The Free Printable 1098 Form You’ve Been Looking For: Your Guide to Mortgage Interest Statements

Navigating tax season can feel like wading through a sea of forms and regulations. One of the most common documents you’ll need if you’re a homeowner is the 1098 form, the Mortgage Interest Statement. This vital form details the amount of mortgage interest you paid during the tax year, potentially allowing you to claim valuable deductions. This article provides a comprehensive guide to understanding the 1098 form, where to find a free printable 1098 form, and how to use it effectively.

What is a 1098 Form and Why Do You Need It?

The 1098 form, officially titled “Mortgage Interest Statement,” is a document issued by your mortgage lender. It’s crucial for homeowners because it provides information about:

- Mortgage Interest Paid: This is the primary information on the form, detailing the amount of interest you paid on your mortgage during the tax year.

- Points Paid: If you paid points (loan origination fees) to secure your mortgage, the form will also list those.

- Mortgage Insurance Premiums (MIP) Paid: In some cases, the form may also include mortgage insurance premiums.

- Other Relevant Information: Your lender’s information, your information, and the property address are also included.

You’ll use the information on the 1098 form to claim deductions for mortgage interest on your federal income tax return if you itemize deductions. Itemizing can potentially save you money, but it’s important to understand the rules and requirements.

Where to Find a Free Printable 1098 Form

While you can’t generate a 1098 form yourself (it’s issued by your lender), you can often access a digital copy for printing online through your lender’s website or tax preparation software. Here’s a breakdown of how to find the form:

- Your Mortgage Lender’s Website: The most reliable source. Most lenders provide access to your 1098 form through their online portal. You’ll typically need to log in to your account and navigate to the “Tax Documents” or “1098 Forms” section. You can then usually download a PDF version, which you can print for free.

- Tax Preparation Software: If you use tax preparation software like TurboTax, H&R Block, or TaxAct, you can often import your 1098 information directly from your lender. These programs may also provide access to a printable version of the form.

- Contacting Your Lender Directly: If you can’t find the form online, contact your lender’s customer service. They can often provide a copy via email or mail.

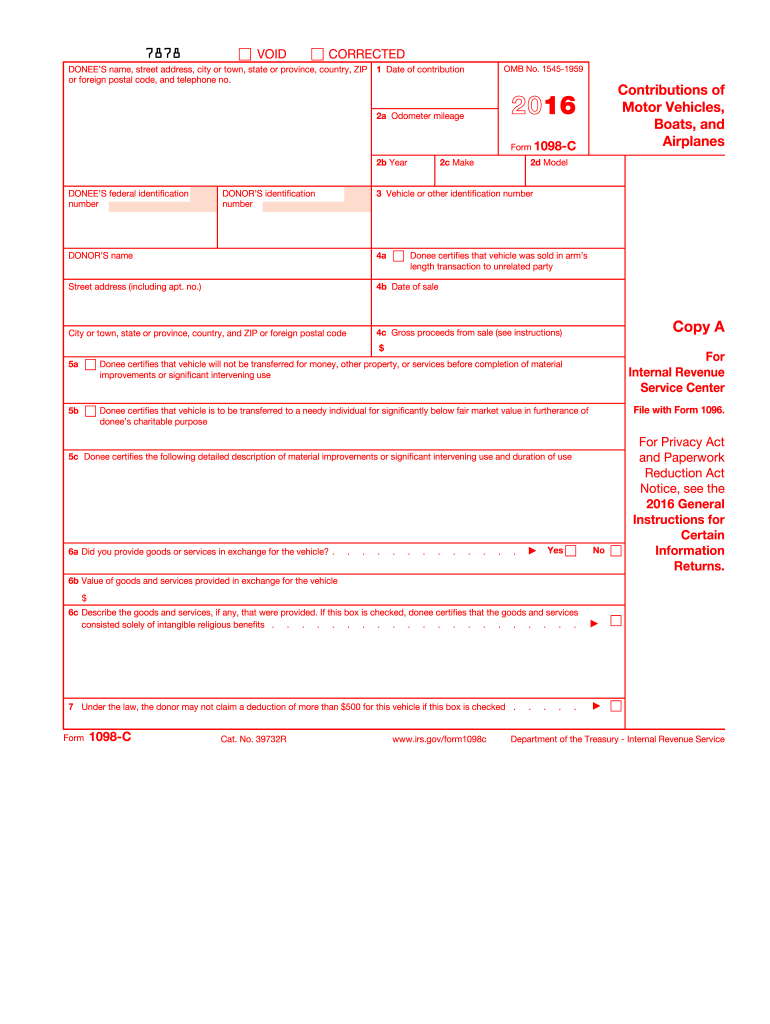

- IRS Website: The IRS website, IRS.gov, provides a blank, informational 1098 form for reference. However, you cannot use this blank form to file your taxes. It’s only for informational purposes to understand the form’s layout and what information it contains.

Important Note: Always use the form provided by your lender. The information on the form is specific to your mortgage and is what you’ll use to file your taxes.

Understanding the Information on Your 1098 Form

Once you have your 1098 form, it’s crucial to understand the information it contains:

- Box 1: Mortgage Interest Paid: This is the total amount of mortgage interest you paid during the tax year. This is the primary number you’ll use for your deduction.

- Box 2: Outstanding Mortgage Principal: This shows the outstanding balance of your mortgage as of January 1st of the tax year (or the date the mortgage originated if it was taken out during the tax year).

- Box 3: Refund of Mortgage Interest: If you received a refund of mortgage interest from your lender, this amount will be listed. This amount reduces your deductible interest.

- Box 4: Mortgage Insurance Premiums: This box will show the amount you paid for mortgage insurance premiums (if any) during the tax year.

- Box 5: Points Paid: This shows the points you paid on your mortgage.

- Box 6: Refunding of Overpaid Interest: This box will show the amount of overpaid interest you may have received back.

- Box 7: Address of the Property: Indicates the address of the property securing the mortgage.

Carefully review the form to ensure all the information is accurate. If you find any discrepancies, contact your lender immediately.

Using the 1098 Form for Tax Filing

To use your 1098 form, you’ll need to:

- Determine if you itemize deductions: You can only deduct mortgage interest if you itemize deductions. This means you’ll need to compare your itemized deductions (including mortgage interest, state and local taxes, charitable contributions, etc.) to the standard deduction to see which is more beneficial.

- Report the information on Schedule A: If you itemize, you’ll report the mortgage interest on Schedule A (Form 1040), “Itemized Deductions.”

- Follow the IRS guidelines: Familiarize yourself with the IRS guidelines regarding mortgage interest deductions. There are limits on the amount of interest you can deduct based on the date you took out your mortgage and the amount of your loan.

- Consult a Tax Professional: For complex tax situations or if you’re unsure about any aspect of the process, it’s always advisable to consult with a qualified tax professional.

Conclusion

Obtaining and understanding the 1098 form is a crucial step in the tax preparation process for homeowners. By knowing where to find a free printable 1098 form (typically through your lender’s website), understanding its contents, and following IRS guidelines, you can accurately report your mortgage interest and potentially claim valuable tax deductions. Remember to keep your 1098 form and any supporting documentation for your tax records.

Frequently Asked Questions (FAQs)

1. When will I receive my 1098 form?

Your lender is required to send you the 1098 form by January 31st of the following year. For example, you should receive the 1098 form for the 2024 tax year by January 31st, 2025.

2. What if I didn’t receive a 1098 form?

Contact your mortgage lender immediately. They may have sent it to the wrong address or it might have gotten lost in the mail. You can often access the form online through your lender’s website.

3. Can I still claim the mortgage interest deduction if I don’t have a 1098 form?

No, you cannot claim the mortgage interest deduction without the 1098 form. The form is your official documentation and proof of the interest you paid. Your lender is legally obligated to provide it.

4. Are there any limits to the mortgage interest deduction?

Yes, there are limits. The amount of interest you can deduct depends on the date you took out your mortgage and the amount of the loan. The IRS provides detailed guidance on these limits. Consult the IRS website or a tax professional for specific details.

5. What if I have multiple mortgages?

If you have multiple mortgages, you will receive a 1098 form for each one. You’ll need to report the interest paid on each mortgage on Schedule A.