The Printable Checks Online You Need Right Now: A Comprehensive Guide

In today’s digital landscape, the need for physical checks might seem outdated. However, despite the rise of online payments and electronic transfers, printed checks remain a vital tool for many individuals and businesses. Whether you’re a small business owner managing payroll, a landlord collecting rent, or simply someone who prefers the security and convenience of a paper trail, printable checks offer a flexible and cost-effective solution. This article will delve into the world of printable checks online, providing you with the information you need to choose the right option and navigate the process seamlessly.

Understanding the Benefits of Printable Checks

Before diving into the “how,” let’s clarify why printable checks online are still relevant:

- Cost-Effectiveness: Printing your own checks eliminates the need to purchase pre-printed ones, saving you money on bulk orders and shipping fees.

- Flexibility and Control: You have complete control over the check design, layout, and information included.

- Customization: Tailor your checks to reflect your brand or personal style.

- Convenience: Print checks on demand, whenever you need them, from the comfort of your home or office.

- Security: Printable checks often incorporate security features, such as microprint and watermarks, to deter fraud.

- Compatibility: Works with various accounting software and check printing applications.

Exploring Your Printable Check Online Options

The market offers a variety of online platforms and software solutions for generating printable checks. Here’s a breakdown of the key options:

- Check Printing Software: These software programs are specifically designed for creating and printing checks. They often integrate with accounting software and offer advanced features like MICR font support and security enhancements. Popular options include:

- Checkeeper: A cloud-based service that allows you to print checks from any device.

- QuickBooks Check Printing: If you use QuickBooks, this is a native and integrated solution.

- CheckSoft: A comprehensive check printing software for Windows.

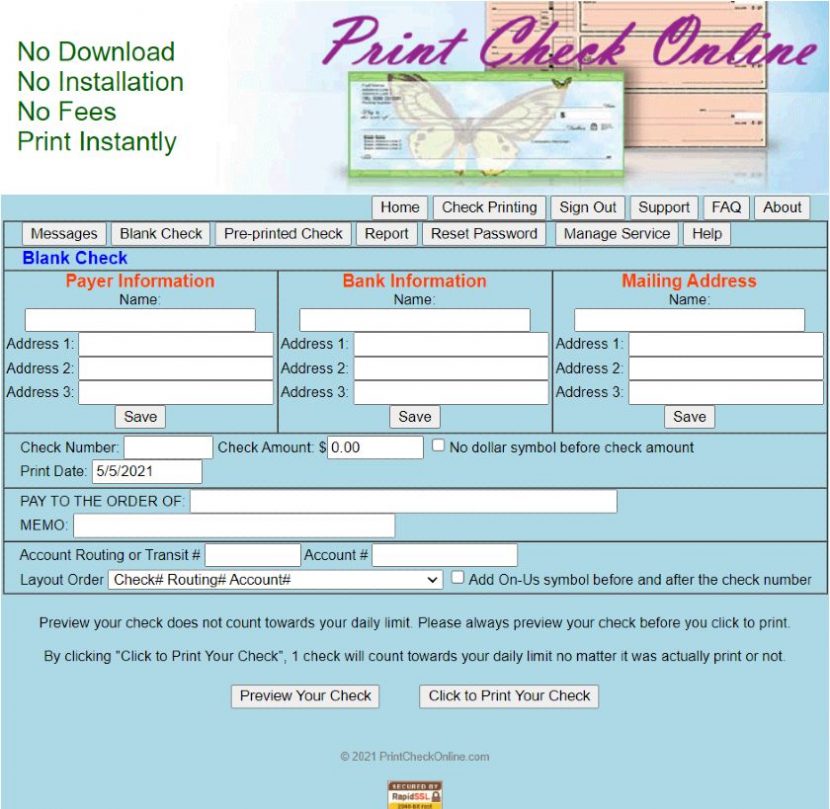

- Online Check Printing Services: Some websites offer on-demand check printing services where you can upload your data, customize the check layout, and print directly from their platform.

- Templates and Fillable PDFs: You can find free or paid check templates online (often in Microsoft Word or PDF format). These templates require you to manually enter the check information, which is time-consuming but cost-effective.

- Accounting Software Integration: Many accounting software packages, such as QuickBooks Online, Xero, and FreshBooks, have built-in check printing capabilities.

Key Features to Look for in Printable Check Solutions

When choosing a printable check solution, consider these essential features:

- MICR Font Support: Ensure the software or platform supports the Magnetic Ink Character Recognition (MICR) font, which is crucial for banks to process your checks.

- Security Features: Look for options that offer features like:

- Secure MICR font

- Watermarks

- Microprint

- Void pantograph

- Compatibility: Verify compatibility with your printer and accounting software (if applicable).

- Customization Options: The ability to customize the check layout, add logos, and include specific information is valuable.

- Ease of Use: The platform should be user-friendly and easy to navigate, especially if you’re not tech-savvy.

- Cost: Consider the price of the software or service, as well as any associated fees (e.g., per-check printing costs).

- Customer Support: Reliable customer support is essential in case you encounter any issues.

The Step-by-Step Process of Printing Checks Online

While the specific steps may vary depending on the chosen solution, the general process is as follows:

- Choose a Solution: Select the software or service that best meets your needs.

- Set Up Your Account: Create an account and provide the necessary information, such as your bank details (account number, routing number), and business/personal information.

- Customize Your Check Template: If applicable, customize the check layout, add your logo, and specify the information fields.

- Enter Check Information: Input the payee’s name, amount, date, and any memo information.

- Preview and Review: Before printing, preview the check to ensure all the information is correct.

- Print the Check: Load your check stock into your printer and print the check.

- Securely Store Records: Keep a record of each check printed, including the payee, amount, and date.

Ensuring Security and Compliance

Printing checks involves handling sensitive financial information. Here are some important security and compliance considerations:

- Use Secure Paper: Always use check stock that meets industry standards and includes security features.

- Protect Your Data: Secure your software, computer, and network with strong passwords, firewalls, and antivirus software.

- Store Check Stock Securely: Keep your check stock in a locked and secure location to prevent unauthorized access.

- Verify Bank Information: Double-check all bank account and routing numbers before printing checks.

- Comply with Regulations: Be aware of any applicable regulations related to check printing and processing in your region.

Conclusion: Embracing the Efficiency of Printable Checks

Printable checks online provide a powerful and convenient way to manage your finances. By carefully evaluating your options, choosing a reliable solution, and following security best practices, you can streamline your check printing process, save money, and maintain control over your payments. Whether you’re a small business owner, a landlord, or simply looking for a more flexible payment method, printable checks offer a valuable solution in today’s digital world.

Frequently Asked Questions (FAQs)

- What kind of printer do I need to print checks? You’ll need a laser printer capable of printing MICR fonts. Inkjet printers are generally not recommended for check printing due to the potential for ink smudging and the inability to print MICR fonts effectively.

- Is it safe to print checks online? Yes, it can be safe if you use reputable software or services and implement appropriate security measures, such as using secure check stock, protecting your data, and verifying all information before printing.

- Where can I buy check stock? Check stock can be purchased from office supply stores, online retailers (e.g., Amazon), and check printing companies. Ensure you choose check stock that is compatible with your printer and meets industry security standards.

- What is a MICR font, and why is it important? MICR (Magnetic Ink Character Recognition) font is a special font containing numbers and characters printed with magnetic ink. Banks use this font to automatically read and process checks. Without a correctly printed MICR font, your checks may not be processed correctly.

- Can I use regular paper to print checks? No, you should not use regular paper to print checks. You must use check stock that is specifically designed for check printing and meets industry security standards. Using regular paper can lead to issues with bank processing and increase the risk of fraud.