The SSI Rental Agreement Template You Need Right Now: Ensuring a Smooth Landlord-Tenant Relationship

Renting out a property can be a rewarding experience, but it also comes with significant responsibility. A crucial element in any successful rental venture is a well-crafted rental agreement. For landlords who rent to tenants receiving Supplemental Security Income (SSI), having a specific and legally sound agreement is even more vital. This article will delve into the importance of an SSI rental agreement template, what to include, and how it protects both you and your tenant.

Why You Absolutely Need an SSI Rental Agreement Template

While a generic rental agreement might seem sufficient, an SSI-specific template offers several advantages, particularly in the context of a tenant receiving government assistance. It ensures clarity, mitigates potential risks, and promotes a transparent landlord-tenant relationship. Here’s why a tailored template is essential:

- Clarity and Understanding: Explicitly outlines the terms specific to SSI recipients, minimizing misunderstandings.

- Legal Compliance: Helps ensure adherence to federal and state regulations regarding housing and SSI recipients.

- Risk Mitigation: Addresses potential issues related to late rent payments, damage to property, and communication protocols.

- Protection for Both Parties: Provides a legal framework that protects the rights and responsibilities of both the landlord and the tenant.

- Professionalism and Trust: Demonstrates professionalism and a commitment to fair housing practices, building trust with potential tenants.

Key Components to Include in Your SSI Rental Agreement Template

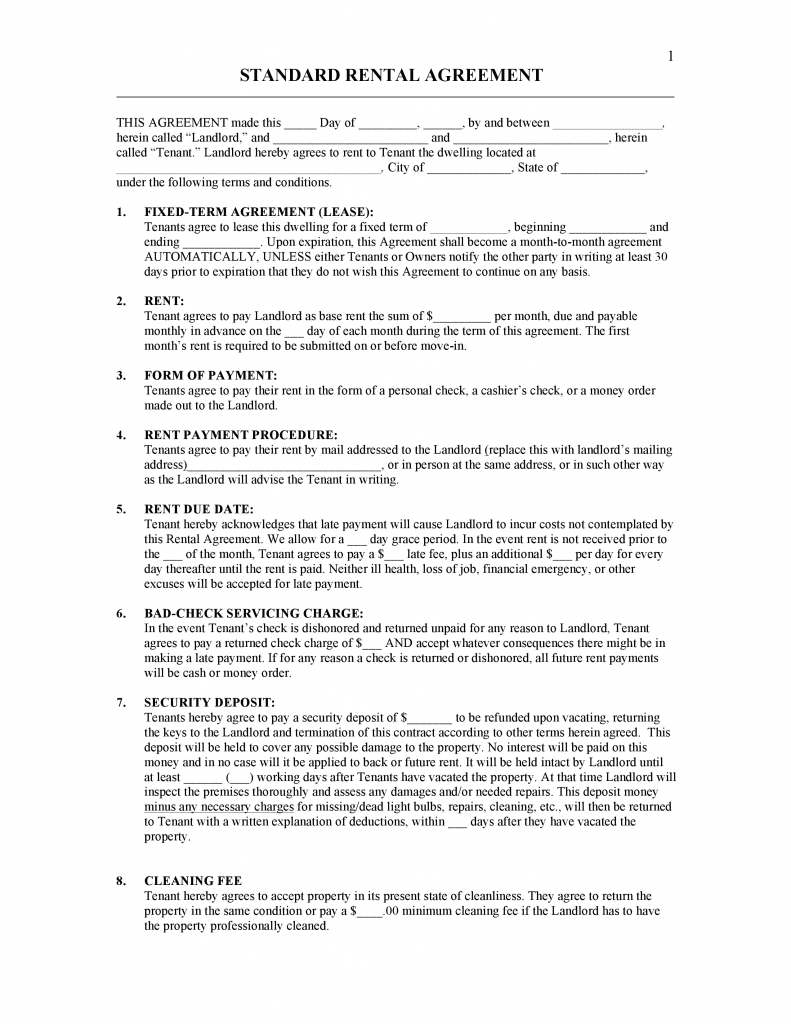

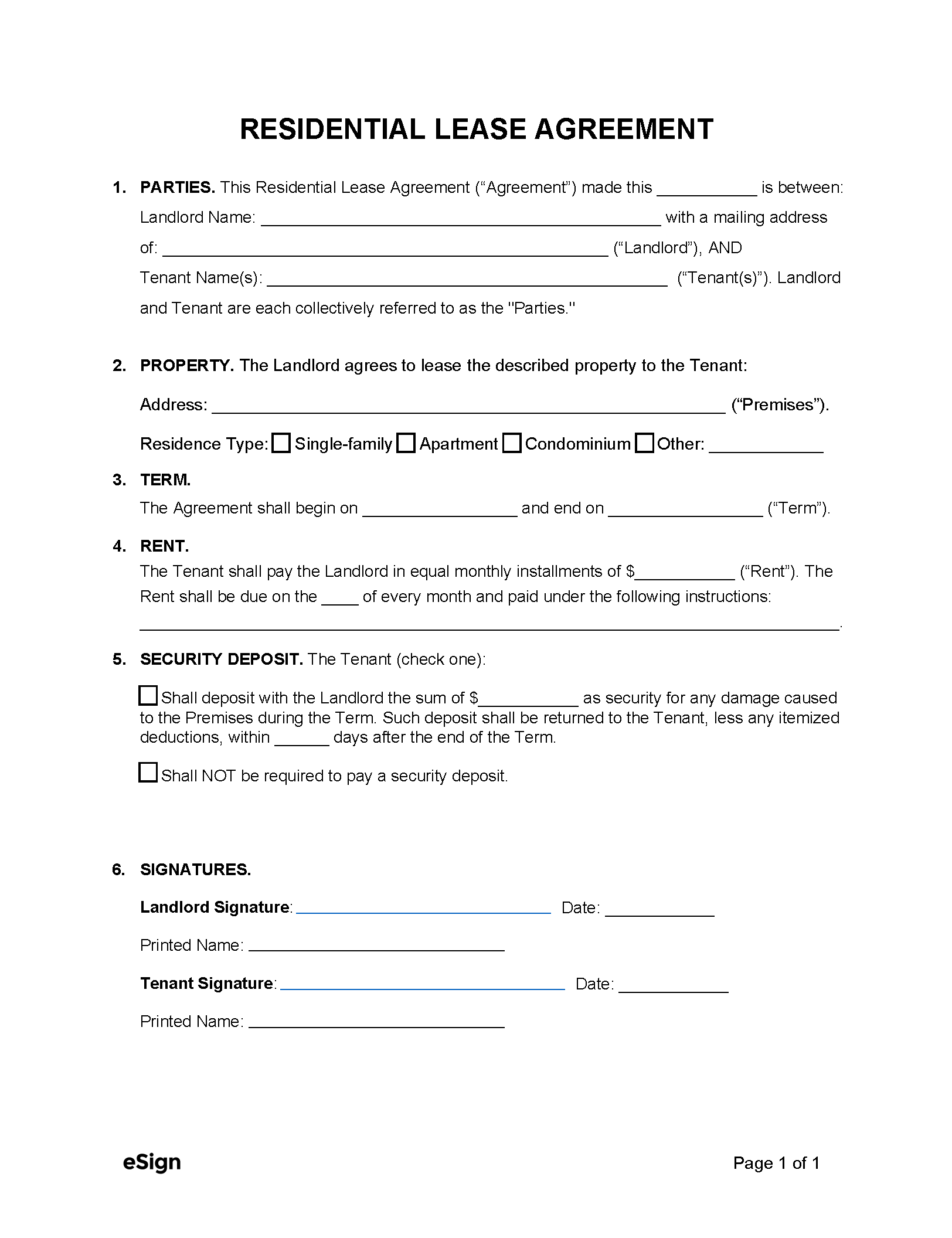

A comprehensive SSI rental agreement template should cover all the standard elements of a rental agreement, plus some crucial additions to address the unique circumstances of SSI recipients. Here’s a breakdown of essential clauses:

1. Basic Information

- Landlord and Tenant Details: Full names, contact information, and addresses.

- Property Address: The complete address of the rental property.

- Lease Term: The start and end dates of the lease.

2. Financial Terms

- Rent Amount: The exact monthly rent amount.

- Due Date and Payment Method: Clearly state the rent due date and acceptable payment methods (e.g., check, online transfer, money order).

- Late Payment Policy: Specify late fees and grace periods, if any.

- Security Deposit: Amount, purpose, and procedures for returning the deposit.

- Income Verification Clause: A statement confirming the tenant’s SSI income, potentially with a provision for periodic verification (with tenant consent and in compliance with privacy laws).

3. Property Usage and Maintenance

- Permitted Occupants: State the maximum number of occupants and any restrictions.

- Property Condition: Outline the condition of the property at the start of the lease and the tenant’s responsibility for its upkeep.

- Maintenance and Repairs: Clearly define the responsibilities of the landlord and tenant for maintenance and repairs.

- Pet Policy: Specify if pets are allowed, any breed or size restrictions, and associated fees or deposits.

- Use of Premises: Outline allowed uses of the property, including restrictions on illegal activities.

4. Specific Clauses for SSI Recipients

- SSI Verification Clause: This clause should acknowledge the tenant’s SSI income and potentially outline a procedure for verifying continued eligibility (with tenant consent).

- Rent Assistance Considerations: If the tenant receives any rent assistance, specify how the assistance is handled (e.g., paid directly to the landlord).

- Communication Protocol: Specify communication methods for rent-related issues, including options for contacting the Social Security Administration if necessary (with tenant consent and awareness).

- Late Payment Contingency: Outline specific steps the landlord will take if rent payments are consistently late, considering potential issues related to SSI payments.

5. Legal and Miscellaneous Provisions

- Governing Law: Specify the state’s laws that govern the agreement.

- Severability Clause: States that if any part of the agreement is deemed unenforceable, the rest of the agreement remains valid.

- Termination Clause: Outlines the conditions under which the lease can be terminated by either party.

- Notices: How notices related to the agreement should be delivered.

- Signatures: Spaces for both the landlord and tenant to sign and date the agreement.

Finding and Customizing an SSI Rental Agreement Template

You can find pre-made SSI rental agreement templates online. However, remember that these are often general templates and may need to be customized to comply with your local and state laws.

- Legal Review: It is highly recommended to have your template reviewed by a legal professional familiar with landlord-tenant law in your area. This ensures compliance and protects your interests.

- Customization: Tailor the template to your specific property and circumstances.

- Adaptation: Keep the agreement updated to account for any changes in local ordinances or state laws.

Best Practices for Working with SSI Tenants

Beyond the agreement itself, fostering a positive landlord-tenant relationship is crucial. Here are some best practices:

- Communication: Maintain open and clear communication with your tenant.

- Respect: Treat all tenants with respect and fairness.

- Transparency: Be transparent about all policies and procedures.

- Patience: Be understanding of potential financial constraints that SSI recipients may face.

- Compliance: Stay informed about fair housing laws and regulations.

Conclusion: Secure Your Investment with a Solid Agreement

A well-drafted SSI rental agreement template is not just a legal document; it’s a foundation for a successful and respectful landlord-tenant relationship. By including the essential components outlined above, customizing the template to your specific needs, and seeking legal counsel, you can protect your investment, ensure compliance, and cultivate a positive rental experience for both you and your tenant. Don’t underestimate the power of a well-crafted agreement – it’s the first step toward a smooth and profitable rental venture.

Frequently Asked Questions (FAQs)

1. Do I need a separate rental agreement for an SSI recipient?

While not legally required, having a dedicated SSI rental agreement template is highly recommended. It offers clarity, addresses specific concerns related to SSI payments, and helps ensure compliance with relevant regulations.

2. Can I require proof of SSI income?

You can include a clause acknowledging the tenant’s SSI income. You can also include a clause requesting periodic verification of continued eligibility, but only with the tenant’s consent and within the bounds of privacy laws.

3. What happens if the tenant’s SSI payments are late?

Your agreement should outline a late payment policy, including fees and grace periods. However, remember to communicate with the tenant and explore options, such as payment plans, before pursuing eviction.

4. Can I evict an SSI recipient for non-payment of rent?

Yes, you can evict a tenant for non-payment of rent, regardless of their income source. However, you must follow the proper legal procedures outlined in your state’s landlord-tenant laws.

5. Is it illegal to discriminate against SSI recipients?

Yes, it is generally illegal to discriminate against someone based on their source of income. You must treat all prospective tenants fairly and make your rental decisions based on their ability to meet the terms of the lease, not their source of income.