The Gold Ownership Certificate: Everything You Need to Know

Gold, a symbol of wealth and security for centuries, continues to captivate investors and collectors alike. Owning gold, however, can take various forms, from physical bullion to digital representations. This article delves into the world of the Gold Ownership Certificate, exploring its purpose, benefits, and potential drawbacks. If you’re considering adding gold to your portfolio or are simply curious about the intricacies of gold ownership, this guide provides a comprehensive overview.

What is a Gold Ownership Certificate?

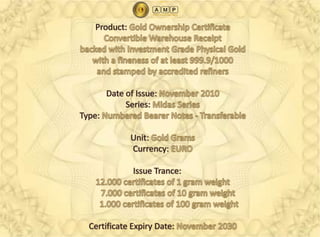

A Gold Ownership Certificate (GOC) is a document that represents ownership of a specific amount of gold. Unlike physically holding gold bars or coins, a GOC typically signifies ownership of gold held in a secure vault, often by a custodian or a financial institution. Think of it as a receipt confirming your entitlement to a specific quantity and quality of gold. This ownership is often tracked through a digital system, making the transfer and management of gold relatively efficient.

Benefits of Owning Gold Through a Certificate:

Investing in gold through a certificate offers several advantages compared to physical possession:

- Security: Your gold is stored in a secure vault, minimizing the risk of theft or damage.

- Liquidity: Certificates can often be bought and sold more easily than physical gold, offering greater flexibility.

- Lower Storage Costs: You avoid the costs associated with storing physical gold, such as insurance and vault fees (though these are often incorporated into the certificate’s fees).

- Convenience: You don’t need to physically handle or transport the gold.

- Potential for Diversification: Gold certificates can be a part of a broader investment strategy, allowing you to diversify your portfolio.

- Accessibility: Some certificates allow you to purchase gold in smaller increments, making it more accessible to investors with limited capital.

Understanding the Different Types of Gold Ownership Certificates:

Several types of gold ownership certificates exist, each with its own features and associated fees:

- Allocated Gold Certificates: These certificates represent ownership of specific, identifiable gold bars or coins, held separately and allocated to your name within the vault. This provides the highest level of security and ownership.

- Unallocated Gold Certificates: These certificates represent ownership of a portion of a larger pool of gold. Your gold isn’t specifically identified but is part of the overall holdings. This type usually has lower fees but carries a slightly higher risk as you are not directly associated with a specific bar.

- Exchange-Traded Gold (ETG) Certificates/ETFs: These certificates are traded on stock exchanges, providing easy access to gold exposure. They track the price of gold and often come with management fees.

- Digital Gold Certificates: Digital gold certificates are represented on the blockchain, and are very liquid. They offer a modern and transparent way to own gold.

Key Considerations Before Investing in a Gold Ownership Certificate:

Before investing in a gold ownership certificate, consider these important factors:

- Fees and Charges: Understand all associated fees, including storage fees, management fees, transaction fees, and any other charges involved. These fees can impact your overall returns.

- Custodian Reputation: Research the reputation and security measures of the custodian or financial institution holding the gold. Ensure they are reputable and have a strong track record.

- Gold Quality: Verify the quality of the gold represented by the certificate. Ensure the gold meets the standards set by the certificate issuer (e.g., .9999 fine gold).

- Liquidity: Assess the ease with which you can buy and sell the certificate. Check the bid-ask spread, which can impact your trading costs.

- Insurance: Determine if the gold held by the custodian is insured against loss or theft.

- Withdrawal Options: Understand the options for withdrawing your gold, should you desire physical possession. This may involve additional fees and procedures.

- Tax Implications: Be aware of the tax implications of owning gold certificates in your jurisdiction.

How to Purchase a Gold Ownership Certificate:

The process of purchasing a gold ownership certificate typically involves these steps:

- Research and Choose a Provider: Select a reputable provider, such as a bank, financial institution, or online platform, that offers gold certificates.

- Open an Account: Complete the necessary paperwork and open an account with the provider.

- Fund Your Account: Deposit funds into your account to purchase the gold certificate.

- Select the Certificate: Choose the type and amount of gold you wish to purchase.

- Complete the Transaction: Execute the purchase and receive confirmation of your ownership.

Risks Associated with Gold Ownership Certificates:

While offering convenience, gold certificates also have inherent risks:

- Counterparty Risk: The financial institution holding the gold could potentially face financial difficulties, potentially impacting your investment.

- Custodial Risk: The custodian could face operational issues, such as fraud or mismanagement, leading to loss of your gold.

- Market Risk: The price of gold can fluctuate significantly, leading to potential losses if you sell your certificate at a lower price than you purchased it.

- Inflation Risk: While gold is often considered a hedge against inflation, its performance can vary, and it may not always keep pace with rising prices.

- Fees and Costs: High fees can erode your returns over time.

Conclusion:

Gold Ownership Certificates offer a convenient and secure way to participate in the gold market, providing benefits like security, liquidity, and accessibility. However, it’s crucial to thoroughly research providers, understand associated fees and risks, and assess your individual investment goals before investing. By carefully considering the factors outlined in this guide, you can make an informed decision about whether a Gold Ownership Certificate aligns with your financial strategy and risk tolerance.

Frequently Asked Questions (FAQs):

Is a Gold Ownership Certificate the same as owning physical gold? No, a certificate represents ownership of gold held in a vault, while physical gold is in your direct possession.

Are Gold Ownership Certificates insured? Insurance policies vary. Some custodians insure the gold against loss or theft. Confirm the specific insurance coverage with your chosen provider.

Can I convert my Gold Ownership Certificate into physical gold? Yes, most providers offer the option to withdraw your gold as physical bullion, but this often involves additional fees and procedures. Check with your provider for specific details.

What are the storage fees associated with gold certificates? Storage fees vary depending on the provider, the type of certificate, and the amount of gold held. They are usually a percentage of the gold’s value and are charged annually or monthly.

How do I sell my Gold Ownership Certificate? The process varies depending on the certificate type and the provider. For ETGs, you sell them on the stock exchange. For other certificates, you typically contact the provider to initiate the sale.