

[Your Name]

[Your Address]

[Your Phone Number]

[Your Email Address]

[Date]

[Recipient's Name/Title]

[Recipient's Address]

Dear [Recipient's Name/Title],

This letter is to confirm that I, [Your Full Name], will be providing financial support to [Recipient's Full Name] to assist with [State the purpose of the support, e.g., living expenses, tuition fees, etc.].

I am committed to providing [Amount in Words] ([Amount in Numbers]) per [Month/Year/Other timeframe] for a period of [Duration, e.g., one year, until December 31, 2024, etc.]. This support will be provided through [Method of Support, e.g., monthly bank transfers, direct payment of tuition fees, etc.].

[Optional: Add specific details about the method of payment, like bank account details, etc.]

I understand that this financial support is intended to [Reiterate the purpose of the support]. I am confident in my ability to provide this support and am committed to fulfilling my obligations.

[Optional: Include a statement about your relationship with the recipient.]

Please feel free to contact me if you require any further information.

Sincerely,

[Your Signature]

[Your Typed Name]

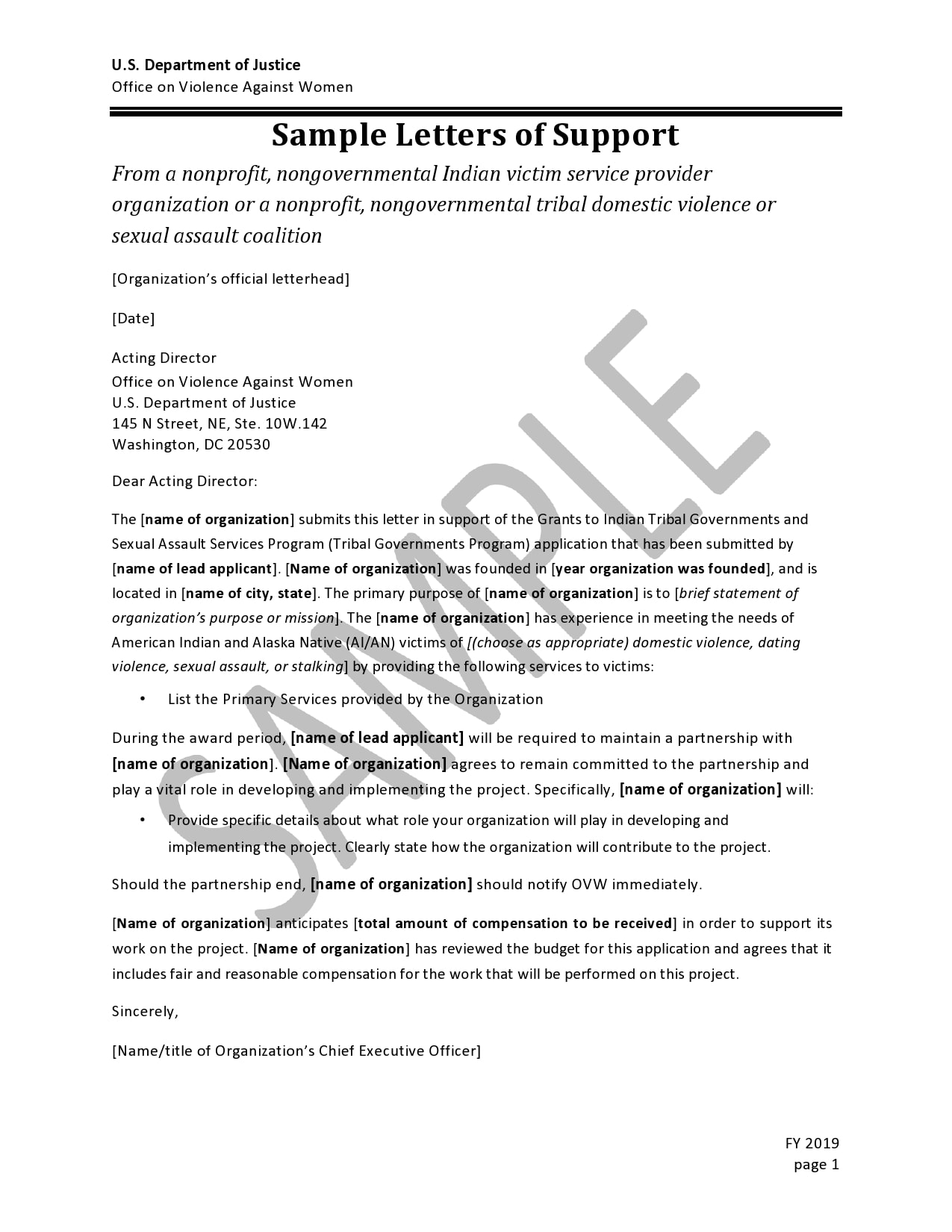

Tailoring Your Letter to Different Situations

The template provides a solid foundation, but you’ll need to adapt it based on the specific purpose and recipient.

- For Immigration: Include details about your relationship with the applicant, your citizenship status, and a statement confirming your understanding of the potential financial responsibilities.

- For Education: Mention the specific educational institution and the purpose of the support (e.g., tuition, living expenses).

- For Loans: Clearly state the purpose of the support, often to help with repayment or provide initial capital.

- For Personal Support: Focus on the relationship and the specific needs you are addressing.

Proofreading and Review: Ensuring Accuracy

Before submitting your financial support letter, meticulously proofread it for any grammatical errors, typos, and inconsistencies. Ensure all the information is accurate and up-to-date. Consider having a second person review the letter to catch any potential mistakes.

Conclusion: Secure Your Financial Future with a Well-Crafted Letter

A well-written financial support letter is a valuable tool that can significantly impact your financial endeavors. By using the template provided and following the guidelines in this article, you can confidently create a persuasive and effective letter that strengthens your application and provides the necessary reassurance to the recipient. Remember to be clear, concise, and accurate in your presentation, and tailor the letter to your specific needs. Good luck!

Frequently Asked Questions (FAQs)

1. What kind of documentation should I include with my financial support letter?

The type of documentation depends on the situation, but common examples include bank statements, pay stubs, investment account statements, and tax returns. These documents serve as proof of your financial capacity.

2. Can I provide financial support to someone who is not a family member?

Yes, you can. The relationship is important, but financial support can be provided to friends, distant relatives, or even individuals you are not related to, provided you have the financial capacity and are willing to take on the responsibility.

3. How long should a financial support letter be valid?

The validity of the letter depends on the purpose. For ongoing support, the letter should specify the duration. For a specific application, the letter is generally valid for a few months. It's best to check with the recipient organization for their specific requirements.

4. What if my financial situation changes after I provide the letter?

If your financial situation changes significantly, it's crucial to notify the recipient as soon as possible. You might need to amend the terms of your support or, in extreme cases, withdraw your support. This highlights the importance of only committing to support you can realistically provide.

5. Is a financial support letter legally binding?

While a financial support letter demonstrates your intent, it's generally not legally binding in itself. However, it can be used as evidence in legal proceedings related to financial obligations. The legal implications depend on the specific context and the laws of the relevant jurisdiction.