The HOA Financial Statement Template You Need to See: A Guide to Financial Transparency

Owning a home in a community governed by a Homeowners Association (HOA) comes with a unique set of responsibilities, and understanding the financial health of your HOA is paramount. Transparency is key to a thriving community, and a well-crafted financial statement is the cornerstone of that transparency. This article will delve into the importance of HOA financial statements, explore the essential components, and provide insights into the template you need to ensure your HOA is financially sound and compliant.

Why HOA Financial Statements Matter

HOA financial statements are more than just numbers on a page; they are a critical tool for:

- Transparency and Accountability: They allow homeowners to see where their dues are being spent, fostering trust and accountability within the community.

- Informed Decision-Making: These statements provide the data necessary for the board to make informed decisions about budgeting, reserve funding, and future projects.

- Legal Compliance: Most states require HOAs to prepare and distribute financial statements, ensuring adherence to legal regulations.

- Protecting Property Values: A financially healthy HOA helps maintain property values by ensuring the community is well-maintained and prepared for future needs.

- Early Problem Detection: Financial statements can highlight potential issues like delinquent assessments or insufficient reserve funds, allowing for proactive solutions.

Essential Components of an Effective HOA Financial Statement Template

A comprehensive HOA financial statement typically includes several key components. Here’s a breakdown of what you should expect to see:

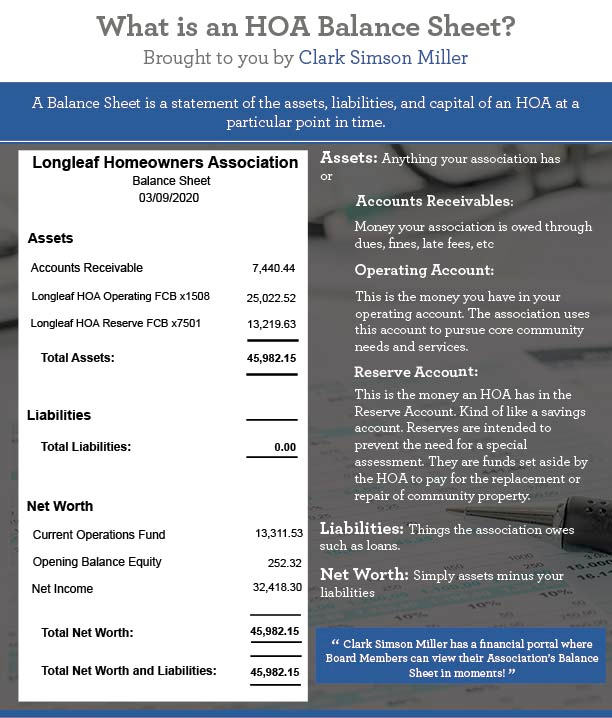

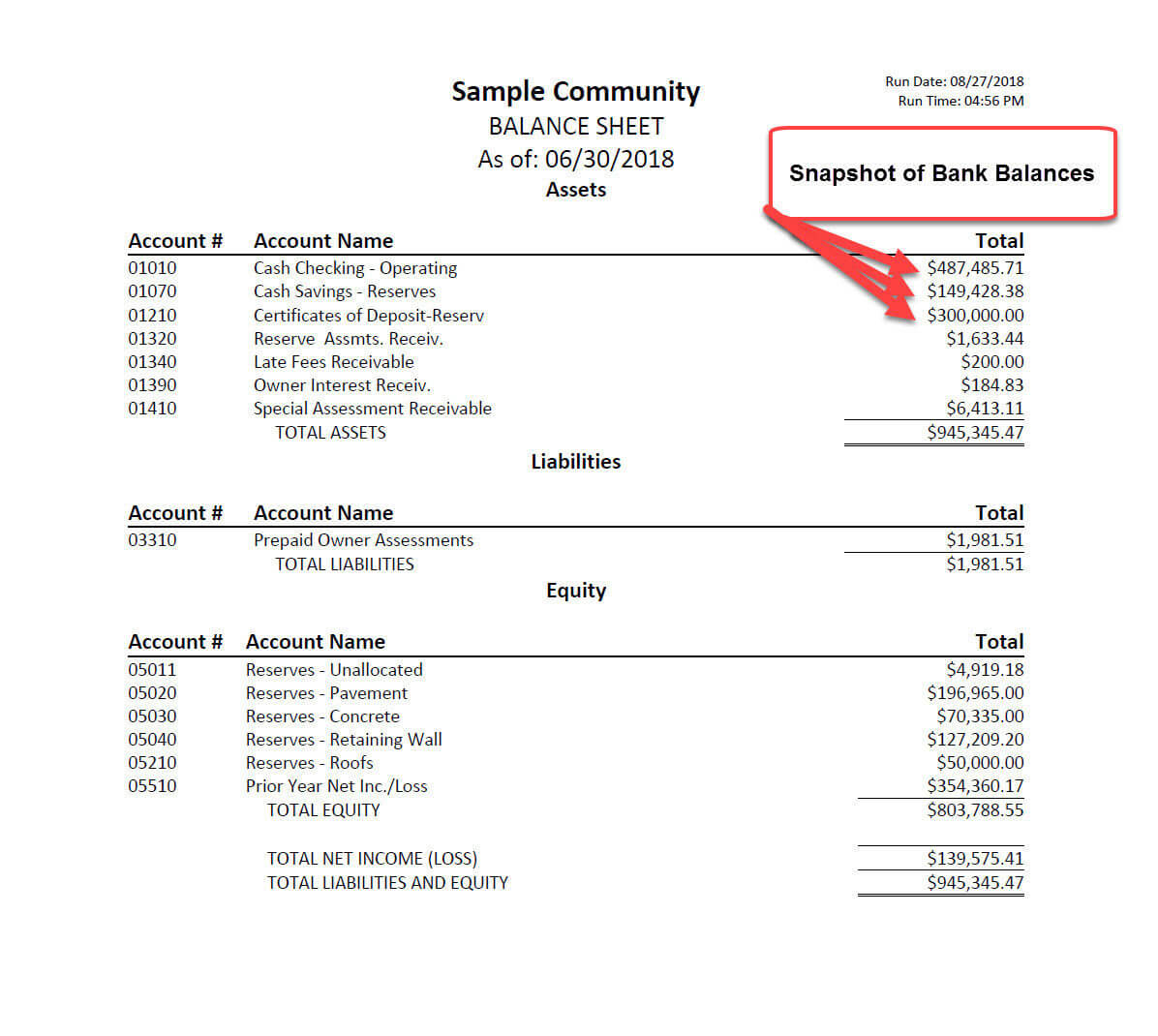

- Balance Sheet: This provides a snapshot of the HOA’s financial position at a specific point in time. It includes:

- Assets: What the HOA owns (e.g., cash, investments, accounts receivable).

- Liabilities: What the HOA owes (e.g., accounts payable, accrued expenses).

- Equity (or Net Assets): The difference between assets and liabilities, representing the HOA’s net worth.

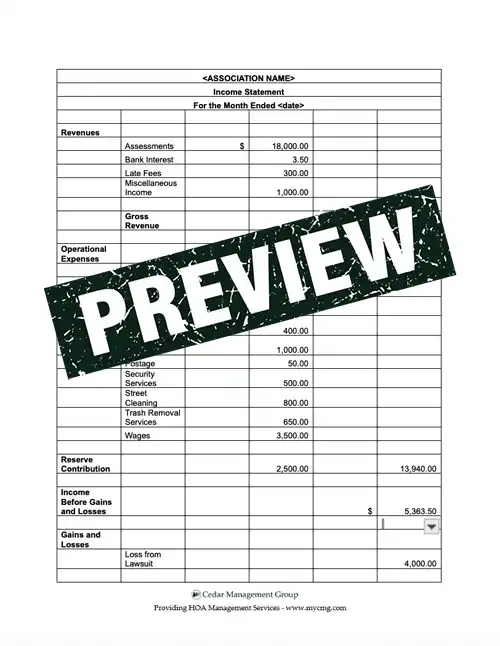

- Income Statement (Profit & Loss Statement): This summarizes the HOA’s financial performance over a specific period (e.g., monthly, quarterly, annually). It includes:

- Revenue: Income from assessments, fees, and other sources.

- Expenses: Costs incurred for operations, maintenance, and administration.

- Net Income (or Loss): The difference between revenue and expenses.

- Statement of Cash Flows: This tracks the movement of cash in and out of the HOA during a specific period. It’s broken down into:

- Operating Activities: Cash flow from day-to-day operations.

- Investing Activities: Cash flow from the purchase or sale of assets.

- Financing Activities: Cash flow from borrowing or repaying funds.

- Budget vs. Actual Report: This compares the actual financial performance to the approved budget, highlighting variances and areas needing attention.

- Reserve Study Funding Analysis: If your HOA has a reserve study, this section outlines the funding status of the reserve accounts, ensuring sufficient funds for future repairs and replacements of common elements.

- Notes to the Financial Statements: These provide important context and explanations for the financial data, including accounting policies, significant transactions, and any known contingencies.

Finding the Right HOA Financial Statement Template

While there isn’t a single “perfect” template, several resources can help you create or adapt one that meets your HOA’s needs:

- Accounting Software: Programs like QuickBooks or specialized HOA accounting software often include pre-built templates or customizable options.

- Professional Accountants: Hiring a CPA specializing in HOA accounting can provide you with a tailored template and guidance on best practices.

- Online Resources: Many websites offer free or paid HOA financial statement templates in various formats (e.g., Excel, PDF). Search for “HOA financial statement template” or “HOA budget template” to find examples.

- Consider Your State’s Requirements: Ensure your template complies with any specific reporting requirements mandated by your state’s laws.

Best Practices for Preparing and Distributing Financial Statements

- Accuracy is paramount: Ensure all financial data is accurate and properly documented.

- Consistency is key: Use a consistent accounting method and reporting format.

- Transparency is crucial: Clearly present the information in a way that is easy for homeowners to understand.

- Timely distribution: Distribute financial statements regularly (e.g., monthly, quarterly, annually) as specified in your HOA’s governing documents.

- Board Review: The board should review the financial statements thoroughly before distribution.

- Offer Explanations: Provide summaries, narrative explanations, or even hold a homeowner meeting to address any questions or concerns.

The Importance of Professional Assistance

While understanding the basics of HOA financial statements is essential, consider the value of professional assistance. A Certified Public Accountant (CPA) with experience in HOA accounting can:

- Ensure compliance with all applicable regulations.

- Provide expert guidance on budgeting, reserve planning, and financial management.

- Prepare accurate and reliable financial statements.

- Help identify and address potential financial risks.

Conclusion: Empowering Your HOA with Financial Literacy

A well-designed and consistently used HOA financial statement template is a powerful tool for fostering transparency, accountability, and financial stability within your community. By understanding the key components, utilizing the appropriate resources, and seeking professional guidance when needed, your HOA can ensure its long-term financial health and maintain the value of your homeowners’ investments. Take the time to review your HOA’s current financial reporting practices and make any necessary adjustments to ensure you are providing the most comprehensive and accessible information possible.

FAQs

1. How often should an HOA distribute financial statements?

The frequency of distribution is typically outlined in your HOA’s governing documents. Common practices include monthly, quarterly, or annual reporting.

2. What is a reserve study, and why is it important?

A reserve study is a professional assessment of the expected lifespan and replacement costs of the HOA’s common elements (e.g., roofs, pavement, pools). It helps the HOA plan for future expenses and ensures sufficient funds are available for necessary repairs and replacements.

3. Are HOA financial statements audited?

It depends on the size of the HOA, its governing documents, and potentially state law. Larger HOAs may be required to have annual audits performed by a CPA. Smaller HOAs may only require a review or compilation.

4. What if I don’t understand the financial statements?

Don’t be afraid to ask for help! The HOA board should be available to answer questions. You can also consult with a professional accountant or financial advisor for clarification.

5. Can homeowners access the HOA’s financial statements?

Yes, homeowners typically have the right to access the HOA’s financial statements. This is a fundamental aspect of transparency and accountability. The HOA should have a clear process for making these records available, such as posting them on a website or providing copies upon request.