The Free Excel Ledger Template with Debits and Credits You’ll Ever Need

Are you struggling to keep your finances organized? Do you find yourself lost in a sea of receipts and bank statements, wishing for a simple, effective way to track your income and expenses? Look no further! This article provides a comprehensive guide and access to the free Excel ledger template with debits and credits that will revolutionize your financial management. This isn’t just any template; it’s designed to be user-friendly, customizable, and powerful enough to handle your personal or small business needs.

This template is your key to unlocking financial clarity and taking control of your money. Whether you’re a seasoned financial guru or just starting, you’ll find this resource invaluable. Let’s dive in!

What is a Ledger and Why Do You Need One?

A ledger is a fundamental accounting tool that acts as a record of all financial transactions. It provides a detailed view of your financial activity, allowing you to:

- Track Income and Expenses: See precisely where your money comes from and where it goes.

- Monitor Your Financial Health: Understand your cash flow, identify potential financial issues, and plan for the future.

- Simplify Tax Preparation: Easily gather the information needed for accurate tax filing.

- Make Informed Financial Decisions: Based on real data, you can make smarter choices about spending, saving, and investing.

Our free Excel ledger template streamlines this process, making it easy to track your debits and credits in a clear, organized format.

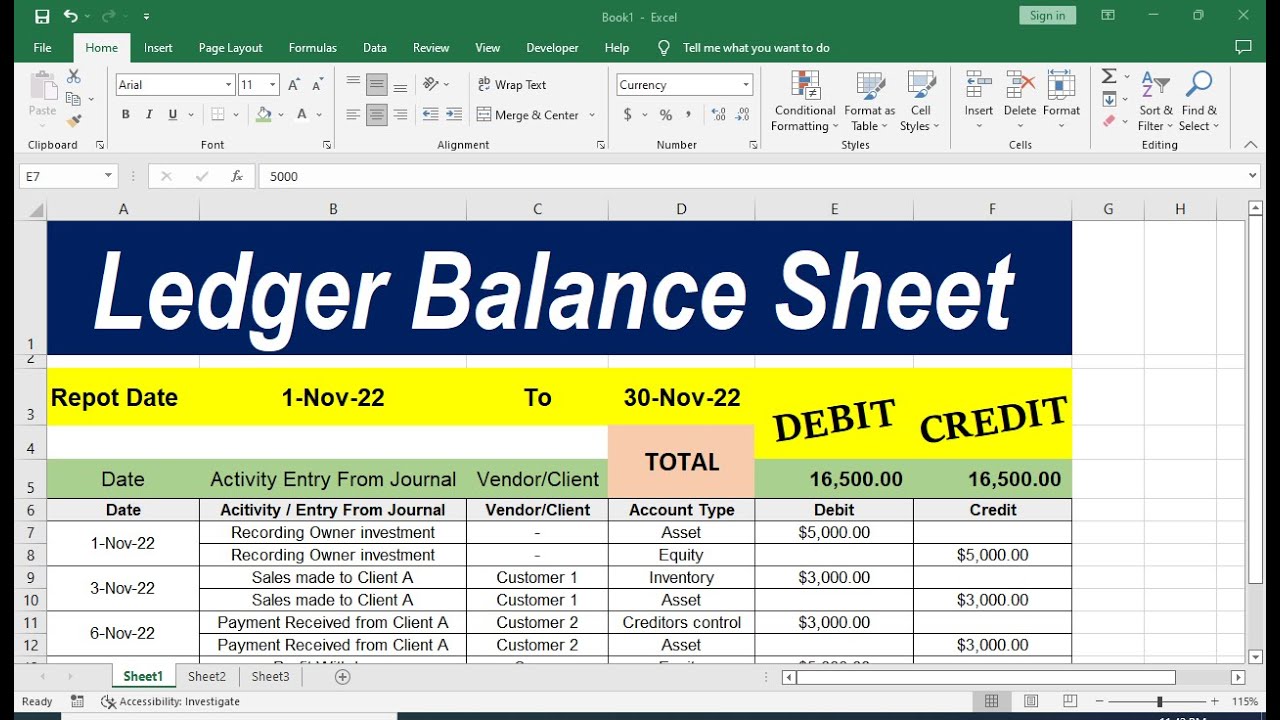

Features of the Free Excel Ledger Template

This template is designed with simplicity and functionality in mind. Here’s what you can expect:

- User-Friendly Interface: Easy-to-understand layout, even for beginners.

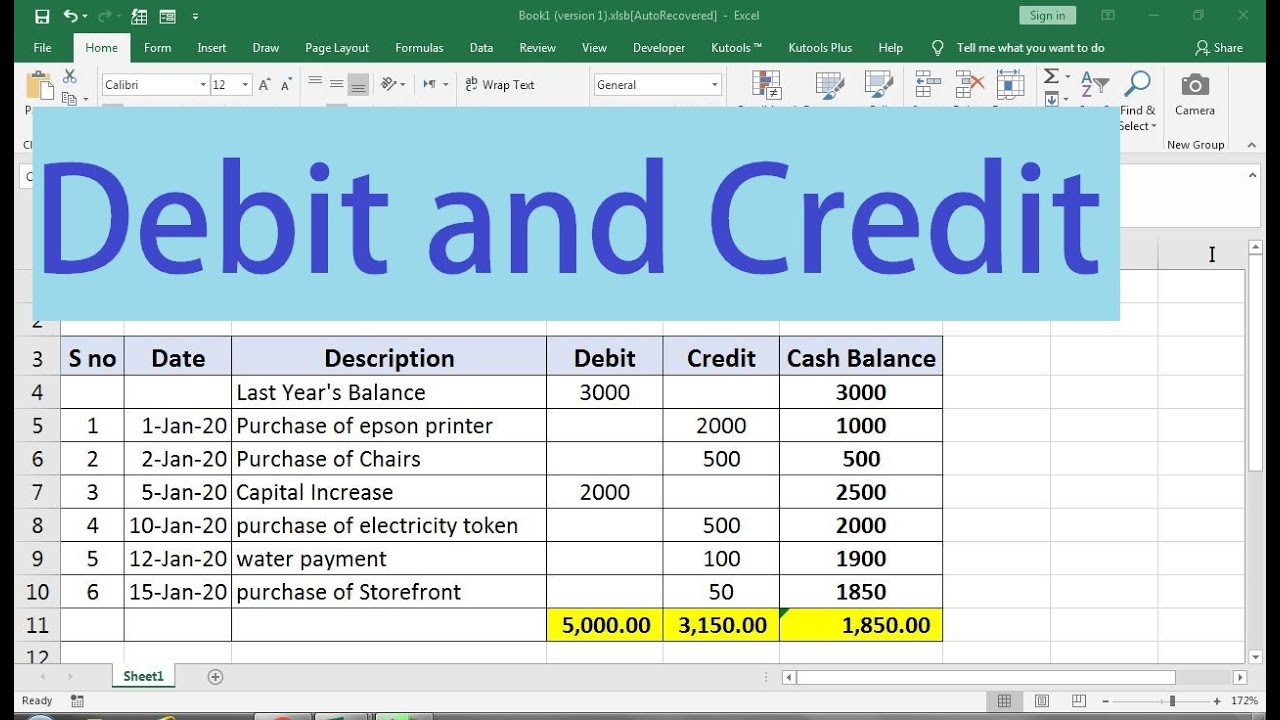

- Debit and Credit Columns: Clearly separates income (credits) and expenses (debits).

- Date Column: Track transactions by date for easy chronological organization.

- Description Column: Provide details about each transaction for clarity.

- Category Column: Categorize your transactions (e.g., Groceries, Salary, Rent) for insightful reporting.

- Automatic Calculations: The template automatically calculates totals for debits, credits, and your running balance, saving you time and preventing errors.

- Customizable Categories: Easily add or modify categories to fit your specific needs.

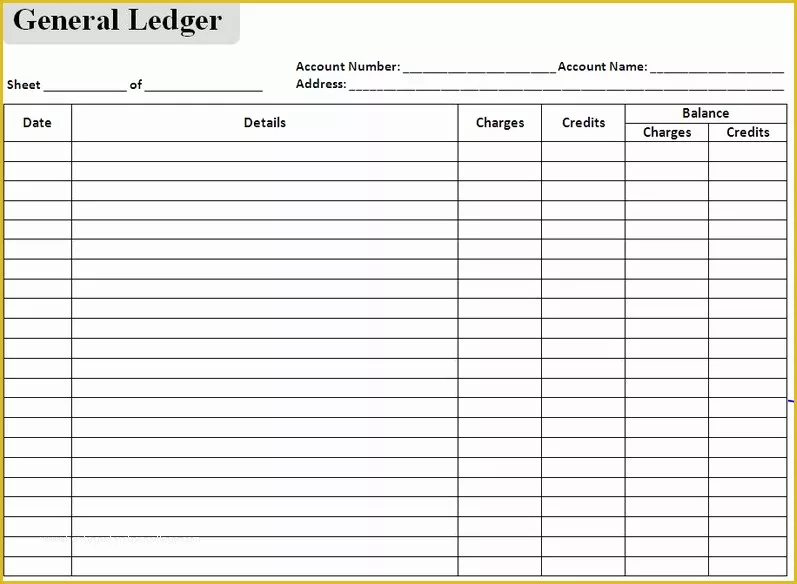

- Print-Ready Format: Designed for easy printing and physical record-keeping.

- Free to Download and Use: No hidden fees or subscriptions!

[Insert a clear, direct link to download the free Excel ledger template here. Example: “Download your free Excel ledger template here: [Link to Download]”]

How to Use the Excel Ledger Template: A Step-by-Step Guide

Using the template is simple. Follow these steps:

- Download and Open: Download the template and open it in Microsoft Excel (or a compatible spreadsheet program).

- Set Up Categories: Customize the “Category” column to include categories relevant to your income and expenses.

- Enter Transactions: For each transaction, enter the following information:

- Date: The date of the transaction.

- Description: A brief description of the transaction (e.g., “Grocery Shopping”).

- Category: Select the appropriate category for the transaction.

- Debit: Enter the amount if it’s an expense (money going out).

- Credit: Enter the amount if it’s income (money coming in).

- Review and Analyze: Regularly review your ledger to monitor your financial progress.

- Adapt and Adjust: As your financial situation changes, adapt the categories and add or remove entries as needed.

Tips for Effective Ledger Management

To get the most out of your Excel ledger template, consider these tips:

- Be Consistent: Enter transactions regularly, ideally daily or weekly, to avoid a backlog.

- Be Accurate: Double-check your entries to avoid errors.

- Use Clear Descriptions: Provide detailed descriptions to easily understand your transactions later.

- Categorize Thoughtfully: Choose categories that accurately reflect your spending habits.

- Review Regularly: Set aside time each week or month to review your ledger and analyze your finances.

- Back Up Your Data: Save multiple copies of your ledger to protect against data loss.

Benefits Beyond Basic Tracking

This free Excel ledger template offers benefits beyond just basic tracking:

- Improved Budgeting: By analyzing your spending habits, you can create a more effective budget.

- Debt Management: Track your debt payments and monitor your progress towards becoming debt-free.

- Goal Setting: Use your ledger to track progress towards financial goals, like saving for a down payment or paying off student loans.

- Business Applications: Suitable for tracking the finances of small businesses, freelancers, and entrepreneurs.

Conclusion: Take Control of Your Finances Today

This free Excel ledger template with debits and credits is a powerful tool for anyone looking to improve their financial management. It’s easy to use, customizable, and provides valuable insights into your financial health. Download the template today and start taking control of your finances. With consistent effort and accurate record-keeping, you’ll be well on your way to achieving your financial goals.

Remember to [Insert a call to action here, e.g., “Download your free Excel ledger template now and start tracking your finances!”]

Frequently Asked Questions (FAQs)

1. Is this template compatible with other spreadsheet programs besides Microsoft Excel?

Yes, the template is designed to be compatible with most spreadsheet programs, including Google Sheets, LibreOffice Calc, and OpenOffice Calc. However, some formatting or formula adjustments may be necessary depending on the program you use.

2. Can I customize the template to add more columns?

Yes, you can easily customize the template to add additional columns, such as a “Notes” column for more detailed transaction information or a “Payment Method” column. Just insert a new column and label it appropriately.

3. How do I handle recurring transactions, like monthly bills?

You can either manually enter recurring transactions each month or create a separate sheet within the Excel file to track recurring bills. You can then copy and paste the transactions into your main ledger each month. Another option is to use Excel’s built-in features to create a schedule for reminders or automation.

4. Is my financial data secure using this template?

The security of your financial data depends on how you store the Excel file. It’s essential to protect your computer and the file itself with a strong password. Avoid storing sensitive financial information on shared computers or in public cloud storage without proper security measures.

5. Can I use this template for my small business?

Yes, this template can be adapted and used for small business accounting. However, it is basic and might not satisfy all accounting needs. For more complex business needs, consider professional accounting software.