The Only Capital One Bank Routing Number Guide You’ll Ever Need

Navigating the world of banking can sometimes feel like deciphering a secret code. One of the most crucial pieces of that code? The routing number. Whether you’re setting up direct deposit, paying bills online, or transferring money, knowing the correct Capital One Bank routing number is essential. This comprehensive guide cuts through the jargon and provides everything you need to know, ensuring your transactions go smoothly and securely. Consider this your one-stop shop for all things related to Capital One routing numbers!

What is a Routing Number and Why Do You Need It?

A routing number, also known as an ABA routing transit number (RTN), is a nine-digit code that identifies a specific financial institution. Think of it as the bank’s unique address within the banking system. Without it, your money wouldn’t know where to go! You need a routing number for various financial activities, including:

- Setting up direct deposit: Receiving your paycheck, tax refunds, or government benefits.

- Paying bills online: Scheduling automatic payments for utilities, loans, and other recurring expenses.

- Transferring money: Sending funds to other accounts, both within Capital One and at other banks.

- Ordering checks: Pre-printed checks require your bank’s routing number.

- Setting up electronic payments (ACH transfers): Facilitating electronic fund transfers.

Finding Your Capital One Routing Number: The Essential Guide

Capital One, like other banks, uses different routing numbers depending on the state and the type of account. Here’s how to find the correct number for your specific needs:

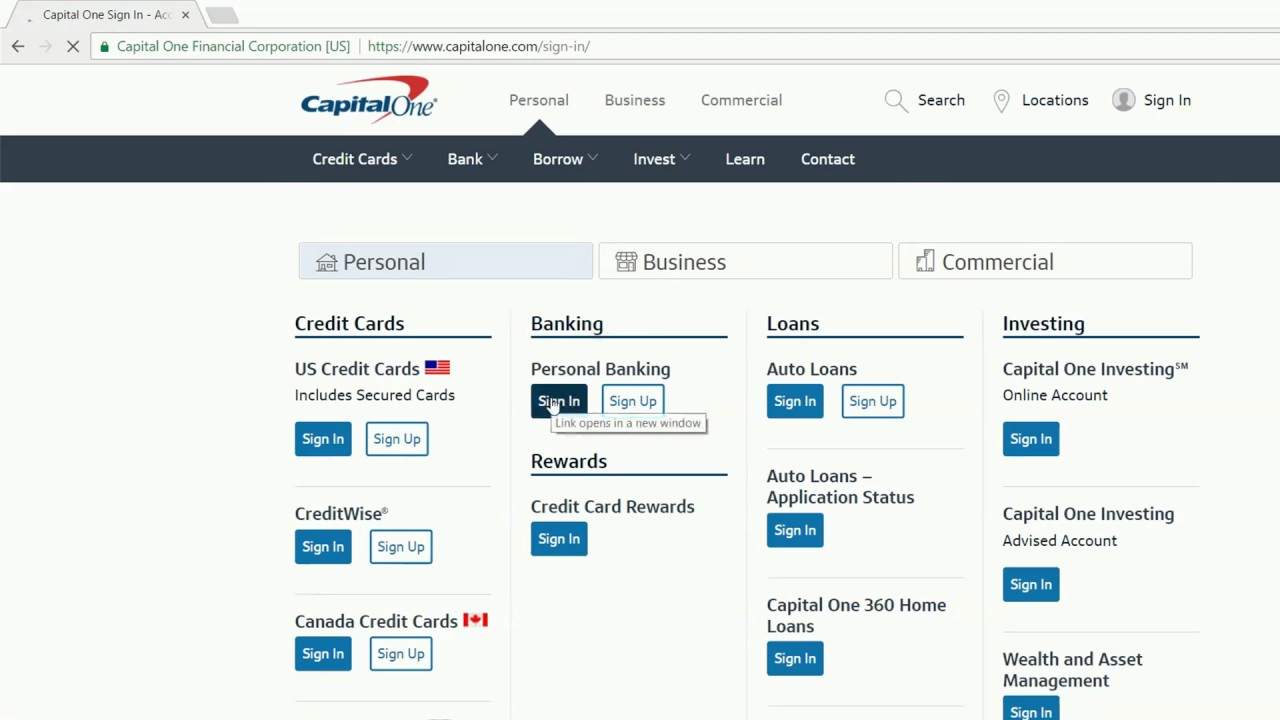

- Online Banking: The easiest and most reliable method is to log in to your Capital One online banking account. The routing number is usually displayed prominently on your account details page, often alongside your account number.

- Mobile App: The Capital One mobile app also provides access to your routing number. Navigate to your account details section.

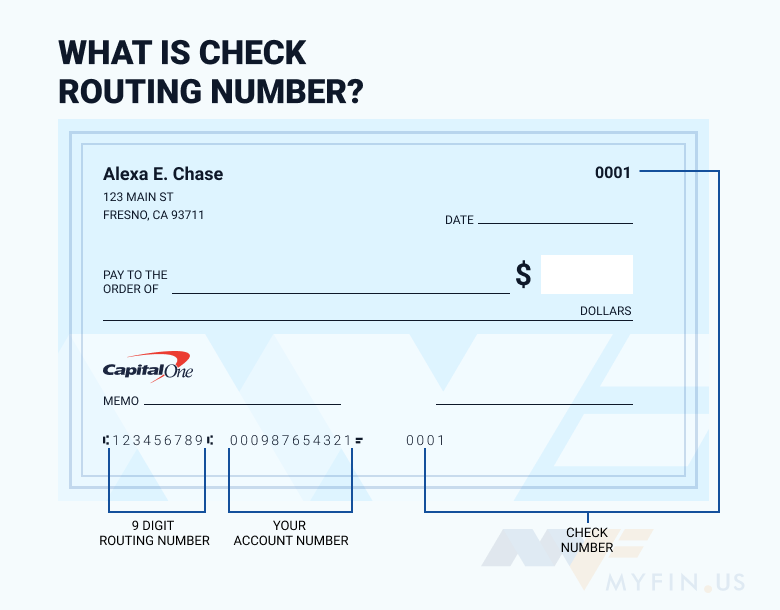

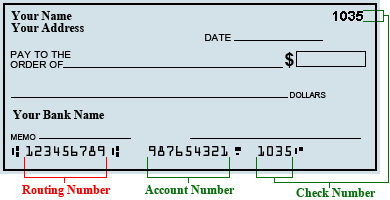

- Your Checks: Your routing number is printed on the bottom left corner of your checks. It’s the first set of numbers, typically followed by your account number and the check number.

- Capital One Website: Visit the official Capital One website and navigate to their help section. They often provide a routing number lookup tool or a list of common routing numbers.

- Contact Capital One Directly: If you’re still unsure, the safest option is to contact Capital One customer service. You can find their phone number on their website or on your account statements.

Understanding Capital One Routing Numbers by State

While Capital One operates nationally, routing numbers can vary. Here’s a general overview. Always double-check with the methods listed above to confirm the correct routing number for YOUR specific account.

- Capital One 360 Accounts: These accounts typically use the routing number 031176110.

- Checking and Savings Accounts (Other than 360): Routing numbers can vary based on the location where the account was opened. Again, confirm via your online banking or statement.

- Credit Card Payments: While you might use a routing number for receiving funds (like a credit card refund), you generally don’t need one to make a credit card payment through your bank. You’ll typically use your credit card number and other details.

Important Note: Routing numbers can change. Always verify the number before initiating any transaction.

Avoiding Common Mistakes with Routing Numbers

Using the wrong routing number can lead to significant problems, including:

- Delayed transactions: Your payment or deposit could be held up while the banks try to resolve the error.

- Failed transactions: The transaction could be rejected entirely, leading to missed payments or lost funds.

- Funds being sent to the wrong account: In the worst-case scenario, your money could end up in someone else’s account.

- Fees: You might incur fees from your bank or the recipient’s bank if a transaction fails due to an incorrect routing number.

To minimize errors, always:

- Double-check the routing number: Verify the number against your online banking, mobile app, or check.

- Triple-check the account number: Make sure you have the correct account number for the recipient.

- Test the transaction: If possible, start with a small transaction to ensure everything works correctly.

- Keep records: Save confirmation emails or screenshots of your transactions.

Conclusion: Your Financial Success Starts with Accuracy

Knowing and using the correct Capital One routing number is fundamental to successful banking. By following the guidance in this article, you can confidently manage your finances, ensuring your money goes where it needs to go, when it needs to go there. Remember to always verify your routing number and account number before any transaction and to keep your banking information secure. You’re now well-equipped to navigate the world of Capital One banking!

Frequently Asked Questions (FAQs)

1. Where can I find my Capital One routing number for direct deposit?

The easiest place to find your routing number for direct deposit is within your Capital One online banking account or mobile app. You can usually find it in the account details section. You can also find it on your checks or by contacting Capital One directly.

2. Does Capital One have different routing numbers for different states?

While Capital One operates nationwide, some routing numbers may vary based on the type of account and the location where it was opened. Capital One 360 accounts often use a specific routing number, while other accounts might have different numbers. Always verify the number through your account details.

3. What happens if I use the wrong Capital One routing number?

Using the wrong routing number can lead to delayed or failed transactions, and in some cases, your money may be sent to the wrong account. It is crucial to always double-check the routing number before making any transactions.

4. Can I use the routing number from my check to set up direct deposit for my paycheck?

Yes, the routing number found on your Capital One check is generally the correct routing number for setting up direct deposit, assuming it is the correct account. However, it’s always best to verify it against your online banking or mobile app.

5. How do I update my Capital One routing number if it changes?

If your routing number changes, you will need to update it wherever you have provided it. This includes direct deposit information with your employer, online bill payments, and any other services that use your routing number. Capital One will likely notify you if your routing number is changing.