The Rent Receipt Download in India You’ve Been Looking For: Your Complete Guide

Navigating the Indian rental landscape often involves a paper trail, and a crucial piece of that puzzle is the rent receipt. Whether you’re a tenant seeking tax benefits or a landlord needing to maintain meticulous records, having readily accessible rent receipts is essential. This comprehensive guide provides everything you need to know about rent receipt downloads in India, ensuring you can easily access and manage this vital documentation.

Why Rent Receipts Matter: Understanding Their Importance

Before diving into download methods, let’s clarify why rent receipts are so critical. They serve multiple purposes, making them indispensable for both tenants and landlords:

- Tax Benefits (For Tenants): Rent receipts are the primary document required to claim House Rent Allowance (HRA) deductions under Section 10(13A) of the Income Tax Act. This can significantly reduce your taxable income.

- Proof of Payment: They serve as irrefutable evidence of rent payments made, protecting both parties in case of disputes.

- Legal Protection: In case of legal issues related to tenancy, rent receipts act as crucial supporting documents.

- Record Keeping (For Landlords): Rent receipts help landlords maintain accurate financial records, track rental income, and comply with tax regulations.

- Loan and Credit Applications: Some financial institutions may require rent receipts as proof of residence for loan or credit card applications.

Methods for Downloading Rent Receipts in India

While the traditional method of receiving a physical rent receipt is still prevalent, several modern methods offer greater convenience and efficiency. Here’s a breakdown of the most common ways to obtain your rent receipt download:

From Your Landlord Directly: This is the most direct and often the preferred method.

- Physical Receipts: Your landlord provides a paper receipt after each payment.

- Digital Receipts (Email or WhatsApp): Many landlords are now opting for digital receipts, sending them via email or messaging apps like WhatsApp. This is a convenient and environmentally friendly option.

- Rent Agreement Clause: Your rent agreement may specify how and when rent receipts will be provided.

Through Online Rent Payment Platforms: If you use platforms like NoBroker, Housing.com, or Magicbricks to pay your rent, you typically have access to downloadable rent receipts within your account.

- Easy Download: These platforms often have a dedicated section for rent receipts, allowing you to download them in PDF or other formats.

- Automated Generation: Receipts are usually generated automatically after each successful payment.

- Accessibility: You can access your receipts anytime, anywhere, as long as you have internet access.

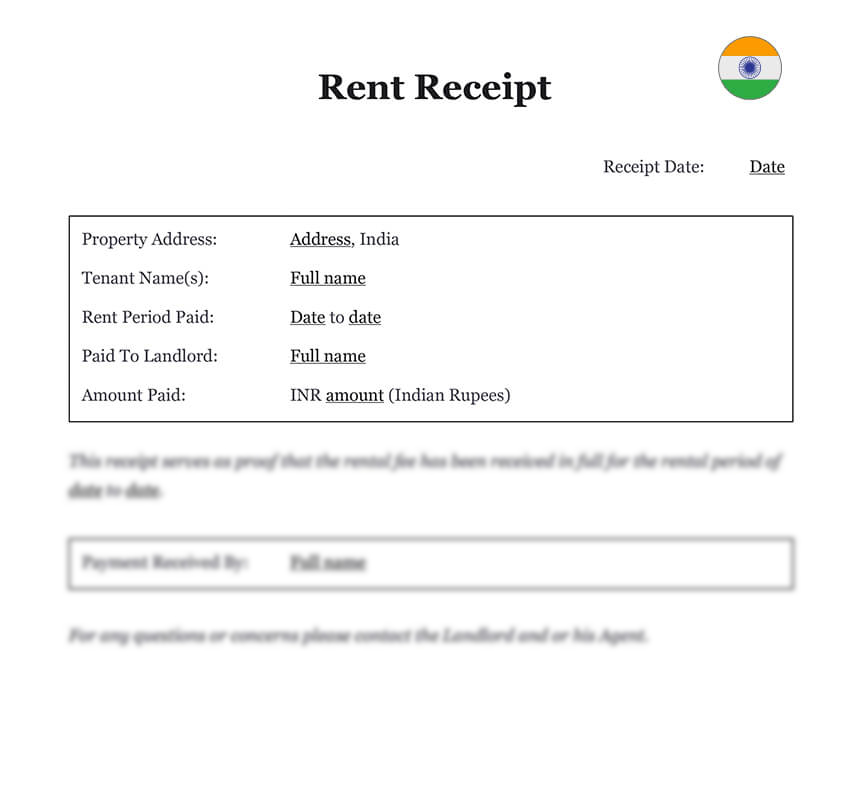

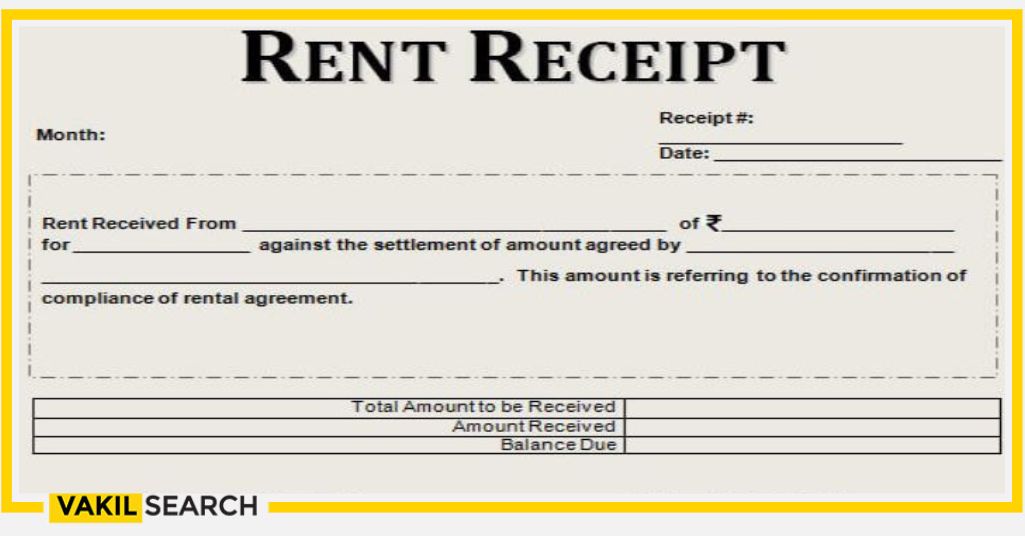

Using Rent Receipt Generators (If Your Landlord Doesn’t Provide One): Several online rent receipt generators are available. These tools allow you to create professional-looking receipts, but it’s crucial to ensure they are legally compliant and include all the necessary details.

- Required Information: These generators typically ask for details like:

- Landlord’s Name and Address

- Tenant’s Name and Address

- Property Address

- Rental Period (Month/Year)

- Rent Amount Paid

- Payment Method

- Landlord’s Signature (or Digital Signature, if applicable)

- Legality Check: Always check with a legal professional or tax advisor if you have questions about the compliance of a rent receipt generated by a third-party tool.

- Required Information: These generators typically ask for details like:

Key Information to Include on Your Rent Receipt

Regardless of the download method, a valid rent receipt must contain the following essential information:

- Landlord’s Full Name and Address: This is the person or entity receiving the rent.

- Tenant’s Full Name and Address: This is the person paying the rent.

- Property Address: The complete address of the rented property.

- Rental Period: The specific month and year for which the rent is paid.

- Rent Amount Paid (in Rupees): The exact amount of rent paid.

- Payment Method: How the rent was paid (e.g., Cash, Cheque, Online Transfer, UPI).

- Payment Date: The date on which the rent was paid.

- Landlord’s Signature (or Digital Signature): This validates the receipt.

- Revenue Stamp (if the rent exceeds a certain amount, consult a tax advisor for the specifics): Depending on the amount, a revenue stamp may be required.

Troubleshooting Common Issues with Rent Receipt Downloads

Sometimes, you might encounter problems when trying to download your rent receipt. Here are some troubleshooting tips:

- Check Your Online Payment Platform Account: Ensure you are logged in and have access to the correct account associated with your rent payments.

- Verify Your Email Address: If you are expecting digital receipts, confirm that the correct email address is registered with your landlord or the payment platform.

- Contact Your Landlord Directly: If you are not receiving receipts from your landlord, reach out to them promptly.

- Check Your Spam Folder: Digital receipts may sometimes end up in your spam or junk folder.

- Ensure the Receipt is Complete: Make sure all required information is included. If anything is missing, request a revised receipt.

Conclusion: Streamlining Your Rental Experience

Downloading rent receipts in India is simpler than ever, thanks to various methods and online platforms. By understanding the importance of these receipts and utilizing the available resources, you can streamline your rental experience, ensure compliance with tax regulations, and protect your financial interests. Remember to keep your rent receipts organized for easy access and reference throughout the financial year.

Frequently Asked Questions (FAQs)

1. What is the validity period for keeping rent receipts?

You should retain your rent receipts for at least the period required for income tax assessments. It’s generally recommended to keep them for a minimum of 6 years from the end of the assessment year. This is because the Income Tax Department can scrutinize your tax returns for up to six years.

2. Can I claim HRA without a rent receipt?

No, you cannot claim HRA deductions without providing rent receipts to your employer or when filing your income tax return. The rent receipt is the primary documentation required to support your HRA claim.

3. What if my landlord refuses to provide a rent receipt?

If your landlord refuses to provide a rent receipt, politely explain the importance of the receipt for your tax purposes. You can also remind them of the legal implications. If the issue persists, you might consider consulting a legal professional to understand your rights and options. Document all rent payments with bank statements or other proof of payment.

4. Are rent receipt generator tools reliable?

While rent receipt generators can be helpful, it’s crucial to ensure they are legally compliant and include all necessary information. Always verify the accuracy and completeness of the generated receipt. It’s also advisable to consult with a tax advisor or legal professional if you have any doubts about their validity.

5. Can I use a handwritten rent receipt?

Yes, a handwritten rent receipt is valid, provided it contains all the essential information mentioned above and is signed by your landlord. However, a professionally formatted receipt is generally preferred for clarity and ease of review.