Taming Your Finances: The Monthly Expense Monthly Budget Planner Template That Works Every Time

Feeling overwhelmed by where your money goes each month? Are you constantly wondering why you never seem to have anything left at the end of the month? The answer might lie in a powerful tool: a comprehensive monthly budget planner. This isn’t just about tracking expenses; it’s about taking control of your financial future. This article will guide you through the creation and utilization of a monthly expense monthly budget planner template that, when followed consistently, can transform your relationship with money.

Why You Need a Monthly Budget Planner

Before we dive into the details, let’s understand the “why” behind budgeting. A well-structured monthly budget planner provides numerous benefits, including:

- Increased Awareness: You’ll gain a clear understanding of your income and expenses, pinpointing exactly where your money is going.

- Debt Reduction: By identifying areas where you can cut back, you can allocate more funds towards paying down debt.

- Savings Goals: Budgeting helps you prioritize and achieve your financial goals, whether it’s saving for a down payment, a vacation, or retirement.

- Reduced Financial Stress: Knowing where your money is going and having a plan for the future can significantly reduce financial anxiety.

- Improved Financial Discipline: Regular budgeting fosters healthy financial habits and promotes responsible spending.

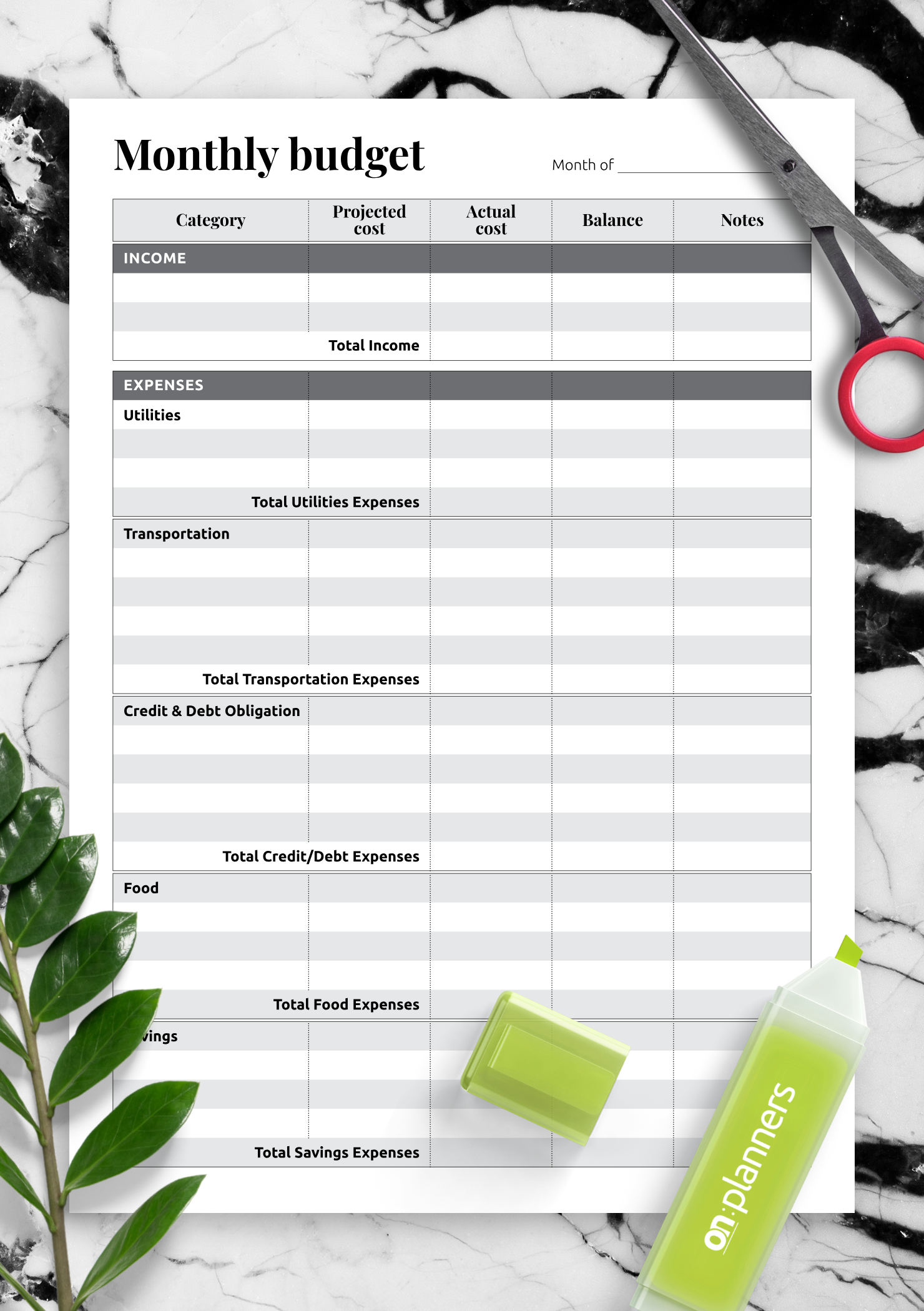

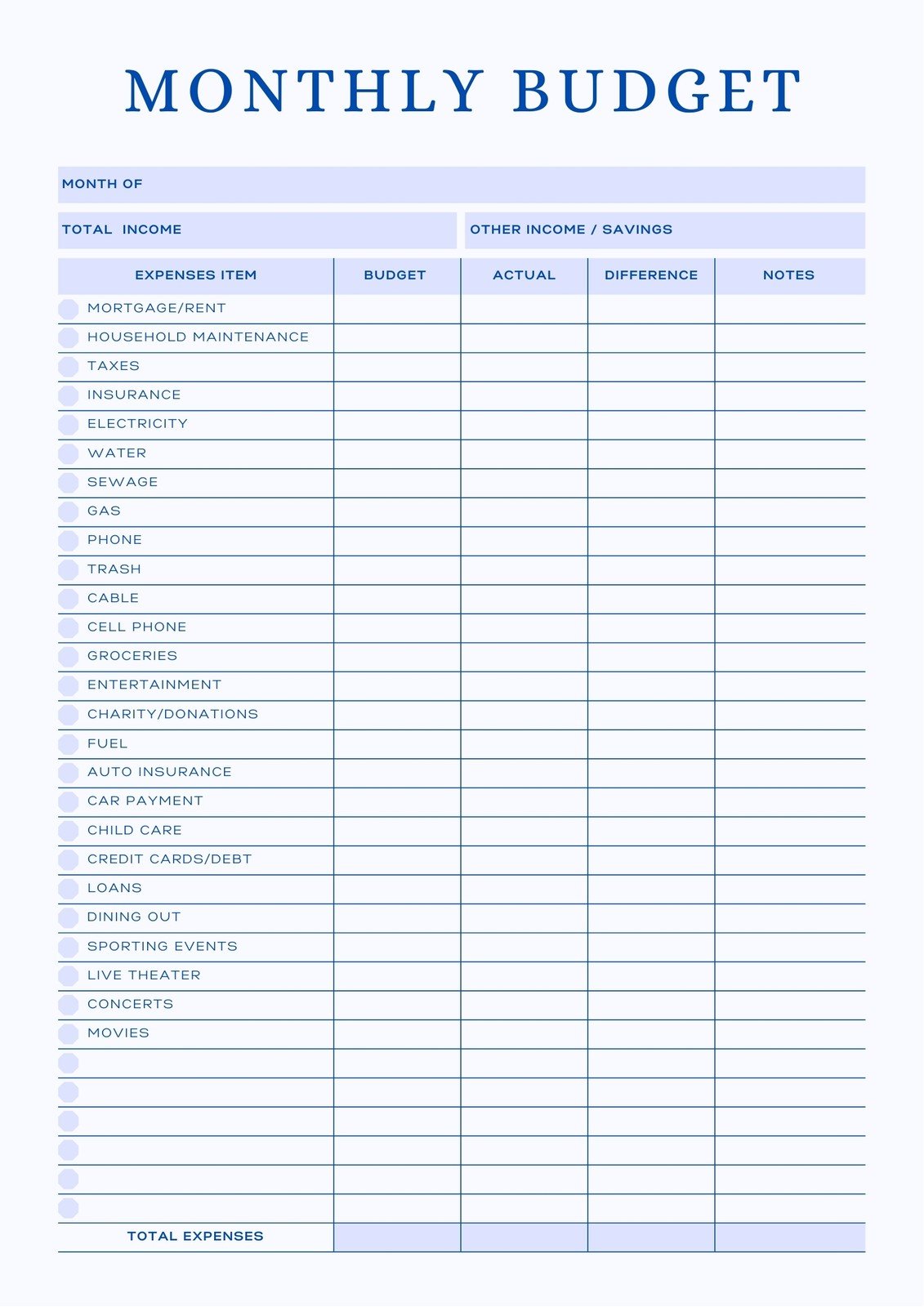

Creating Your Monthly Expense Monthly Budget Planner Template: A Step-by-Step Guide

This template can be created using a spreadsheet program like Microsoft Excel, Google Sheets, or even a simple notebook and pen. The key is to be consistent and adaptable.

Step 1: Determine Your Income

- Calculate Your Net Income: This is the most crucial step. Determine your take-home pay after taxes, deductions, and other withholdings. This is the money you actually have to work with each month.

- Include All Income Sources: Don’t forget to include any additional income, such as freelance earnings, side hustle profits, or investment returns.

Step 2: Categorize Your Expenses

Divide your expenses into categories. This is the heart of your budget planner. Here are some common categories:

- Fixed Expenses: These are expenses that remain relatively constant each month.

- Rent/Mortgage

- Utilities (electricity, gas, water)

- Internet/Cable

- Loan Payments (student loans, car loans)

- Insurance (health, car, home/renters)

- Variable Expenses: These expenses fluctuate from month to month.

- Groceries

- Dining Out

- Transportation (gas, public transit)

- Entertainment

- Clothing

- Personal Care

- Savings and Debt Payments: This category is crucial for financial health.

- Emergency Fund Contributions

- Retirement Savings

- Debt Payments (credit cards, high-interest loans)

Step 3: Estimate Your Expenses

- Review Past Bank Statements: Look back at your previous bank statements and credit card bills to get a clear picture of your spending habits.

- Be Realistic: Don’t underestimate expenses to make your budget look better. Aim for accuracy.

- Overestimate Where Possible: It’s better to overestimate expenses slightly than to underestimate and run out of money.

Step 4: Allocate Your Funds

- The Zero-Based Budgeting Method: This is a popular and effective method. In this approach, you assign every dollar of your income to a specific category. At the end of the month, your income minus your expenses should equal zero.

- Prioritize Needs Over Wants: Ensure your essential expenses (housing, food, utilities) are covered before allocating funds to discretionary spending (entertainment, dining out).

- Allocate for Savings and Debt Repayment: Make these categories a priority. Even small amounts can make a big difference over time.

Step 5: Track Your Spending

- Use a Spreadsheet or Budgeting App: Regularly input your expenses into your chosen template.

- Keep Receipts: Save all receipts to ensure accurate tracking.

- Monitor Progress Throughout the Month: Check your budget regularly to see if you’re staying on track.

Step 6: Review and Adjust Your Budget

- Monthly Review: At the end of each month, compare your actual spending to your budget.

- Identify Areas for Improvement: Did you overspend in any categories? Where can you cut back?

- Adjust Your Budget for the Next Month: Based on your review, make adjustments to your budget for the following month. This is a continuous process of refinement.

- Adapt to Life Changes: Life happens! Be prepared to adjust your budget as your income, expenses, and financial goals change.

Tips for Success: Making Your Budget Work Long-Term

- Automate Payments: Automate as many bills as possible to ensure timely payments and reduce the risk of late fees.

- Use Budgeting Apps: Consider using a budgeting app like Mint, YNAB (You Need a Budget), or Personal Capital to help you track your spending and stay organized.

- Set Realistic Goals: Don’t try to overhaul your finances overnight. Start small and gradually improve your budgeting habits.

- Be Patient and Persistent: Budgeting takes time and effort. Don’t get discouraged if you don’t see results immediately. Consistency is key.

- Celebrate Your Successes: Acknowledge and celebrate your financial wins, no matter how small. This will help you stay motivated.

Conclusion: Taking Control of Your Financial Future

A well-designed and consistently used monthly expense monthly budget planner template is a powerful tool for achieving financial freedom. By understanding your income, categorizing your expenses, tracking your spending, and reviewing your progress regularly, you can gain control of your finances, reduce stress, and achieve your financial goals. Start today, and you’ll be well on your way to a more secure and fulfilling financial future.

Frequently Asked Questions (FAQs)

1. What is the best budgeting app?

The “best” budgeting app depends on your individual needs and preferences. Popular options include Mint, YNAB (You Need a Budget), Personal Capital, and EveryDollar. Research different apps and choose the one that best suits your financial situation and goals.

2. How often should I update my budget?

Ideally, you should update your budget at least once a week to track your spending and ensure you’re staying on track. However, a monthly review is essential to compare your actual spending to your budget and make any necessary adjustments for the following month.

3. What if I overspend in a category?

Don’t panic! Identify the overspending category and determine why it happened. Then, look for areas where you can cut back in other categories to compensate. You can also adjust your budget for the next month to reflect your actual spending habits.

4. Is it okay to use a pre-made budget template?

Yes, absolutely! Using a pre-made budget template, whether it’s a spreadsheet or provided by a budgeting app, can be a great starting point. Many free templates are available online. However, personalize the template to fit your specific financial situation and goals.

5. What if I have fluctuating income?

If you have fluctuating income, you’ll need to adapt your budgeting strategy. Consider using a “rolling” or “variable” budget. Base your budget on your lowest expected income for the month, and allocate any extra income to savings, debt repayment, or flexible spending categories.