The Free Weekly Budget Template That Will Fix Your Finances: Your Path to Financial Freedom

Feeling overwhelmed by your finances? Are you constantly wondering where your money goes each week? You’re not alone. Managing money can feel complicated, but it doesn’t have to be. The key to gaining control and achieving your financial goals lies in one simple tool: a budget. And the best part? You can get started with a free weekly budget template that empowers you to take charge of your financial future.

This article will guide you through the benefits of budgeting, how to use a weekly budget template, and how it can be the foundation for a healthier financial life.

Why a Weekly Budget Template Works Wonders

While monthly budgets are common, a weekly budget template offers several distinct advantages, making it a powerful tool for financial management:

- Increased Awareness: Weekly budgets force you to confront your spending habits more frequently. You’re constantly reviewing and adjusting, leading to greater awareness of where your money is going.

- Faster Adjustments: If you overspend in a particular category, you can quickly identify the issue and make adjustments the following week. This agility prevents small overspending habits from snowballing into larger problems.

- Improved Tracking: A weekly format allows for more granular tracking. You can pinpoint specific spending patterns, identify areas for improvement, and adjust your spending accordingly.

- Greater Control: The consistent review and adjustment process empowers you to feel more in control of your finances. This feeling of control is a significant motivator for sticking to your budget.

- Reduced Overspending: By focusing on weekly spending, you’re less likely to make large, impulsive purchases. You’re constantly reminded of your financial goals and how your spending impacts them.

Getting Started: How to Use Your Free Weekly Budget Template

The beauty of a free weekly budget template lies in its simplicity and accessibility. Here’s a step-by-step guide to get you started:

Download Your Template: There are numerous free weekly budget templates available online. Look for options in spreadsheet formats like Google Sheets or Microsoft Excel, as they offer flexibility and ease of use.

Identify Your Income: At the beginning of each week, input your total income. This should include any wages, salary, or other income streams you receive.

Categorize Your Expenses: Create categories for your expenses. Common categories include:

- Fixed Expenses: Rent/Mortgage, Utilities, Loan Payments, Insurance

- Variable Expenses: Groceries, Dining Out, Entertainment, Transportation, Clothing, Personal Care

- Savings and Investments: Emergency Fund, Retirement Accounts, Investment Accounts

Estimate Your Spending: Before the week begins, estimate how much you plan to spend in each category. Be realistic! Review previous spending habits to inform your estimates.

Track Your Spending: Throughout the week, meticulously record every expense in the appropriate category. This is crucial for understanding where your money is actually going.

Compare and Analyze: At the end of the week, compare your actual spending to your estimated spending. Analyze any discrepancies. Did you overspend in a particular category? Why?

Adjust and Refine: Based on your analysis, adjust your budget for the following week. This iterative process is key to continuous improvement and financial control.

Choosing the Right Template: Options and Considerations

The best free weekly budget template for you will depend on your individual needs and preferences. Consider these factors:

- Ease of Use: Choose a template that is easy to understand and use. A clean and organized layout will make the process more enjoyable.

- Customization: Look for a template that allows you to customize categories to fit your specific spending habits.

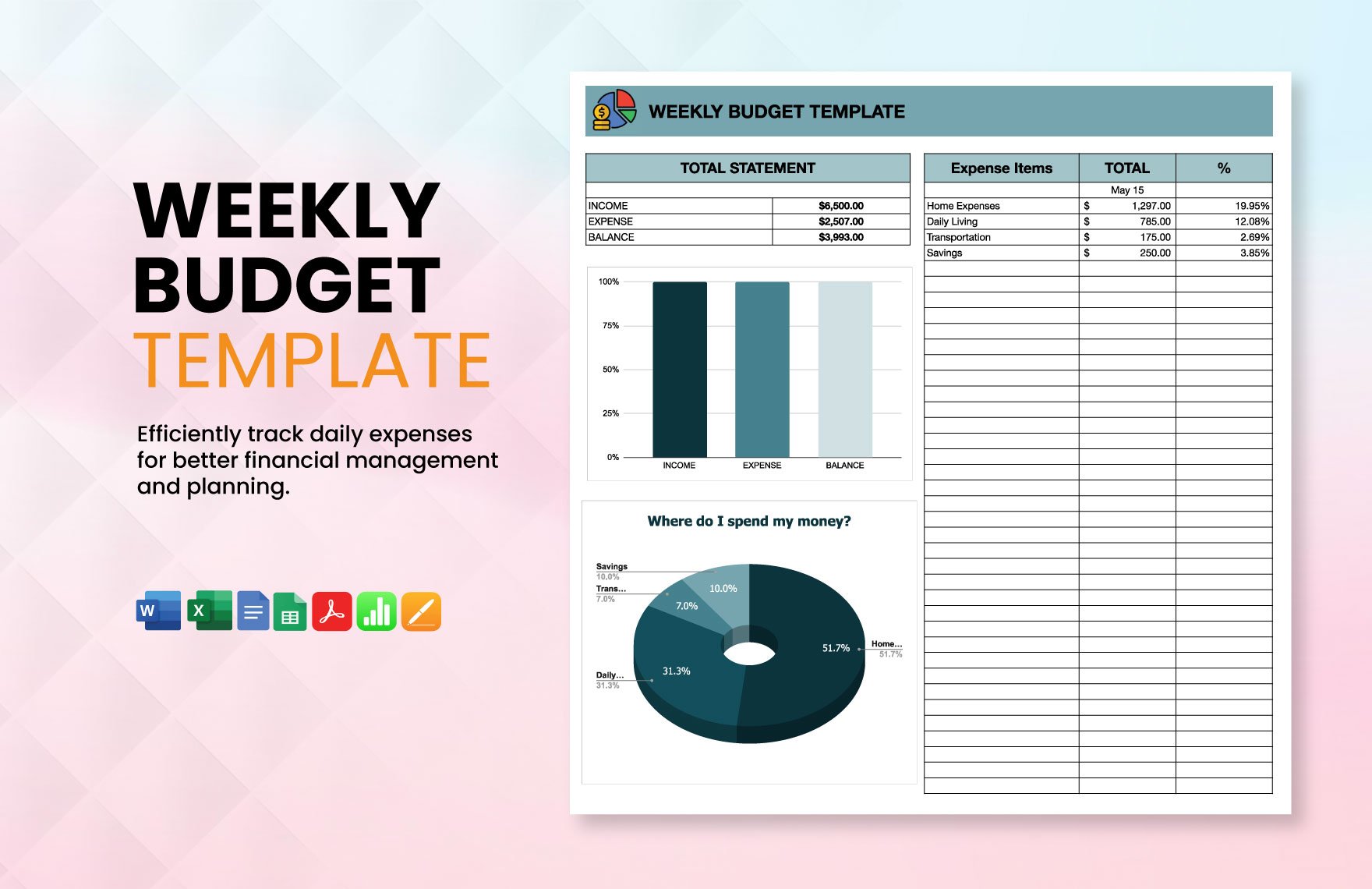

- Automation: Some templates offer features like automatic calculations and charts, which can save you time and provide valuable insights.

- Platform: Decide whether you prefer a spreadsheet-based template (Google Sheets or Excel) or a budgeting app. Apps often offer more features but may require a subscription.

The Long-Term Benefits: Achieving Financial Freedom

Consistently using a free weekly budget template is more than just tracking your expenses; it’s a pathway to achieving your financial goals. By gaining control of your spending, you can:

- Pay off Debt: Identify areas where you can cut back and allocate more money towards paying down high-interest debt.

- Save for the Future: Allocate a portion of your income towards savings and investments, such as an emergency fund or retirement accounts.

- Achieve Financial Goals: Whether it’s buying a house, taking a vacation, or starting a business, a budget helps you plan and save strategically.

- Reduce Financial Stress: Knowing where your money is going and having a plan for the future can significantly reduce financial stress and anxiety.

Frequently Asked Questions (FAQs)

Here are some common questions about using a weekly budget template:

- What if my income varies from week to week?

- Estimate your income conservatively, using the lowest amount you anticipate receiving. This ensures you don’t overspend. You can also use a “rolling budget” where you adjust the budget throughout the month as you receive income.

- How do I handle unexpected expenses?

- Build an “unexpected expenses” or “miscellaneous” category into your budget. This provides flexibility for unforeseen costs. Consider setting up an emergency fund to cover larger, unexpected expenses.

- How do I stay motivated to stick to my budget?

- Set realistic goals, reward yourself for achieving them, and regularly review your progress. Visualize your financial goals and focus on the benefits of achieving them.

- Is a spreadsheet template better than a budgeting app?

- Both have pros and cons. Spreadsheet templates are free and customizable but require manual input. Budgeting apps often offer more features, like automatic transaction tracking, but may come with a subscription fee. Choose the tool that best suits your needs and preferences.

- How often should I review and adjust my budget?

- Review and adjust your budget weekly. This consistent review is crucial for staying on track and making necessary adjustments. However, you can also do a quick check daily to stay on top of your spending.

Conclusion: Start Your Financial Journey Today

A free weekly budget template is a powerful tool that can transform your finances. By taking the time to track your income and expenses, categorize your spending, and regularly analyze your progress, you can gain control of your money, reduce financial stress, and pave the way to a secure and fulfilling financial future. Download a template today and start your journey towards financial freedom!