The Simplified Cash Flow Statement Template That Works Every Time

Cash flow. The lifeblood of any business. Understanding how cash moves in and out is crucial for making informed financial decisions, securing funding, and ensuring long-term sustainability. But the full, formal Cash Flow Statement can seem daunting, especially for small business owners or those new to financial reporting. This article demystifies the process, providing a simplified cash flow statement template that’s easy to use and consistently delivers valuable insights. We’ll break down the components, guide you through the creation process, and equip you with the knowledge you need to effectively manage your cash flow.

What is a Cash Flow Statement and Why Does it Matter?

A Cash Flow Statement (CFS) is a financial statement that summarizes the amount of cash and cash equivalents entering and leaving a company during a specific period. Unlike the income statement, which focuses on revenue and expenses, the CFS tracks actual cash transactions. This is vital because:

- It reveals your ability to meet short-term obligations: Can you pay your bills?

- It helps with strategic planning: How much cash do you have available for investments, expansion, or debt repayment?

- It’s crucial for securing funding: Lenders and investors rely on cash flow statements to assess risk and profitability.

- It identifies potential financial problems: Early warning signs of cash shortages can be spotted.

The Simplified Cash Flow Statement: A Step-by-Step Guide

This simplified template focuses on the core activities that impact your cash position. While it might not meet the rigorous standards of Generally Accepted Accounting Principles (GAAP) for larger businesses, it provides a practical and effective tool for understanding your cash flow.

Step 1: Choose Your Reporting Period

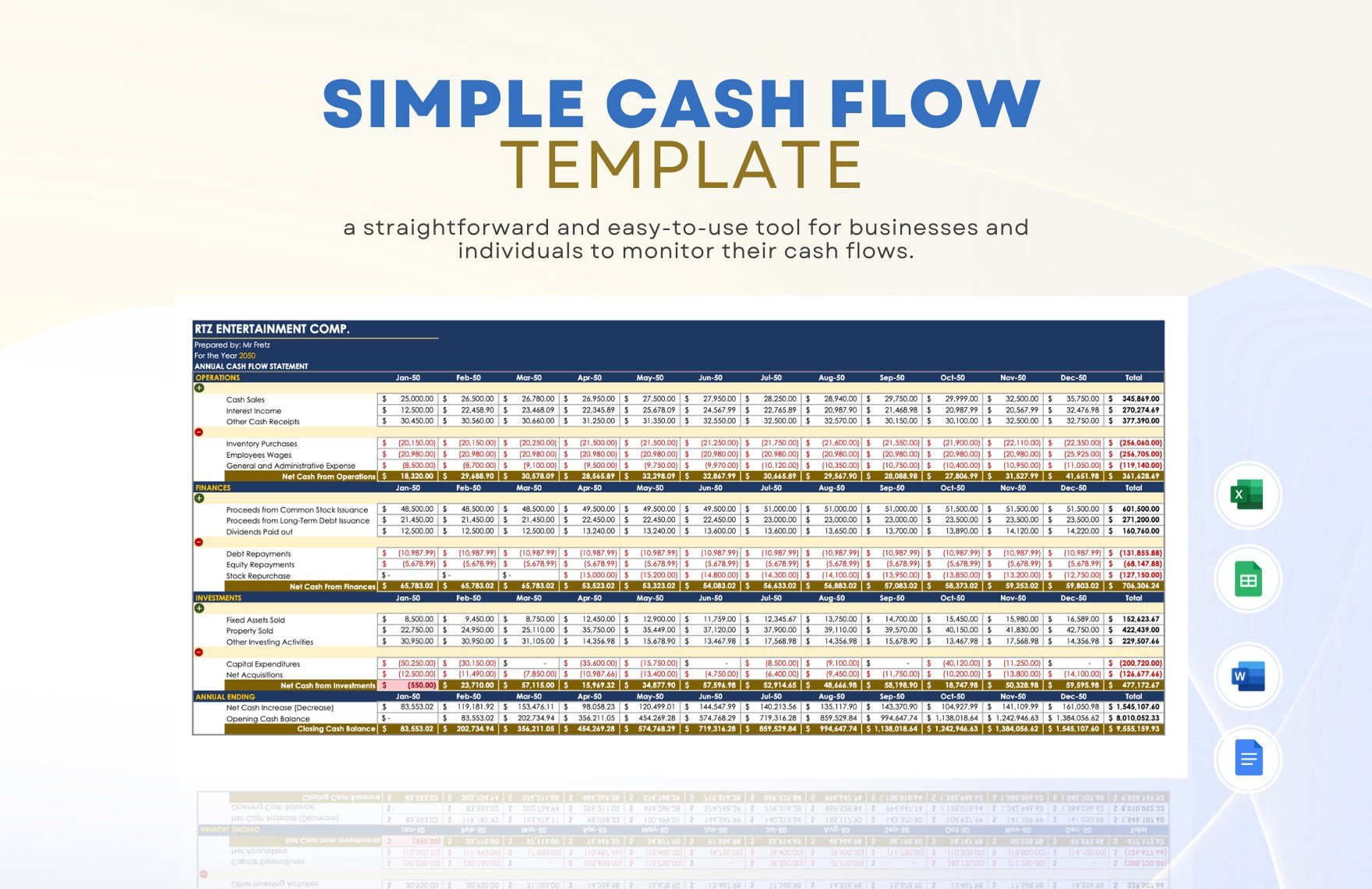

Decide on the period you want to analyze. This could be monthly, quarterly, or annually. Consistency is key.

Step 2: Identify Cash Flow Activities

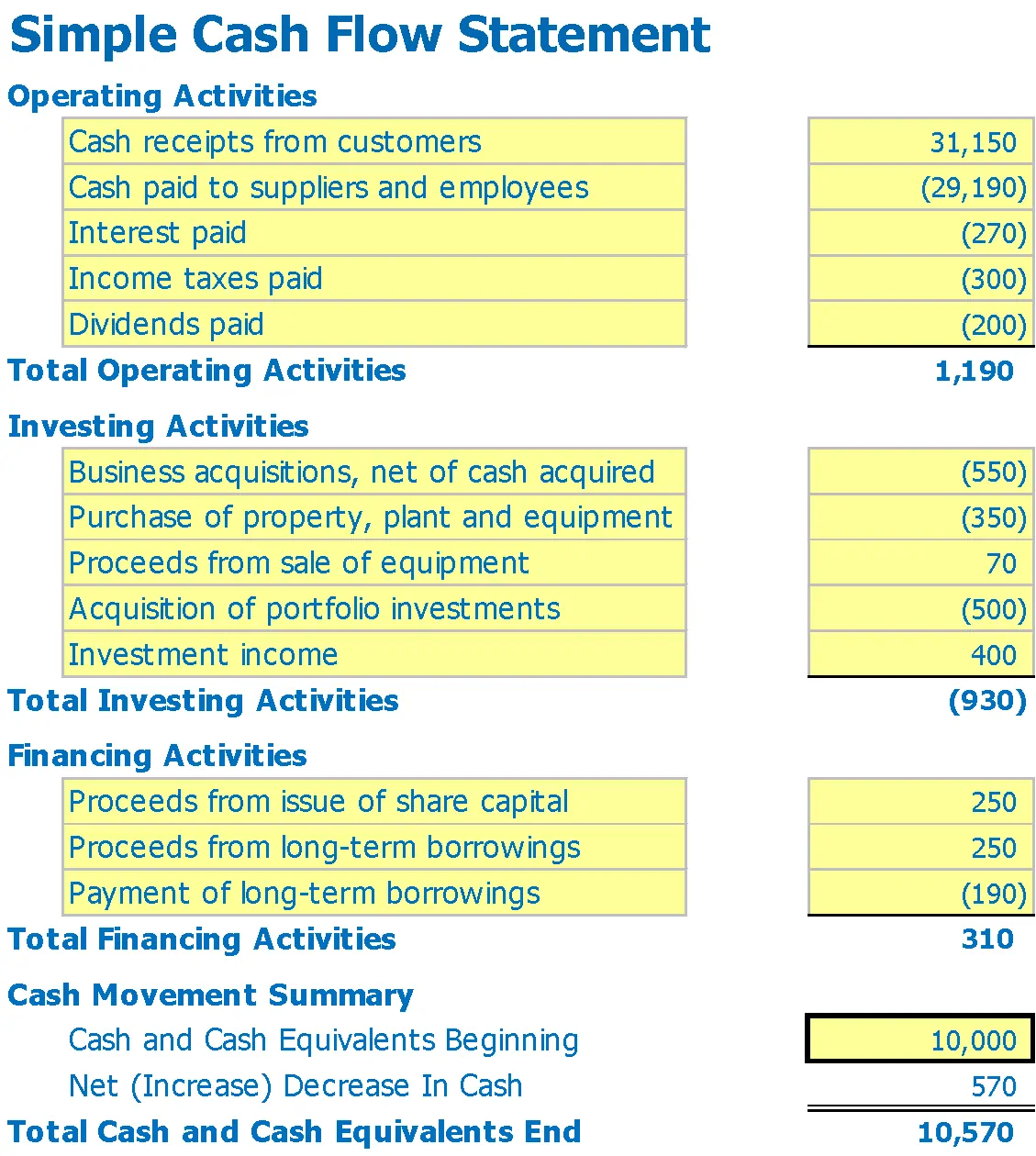

The core of the CFS lies in categorizing your cash inflows and outflows. We’ll use the three main activity categories:

- Operating Activities: These reflect the cash generated from your primary business operations.

- Cash Inflows:

- Cash from sales of goods or services

- Interest received

- Dividends received

- Cash Outflows:

- Cash paid to suppliers

- Cash paid to employees

- Interest paid

- Taxes paid

- Rent

- Cash Inflows:

- Investing Activities: These relate to the purchase and sale of long-term assets.

- Cash Inflows:

- Sale of property, plant, and equipment (PP&E)

- Sale of investments (e.g., stocks, bonds)

- Cash Outflows:

- Purchase of PP&E

- Purchase of investments

- Cash Inflows:

- Financing Activities: These involve how you finance your business.

- Cash Inflows:

- Proceeds from issuing debt (loans, bonds)

- Proceeds from issuing equity (selling stock)

- Cash Outflows:

- Repayment of debt

- Payment of dividends

- Repurchase of stock

- Cash Inflows:

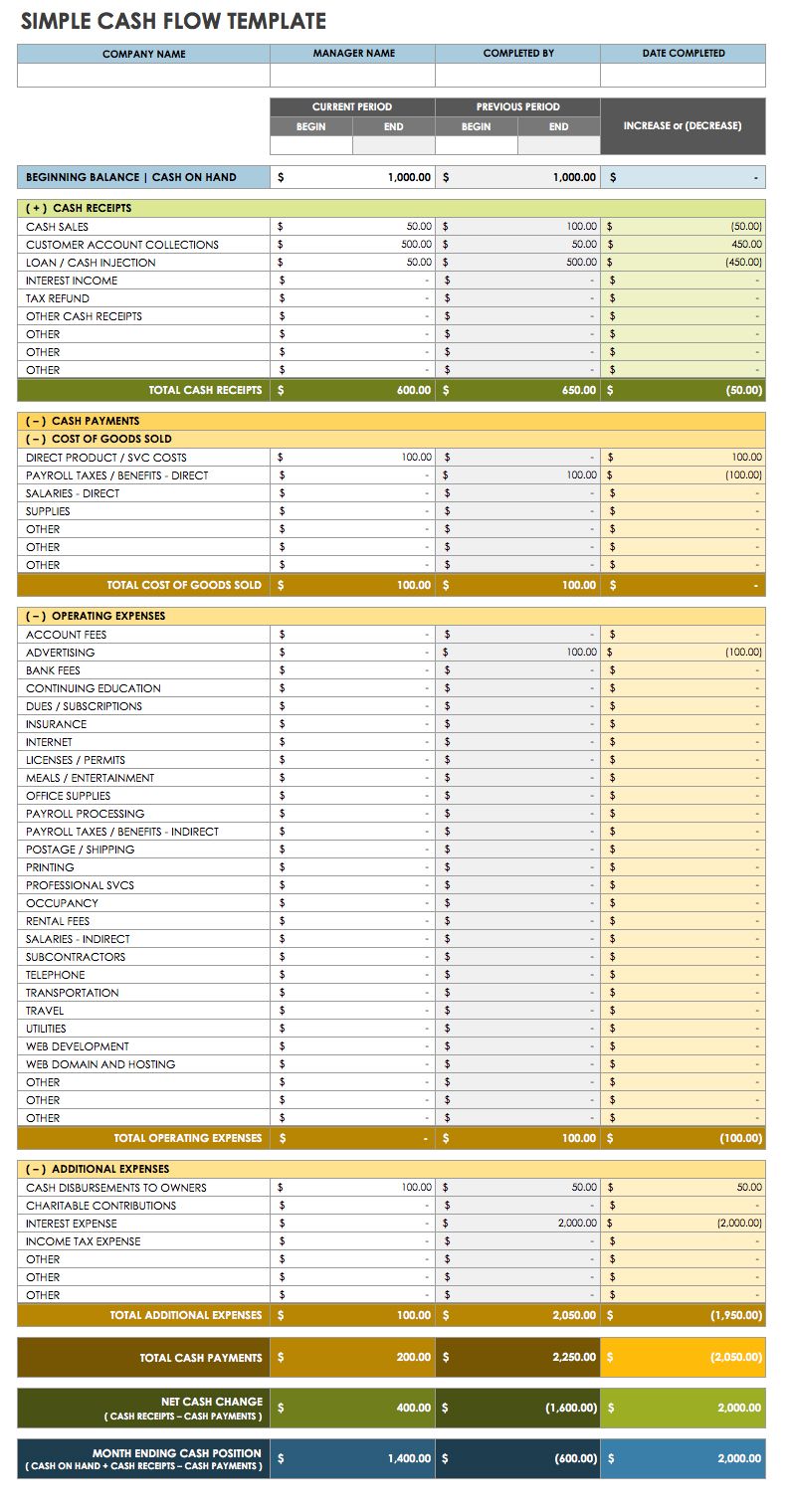

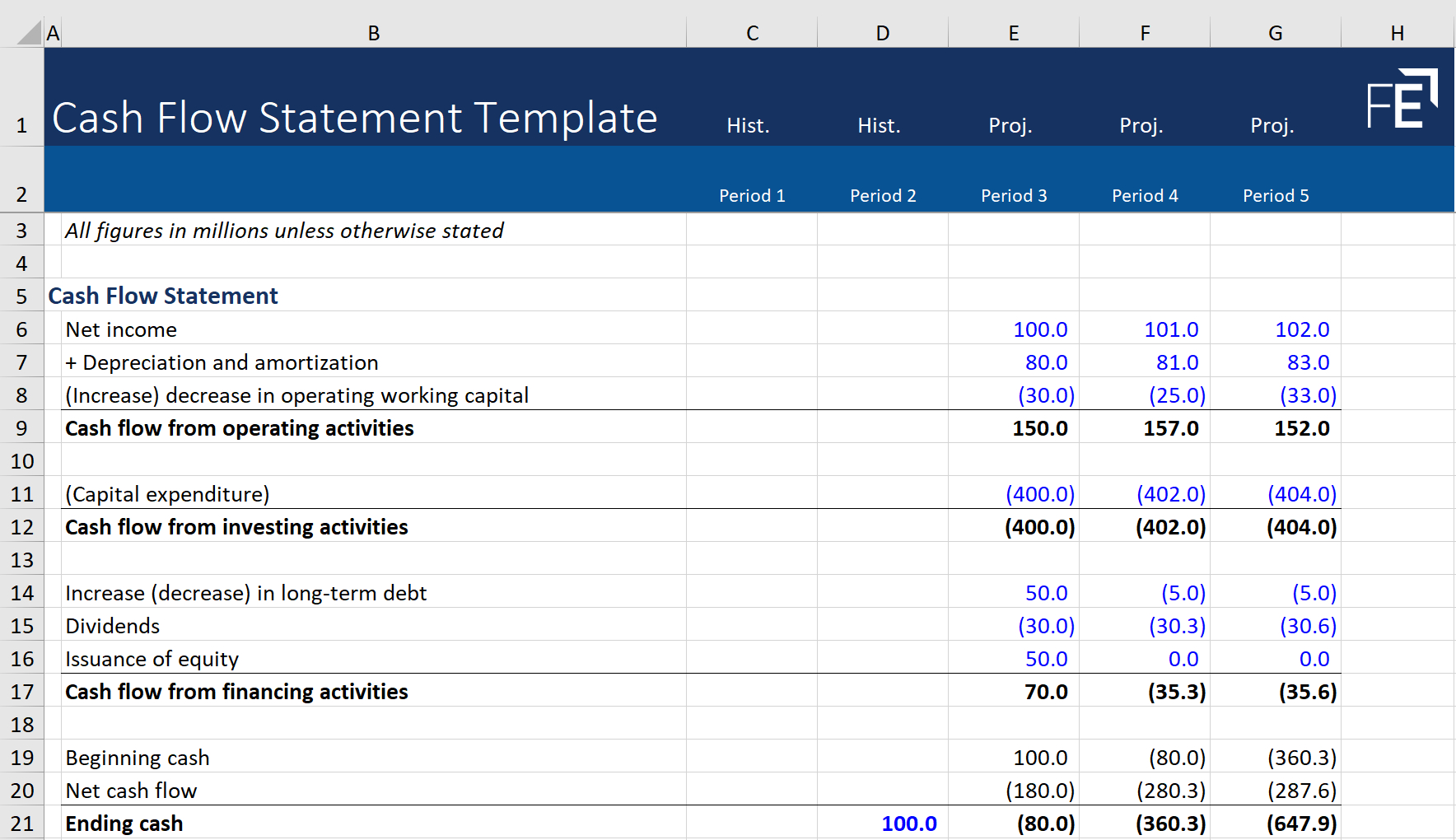

Step 3: Create Your Template

You can use a spreadsheet program like Microsoft Excel or Google Sheets, or even a simple paper-based system. Here’s a basic structure:

| Activity Category | Cash Inflows | Cash Outflows | Net Cash Flow |

|---|---|---|---|

| Operating Activities | |||

| Sales of Goods/Services | |||

| … (Other Operating Inflows) | |||

| Cash Paid to Suppliers | |||

| … (Other Operating Outflows) | |||

| Subtotal: Operating Activities | |||

| Investing Activities | |||

| Sale of Equipment | |||

| Purchase of Equipment | |||

| Subtotal: Investing Activities | |||

| Financing Activities | |||

| Proceeds from Loan | |||

| Repayment of Loan | |||

| Subtotal: Financing Activities | |||

| Net Increase/Decrease in Cash | |||

| Beginning Cash Balance | |||

| Ending Cash Balance |

Step 4: Populate the Template

- Gather your data: Collect all relevant bank statements, receipts, invoices, and other financial records for the chosen period.

- Input the numbers: Carefully record each cash inflow and outflow under the appropriate activity category and column.

- Calculate Subtotals: Sum the inflows and outflows for each activity category. Subtract outflows from inflows to determine the net cash flow for each category.

- Calculate Net Increase/Decrease in Cash: Sum the net cash flow from all three activity categories.

- Calculate Ending Cash Balance: Add the net increase/decrease in cash to your beginning cash balance (the cash balance at the start of the period).

Step 5: Analyze and Interpret Your Results

Once the template is complete, analyze the results:

- Overall Cash Flow: Is your net cash flow positive or negative? A positive cash flow indicates more cash coming in than going out.

- Operating Activities: This is often the most crucial category. Consistent positive cash flow from operations is a sign of a healthy business.

- Investing Activities: Look for trends in asset purchases and sales.

- Financing Activities: Understand how your financing decisions are impacting your cash position. Are you relying on debt, equity, or a combination?

- Compare to Previous Periods: Track your cash flow over time to identify trends and potential problems.

Tips for Success

- Accuracy is paramount: Double-check your numbers to avoid errors.

- Be consistent: Use the same categories and methods each period.

- Review regularly: Analyze your cash flow statement frequently to stay on top of your finances.

- Seek professional advice: If you’re unsure about any aspect of the process, consult with an accountant or financial advisor.

- Consider accounting software: Tools like QuickBooks or Xero can automate much of this process, saving you time and effort.

Conclusion: Mastering Your Cash Flow

This simplified cash flow statement template provides a practical and effective framework for managing your cash flow. By consistently tracking your cash inflows and outflows, you gain valuable insights into your business’s financial health, enabling you to make informed decisions, plan for the future, and ultimately, achieve long-term success. Embrace this tool, and you’ll be well on your way to financial control.

Frequently Asked Questions (FAQs)

1. What’s the difference between a Cash Flow Statement and an Income Statement? The Income Statement (Profit & Loss statement) measures profitability over a period, using the accrual method (revenue is recognized when earned, and expenses when incurred, regardless of cash flow). The Cash Flow Statement tracks actual cash inflows and outflows during the same period.

2. What if my cash flow is negative? A negative cash flow isn’t necessarily a sign of failure, but it warrants investigation. Determine why more cash is leaving the business than coming in. Consider cutting expenses, increasing sales, seeking financing, or improving your collection process.

3. Can I use this simplified template for tax purposes? This simplified template is primarily for internal financial management. While it can inform your tax planning, it generally doesn’t meet the standards required for tax filings. Consult with a tax professional for specific guidance.

4. How often should I prepare a cash flow statement? The frequency depends on your business needs. Many businesses find monthly or quarterly reporting sufficient. However, if you’re experiencing rapid growth, facing financial challenges, or need to closely monitor cash flow, you might need to prepare it more often.