Demystifying Australian Payslips: Your Guide to the Perfect Excel Template

Navigating the world of payroll can feel like a complex labyrinth, especially when you’re a small business owner or managing your own finances. One of the most crucial elements of this process is the payslip – a document that needs to be accurate, compliant, and easily understood. In Australia, with its specific taxation and superannuation requirements, having a reliable payslip template is paramount. This article delves into the world of Australian payslip templates in Excel, providing you with the knowledge and resources to create a system that works for you.

Why Use an Excel Payslip Template for Australia?

Excel offers a powerful and cost-effective solution for generating payslips, especially for businesses with a smaller employee base. Here’s why it’s a popular choice:

- Cost-Effectiveness: Excel is readily available and requires no subscription fees (if you already have it).

- Customization: You can tailor the template to perfectly match your business’s specific needs and branding.

- Flexibility: Easily adapt the template to accommodate changes in legislation, tax rates, and employee details.

- Accessibility: Excel files are easily shared and accessed by employees.

- Data Management: You can use Excel’s formulas and functions to automate calculations and track payroll data.

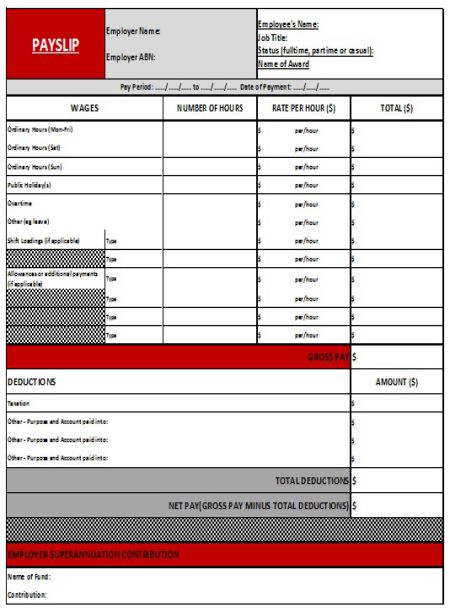

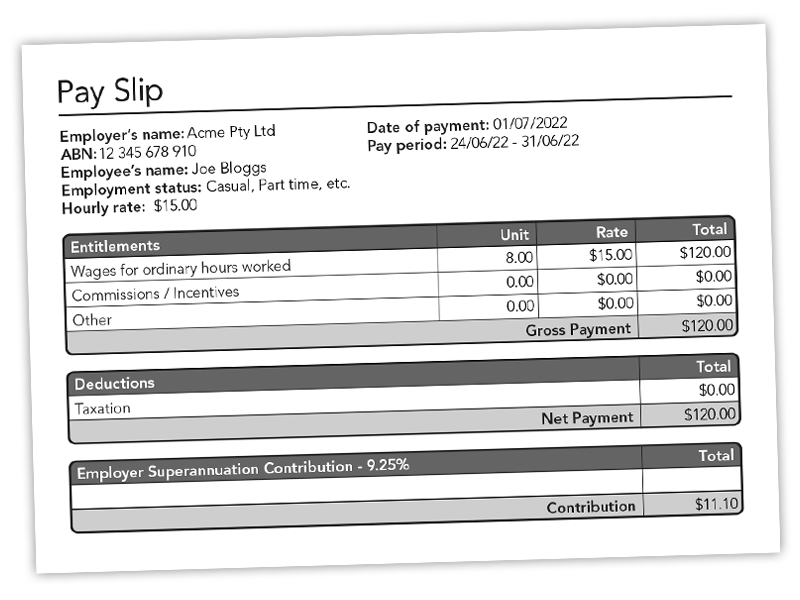

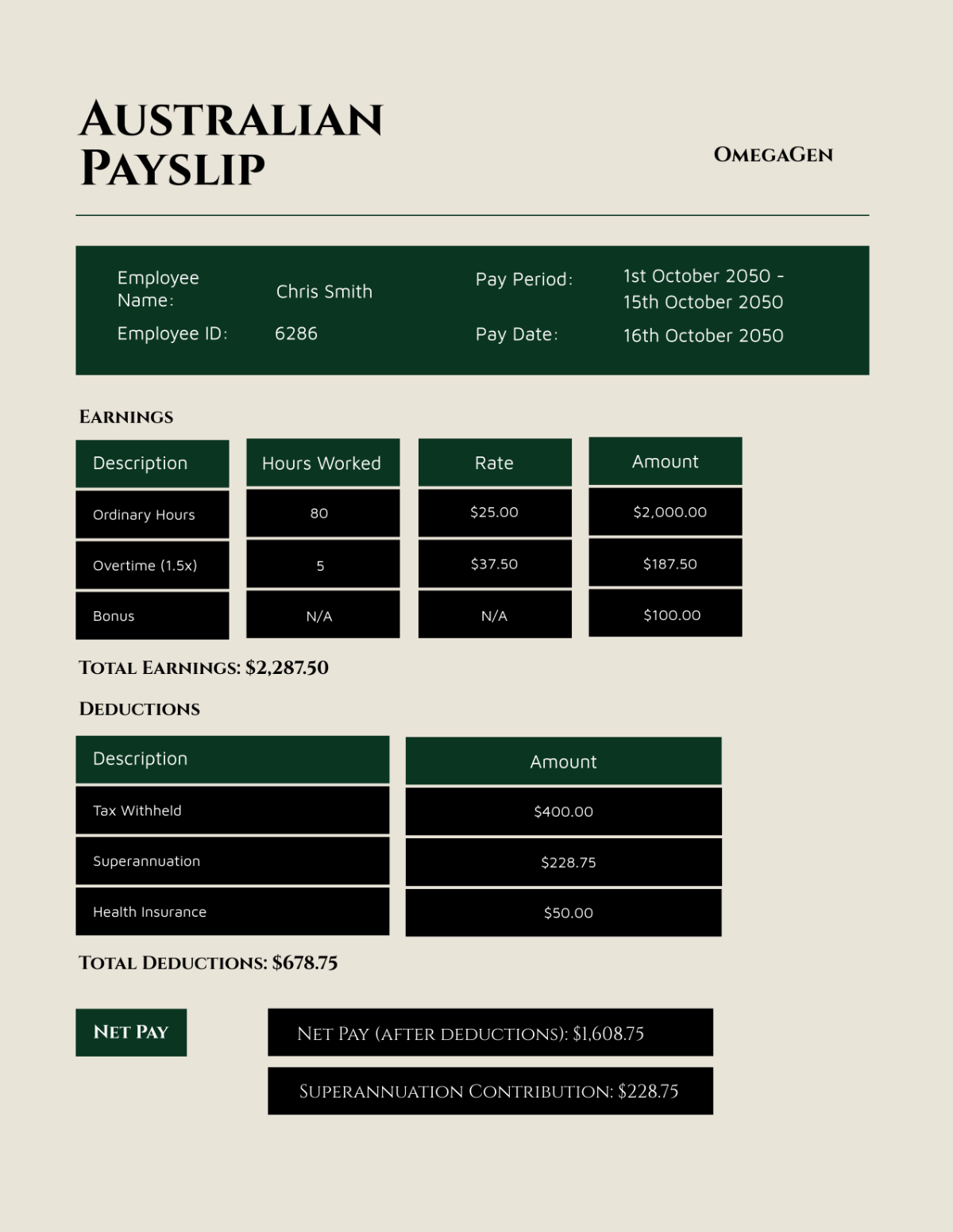

Key Components of a Compliant Australian Payslip Template

Before you start building your Excel template, it’s crucial to understand the mandatory information that must be included on every Australian payslip, as mandated by the Fair Work Act 2009. Your template needs to capture these details accurately:

- Employer Information:

- Employer’s ABN (Australian Business Number)

- Employer’s Name and Contact Details

- Employee Information:

- Employee’s Full Name

- Employee’s Address (optional, but recommended)

- Employee’s Tax File Number (TFN) - Note: this is not displayed on the payslip itself, but is vital for your payroll records.

- Pay Period Details:

- Date of Payment

- Pay Period (e.g., 1st - 14th May 2024)

- Gross Pay

- Earnings Information:

- Ordinary Hours Worked (and Rate)

- Overtime Hours Worked (and Rate) - Clearly state the overtime calculation method

- Penalty Rates (if applicable)

- Allowances (e.g., travel, uniform)

- Any other earnings components.

- Deductions Information:

- Income Tax Withheld (PAYG)

- Superannuation Contributions (Employer and Employee)

- Other Deductions (e.g., union fees, salary sacrifice)

- Net Pay: The total amount paid to the employee after all deductions.

- Payment Method: The method of payment (e.g., bank transfer, cheque).

- Pay Rate: The employee’s hourly rate, salary or piece rate.

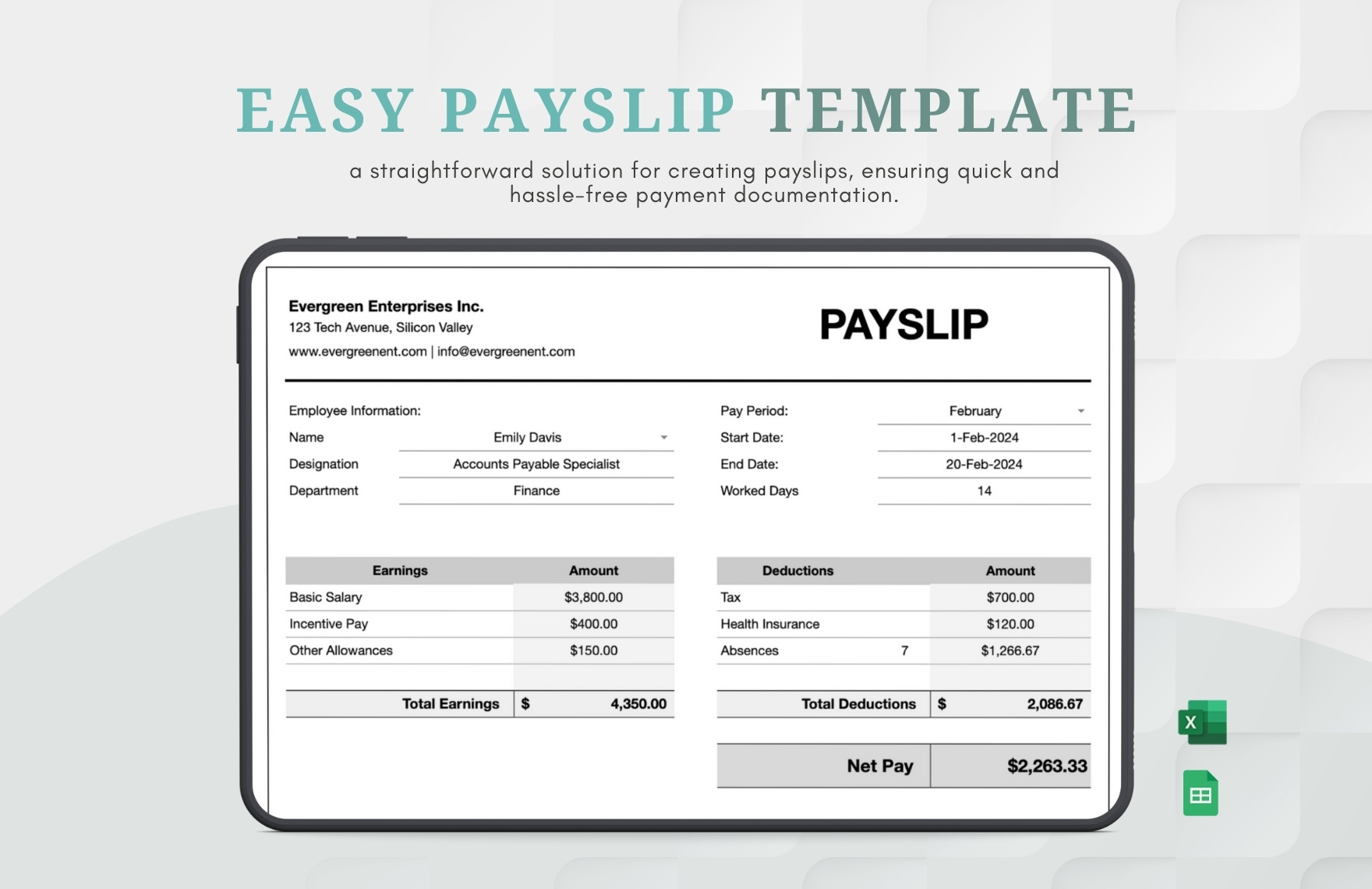

Building Your Australian Payslip Template in Excel: A Step-by-Step Guide

Here’s a practical approach to constructing your payslip template:

- Establish the Foundation:

- Open a new Excel workbook.

- Create a header section at the top for your company logo and contact details.

- Define columns for the required information (as outlined above). Use clear and concise column headers.

- Employee and Pay Period Details:

- Create sections to input the employee’s name, pay period dates, and the date of payment.

- Earnings Section:

- Create columns for:

- Hours Worked (Ordinary, Overtime, etc.)

- Hourly Rate (or equivalent salary)

- Earnings Calculation (using formulas:

Hours * Rate) - Total Earnings for each component.

- Create columns for:

- Deductions Section:

- Columns for:

- Income Tax Withheld (This will likely require a lookup based on tax tables. You can use the

VLOOKUPorINDEXandMATCHfunctions in Excel.) - Superannuation contributions (Employer and Employee contributions, use the current superannuation guarantee rate).

- Other Deductions (e.g., union fees, salary sacrifice).

- Income Tax Withheld (This will likely require a lookup based on tax tables. You can use the

- Calculate the total deductions.

- Columns for:

- Net Pay Calculation:

- Use a formula to calculate Net Pay:

Gross Pay - Total Deductions.

- Use a formula to calculate Net Pay:

- Formatting and Presentation:

- Use clear and consistent formatting (fonts, colours, borders) for readability.

- Ensure all values are formatted as currency or numbers with appropriate decimal places.

- Include a section for the payment method.

- Formulas and Automation:

- Utilize Excel formulas to automate calculations. This will save you time and reduce the risk of errors. Some key formulas include:

SUM(for calculating totals)MULTIPLY(e.g.,Hours * Rate)VLOOKUPorINDEX/MATCH(for tax calculations)IF(for conditional calculations, like overtime)

- Utilize Excel formulas to automate calculations. This will save you time and reduce the risk of errors. Some key formulas include:

- Testing and Review:

- Thoroughly test your template with sample data to ensure accuracy.

- Review the template regularly to ensure it complies with current legislation and tax rates.

Resources and Templates

While building your own offers maximum flexibility, you can also find pre-built Australian payslip templates online. Search for terms like:

- “Australian payslip template Excel”

- “Free payslip template Australia”

- “Excel payroll template Australia”

Be sure to review any downloaded template to ensure it aligns with current legislation and your specific business needs.

Important Considerations:

- Tax Tables: Tax rates change annually. You’ll need to update your template with the latest tax tables provided by the Australian Taxation Office (ATO).

- Superannuation Guarantee: Stay informed of the superannuation guarantee contribution rate and any legislative changes.

- Record Keeping: Maintain accurate records of all payslips and payroll data for the required period (usually seven years).

- Legal Advice: Consider seeking advice from a qualified accountant or payroll professional to ensure your template and payroll processes are fully compliant.

Frequently Asked Questions (FAQs)

1. Is it legal to use an Excel payslip template in Australia?

Yes, as long as the template includes all the mandatory information required by the Fair Work Act 2009 and any other relevant legislation.

2. Where can I find the latest tax tables for my Excel template?

You can download the latest tax tables from the Australian Taxation Office (ATO) website.

3. How often should I update my Excel payslip template?

You should update your template at least annually to reflect changes in tax rates, the superannuation guarantee, and any other relevant legislation. You may also need to update it more frequently if there are mid-year changes.

4. What happens if my payslip is incorrect?

If a payslip is incorrect, you must rectify the error and reissue a corrected payslip. Ensure your payroll processes are robust to minimize errors.

5. Is it better to use Excel or payroll software?

For very small businesses with minimal employees and simple payroll requirements, Excel can be sufficient. However, as your business grows, payroll software offers greater automation, security, and compliance features, making it a more scalable solution.

Conclusion: Empowering Your Payroll Process

Creating and maintaining an accurate and compliant Australian payslip template in Excel is a worthwhile investment of your time. By following the guidelines outlined in this article, you can streamline your payroll process, reduce errors, and ensure you meet your legal obligations. While Excel is a great starting point, remember to stay informed of legislative changes and consider the scalability of your chosen solution as your business evolves. Good luck!