The Free Weekly Budget Template That Will Change Your Finances

Are you tired of living paycheck to paycheck? Do you find yourself wondering where your money goes each week? You’re not alone. Millions struggle with managing their finances, but the good news is, there’s a simple, effective solution: a free weekly budget template. This article will guide you through the benefits of using a weekly budget template and show you how this powerful tool can transform your financial health.

Understanding the Power of a Weekly Budget

A weekly budget template is a structured plan that helps you track your income and expenses over a seven-day period. Unlike a monthly budget, a weekly approach offers greater granularity and control. This allows you to:

- Identify Spending Leaks: Pinpoint areas where you’re overspending, often on seemingly small, everyday purchases.

- Gain Real-Time Insights: See the immediate impact of your spending habits, making it easier to course-correct quickly.

- Stay Organized: Keep a clear picture of your financial situation, reducing stress and anxiety.

- Build Savings Habits: Allocate funds towards your financial goals, such as paying off debt, saving for a down payment, or investing.

- Improve Financial Discipline: Develop a stronger awareness of your financial responsibilities and make conscious spending choices.

What to Include in Your Free Weekly Budget Template

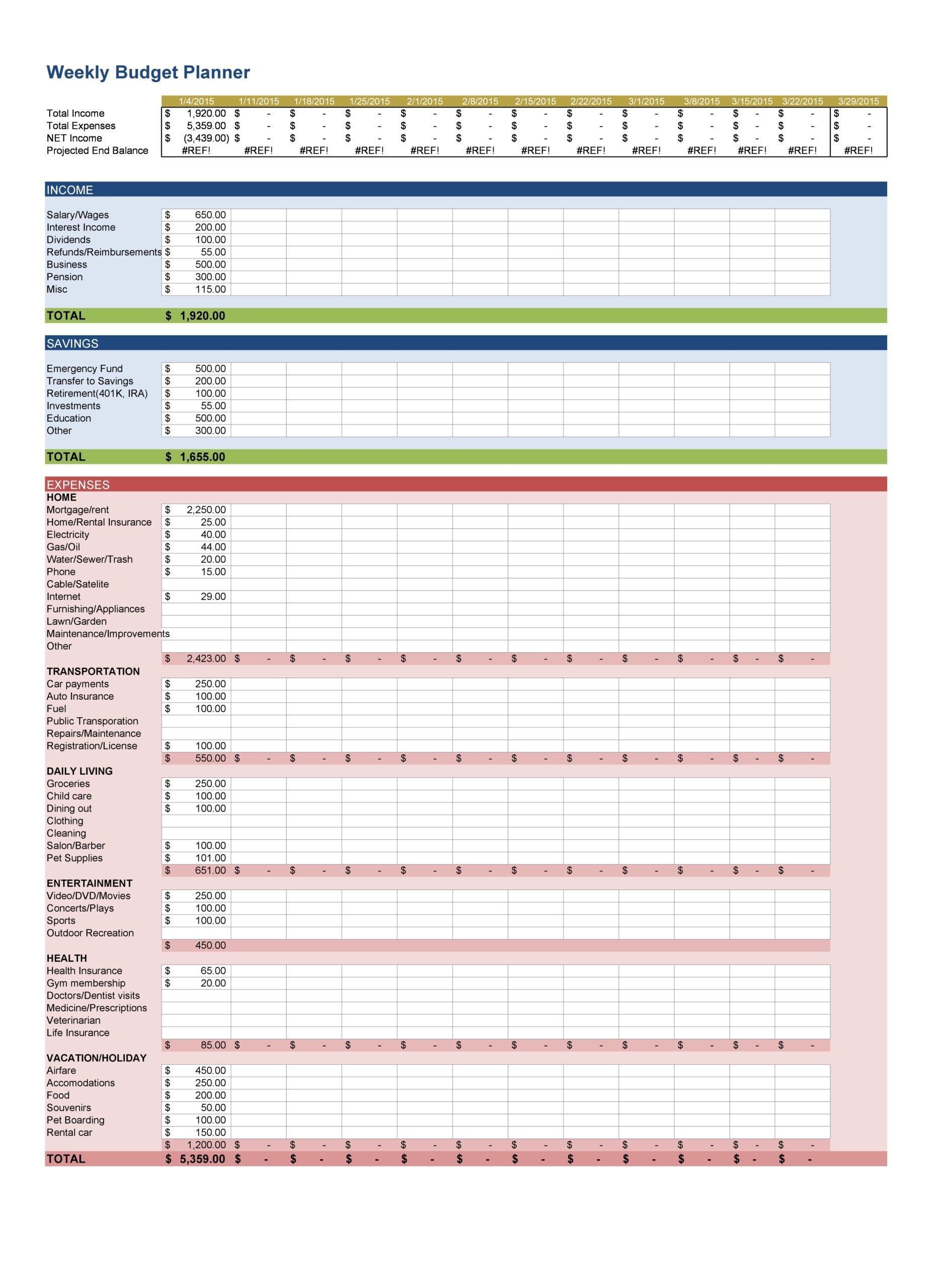

The best weekly budget template is one that suits your individual needs and preferences. However, a basic, effective template will typically include the following sections:

- Income: List all sources of income, including your salary, wages, side hustle earnings, and any other regular income streams.

- Fixed Expenses: These are recurring expenses that remain relatively constant each week, such as:

- Rent or Mortgage Payments

- Loan Payments (car, student loans, etc.)

- Subscription Services (Netflix, Spotify, etc.)

- Insurance Premiums

- Variable Expenses: These expenses fluctuate from week to week and require careful tracking. Examples include:

- Groceries

- Eating Out

- Transportation (gas, public transit)

- Entertainment

- Personal Care

- Savings and Debt Payments: Allocate funds towards your savings goals and/or debt repayment. This is a crucial step for building a secure financial future.

- Tracking and Analysis: Include a section for tracking actual spending against your planned budget. This helps you identify areas for improvement and adjust your budget accordingly.

Where to Find Your Free Weekly Budget Template

Fortunately, accessing a free weekly budget template is easier than ever. You have several options:

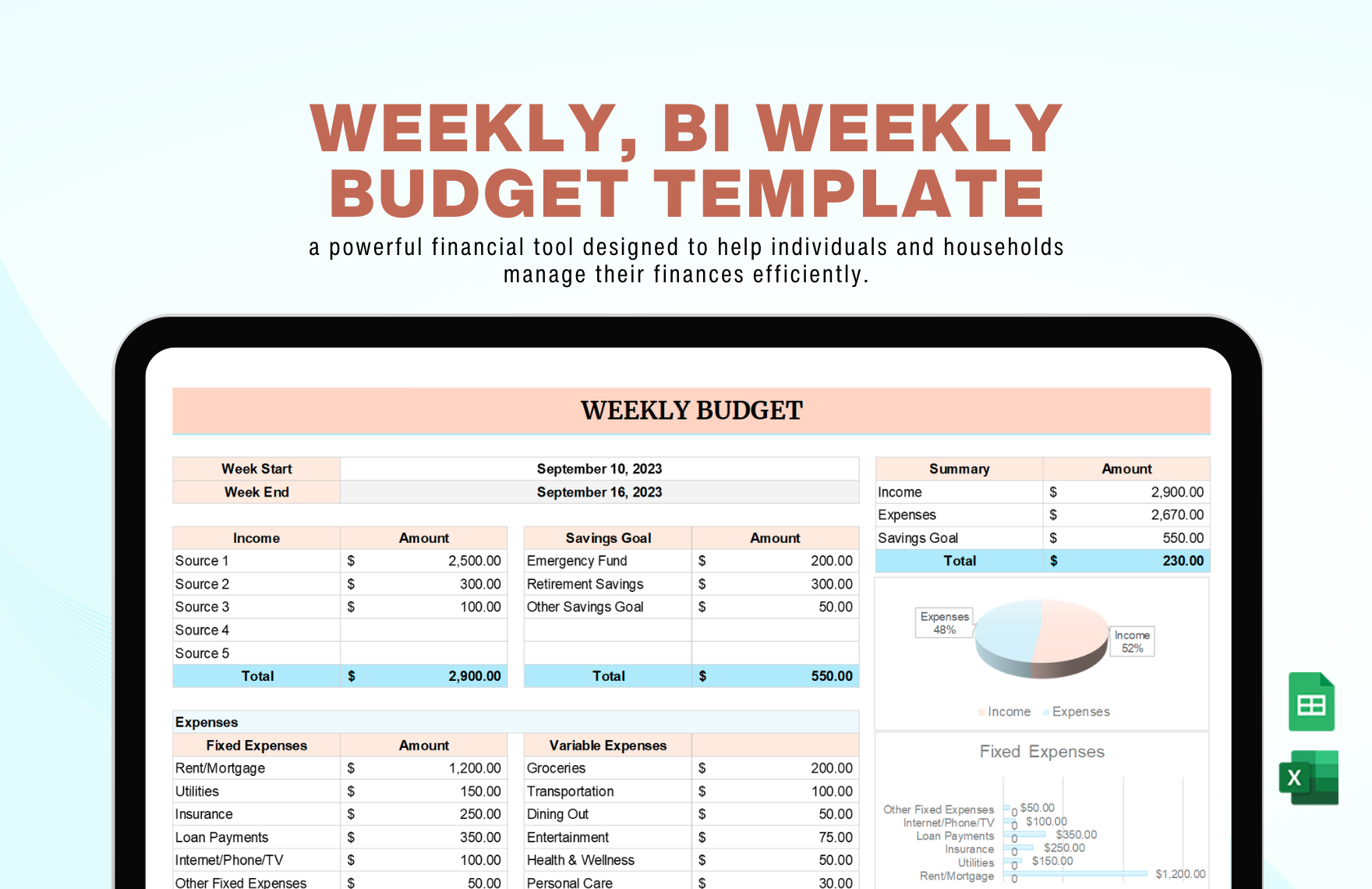

- Spreadsheet Programs (Google Sheets, Microsoft Excel): This is a popular and versatile choice. You can easily create your own template or find pre-designed templates online. Search for “free weekly budget template Excel” or “free weekly budget template Google Sheets”.

- Online Budgeting Apps: Many budgeting apps offer free versions that include weekly budgeting features. Some popular choices include:

- Mint (Intuit)

- YNAB (You Need A Budget) - While a paid service, they offer a free trial.

- Personal Capital

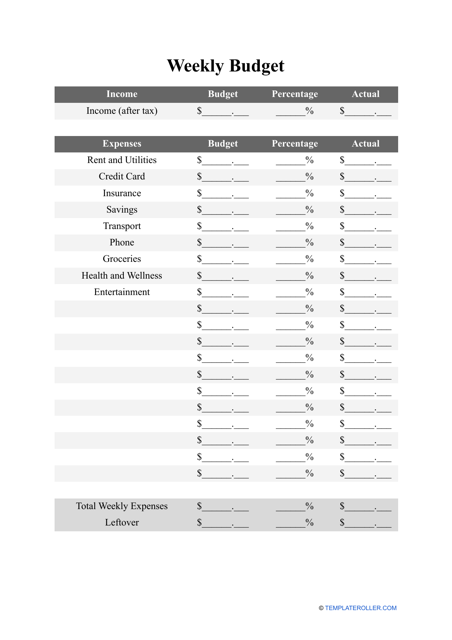

- Downloadable Templates: Numerous websites and financial institutions offer free, downloadable weekly budget templates in various formats (PDF, Word, etc.). A quick search for “free printable weekly budget template” will yield a wealth of options.

How to Use Your Free Weekly Budget Template Effectively

Once you’ve selected your template, follow these steps to maximize its effectiveness:

- Gather Your Financial Information: Collect your income, expense statements, and any outstanding debt information.

- Estimate Your Income: Accurately project your weekly income.

- Categorize Your Expenses: Group your expenses into meaningful categories (e.g., groceries, dining out, transportation).

- Create Your Budget: Allocate your income to your different expense categories, savings, and debt payments. Be realistic about your spending habits.

- Track Your Spending: Throughout the week, meticulously track your spending against your budget. Use receipts, bank statements, and budgeting apps to ensure accuracy.

- Review and Adjust: At the end of each week, review your budget. Compare your actual spending to your planned spending. Make adjustments to your budget for the following week based on your findings.

- Stay Consistent: Consistency is key. Stick to your budget as closely as possible, and make it a regular habit.

The Long-Term Benefits of Weekly Budgeting

By consistently using a free weekly budget template, you’ll experience significant positive changes:

- Reduced Financial Stress: Knowing where your money goes provides a sense of control and reduces anxiety.

- Increased Savings: By identifying spending leaks and allocating funds to savings, you’ll build your financial cushion.

- Faster Debt Reduction: Prioritizing debt payments in your budget accelerates your journey to becoming debt-free.

- Achieving Financial Goals: Whether it’s buying a home, taking a vacation, or investing for retirement, a budget is the roadmap to your financial goals.

- Improved Financial Literacy: You’ll gain a deeper understanding of your financial habits and make smarter financial decisions.

Conclusion: Take Control of Your Finances Today!

A free weekly budget template is a powerful tool that can revolutionize your financial life. By taking the time to create and consistently use a budget, you’ll gain control over your spending, build savings, and move closer to your financial goals. Don’t wait – start today and experience the transformative power of financial planning. Download your free template, commit to the process, and watch your financial future flourish.

Frequently Asked Questions (FAQs)

1. Is a weekly budget better than a monthly budget?

A weekly budget offers greater granularity and control, allowing for more frequent adjustments and a clearer understanding of your spending habits. It can be particularly helpful for those who receive income weekly or bi-weekly.

2. What if I overspend in a specific category?

Don’t panic! Review your budget and identify areas where you can cut back in the following week. You can also adjust your budget mid-week if necessary. The key is to learn from your mistakes and make adjustments to stay on track.

3. How long does it take to set up and manage a weekly budget?

Initial setup may take an hour or two, depending on the complexity of your financial situation. Once set up, managing your weekly budget typically takes 15-30 minutes per week, depending on your tracking method.

4. What if my income varies from week to week?

If your income fluctuates, base your budget on your lowest expected income. Then, when you earn more, allocate the extra funds to savings, debt repayment, or other financial goals.

5. Where can I find a good, free weekly budget template?

As detailed above, you can find free templates on spreadsheet programs like Google Sheets and Microsoft Excel, through free budgeting apps, and by searching online for downloadable templates. Choose the format that best suits your needs and preferences.