The Supplier Risk Assessment Template in Excel That Works: Streamlining Your Supply Chain Security

In today’s interconnected business landscape, a robust supply chain is the lifeblood of any successful organization. However, it’s also a complex network vulnerable to a myriad of risks – from financial instability and operational disruptions to ethical concerns and cybersecurity threats. That’s where supplier risk assessment comes in. This proactive process helps you identify, evaluate, and mitigate potential vulnerabilities within your supply chain, safeguarding your business from costly disruptions and reputational damage.

While sophisticated software solutions exist for supplier risk management, the reality is that many businesses, especially small to medium-sized enterprises (SMEs), often rely on more accessible and budget-friendly tools. This is where the power of a well-designed Excel template truly shines. This article will guide you through creating and utilizing a supplier risk assessment template in Excel that WORKS, providing you with the knowledge and resources to effectively manage your supply chain risks.

Why Use an Excel-Based Supplier Risk Assessment Template?

Before diving into the specifics, let’s understand why an Excel template is a practical choice:

- Accessibility: Excel is widely available and requires no specialized software or training to get started.

- Cost-Effective: It eliminates the need for expensive subscription services.

- Customization: You can tailor the template to your specific industry, business needs, and risk priorities.

- Flexibility: Easily modify and update the template as your supply chain evolves.

- Data Visualization: Excel offers powerful charting and graphing capabilities for visualizing risk data and identifying trends.

Building Your Effective Supplier Risk Assessment Template in Excel

Creating a functional supplier risk assessment template involves several key steps. Here’s a breakdown of the essential components:

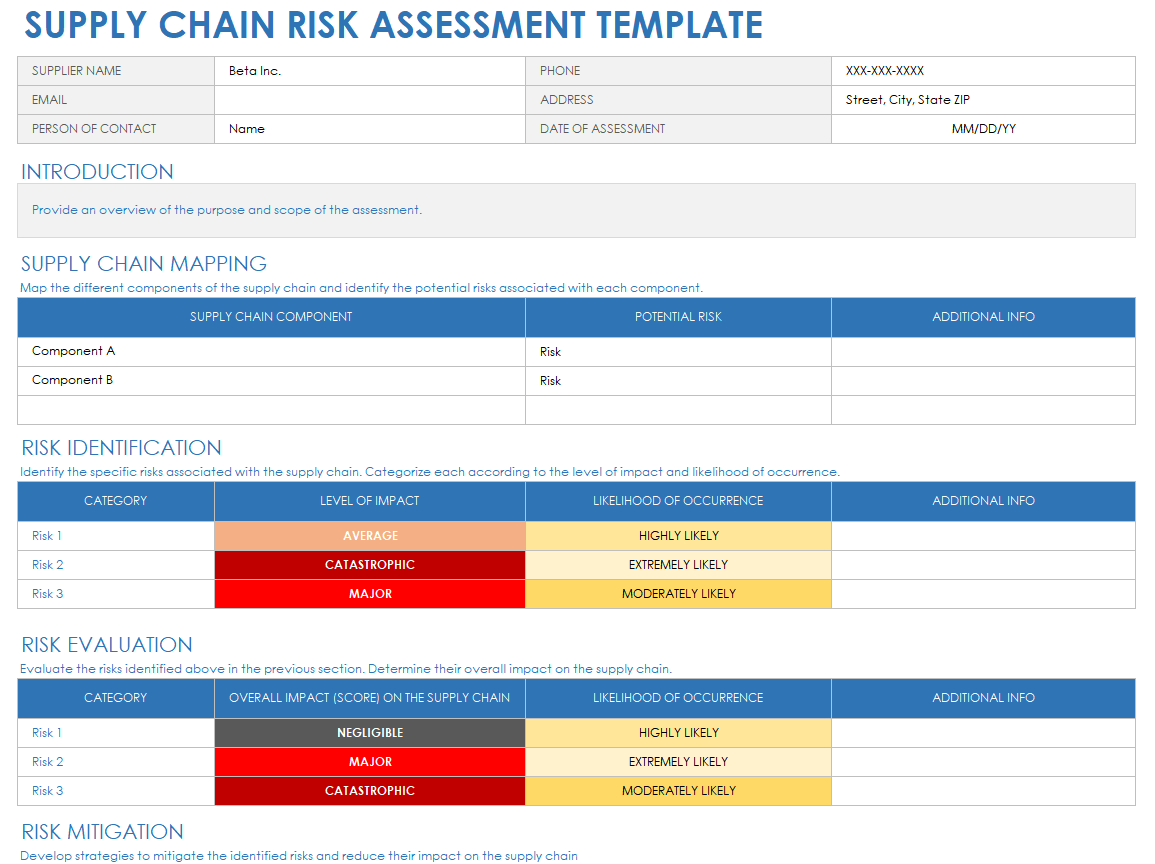

1. Define Your Risk Categories

The first step is to identify the specific areas of risk relevant to your business and industry. Common risk categories include:

- Financial Risk:

- Financial stability and creditworthiness of the supplier

- Payment terms and potential for late payments

- Operational Risk:

- Capacity to meet demand and production capabilities

- Delivery reliability and on-time performance

- Quality control and adherence to standards

- Geopolitical Risk:

- Political instability in the supplier’s operating location

- Trade regulations and tariffs

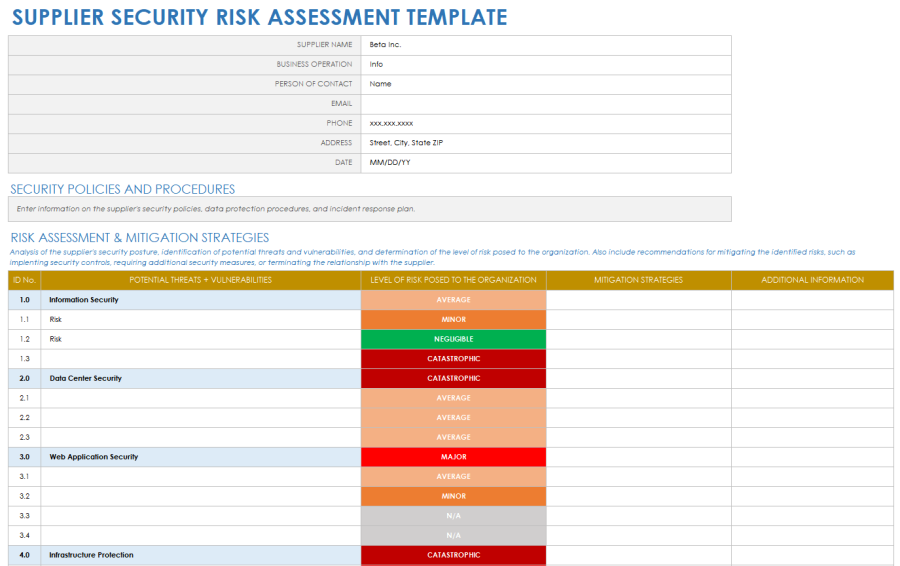

- Cybersecurity Risk:

- Data security practices and protection of sensitive information

- Vulnerability to cyberattacks

- Compliance Risk:

- Adherence to legal and regulatory requirements (e.g., labor laws, environmental regulations)

- Ethical sourcing practices and potential for human rights violations

- Reputational Risk:

- Potential for negative publicity due to supplier’s actions or business practices

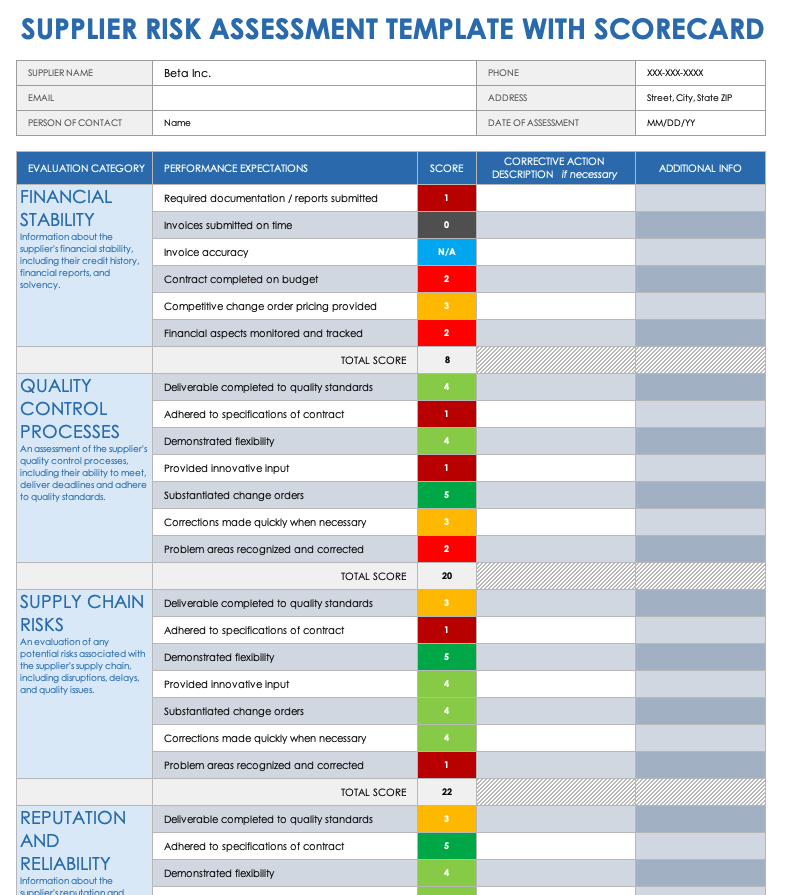

2. Create a Scoring System

Establish a consistent scoring system to quantify the level of risk within each category. A common approach is to use a numerical scale, such as:

- 1 - Low Risk: Minimal impact to your business.

- 2 - Medium Risk: Potential for some disruption or impact.

- 3 - High Risk: Significant potential for disruption or impact.

- 4 - Very High Risk: Severe impact to your business.

You can also incorporate a weighted scoring system, assigning different weights to each risk category based on its importance to your business. For example, cybersecurity risk might be weighted higher than financial risk for a company handling sensitive customer data.

3. Develop Assessment Questions

For each risk category, create a set of assessment questions. These questions should be specific, measurable, and designed to gather the necessary information about your suppliers. Examples include:

- Financial Risk: “What is the supplier’s current credit rating?” “What is the supplier’s debt-to-equity ratio?”

- Operational Risk: “What is the supplier’s production capacity?” “What is the supplier’s historical on-time delivery rate?”

- Cybersecurity Risk: “Does the supplier have an incident response plan?” “Has the supplier undergone a recent cybersecurity audit?”

- Compliance Risk: “Does the supplier comply with all relevant labor laws?” “Does the supplier have any environmental certifications?”

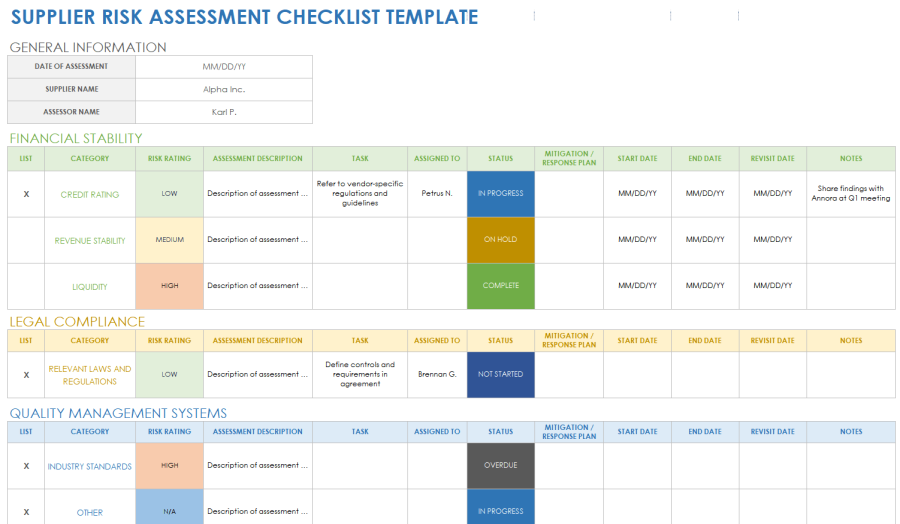

4. Design Your Excel Template Layout

Structure your Excel template logically and clearly. Consider the following columns:

- Supplier Name: The name of the supplier being assessed.

- Risk Category: The specific category being evaluated (e.g., Financial, Operational).

- Assessment Question: The question being asked.

- Response: The supplier’s answer (e.g., “Yes,” “No,” a numerical value).

- Score: The assigned score based on the response.

- Weight (Optional): The weight assigned to the risk category.

- Weighted Score (Optional): The score multiplied by the weight.

- Notes/Comments: Space for additional observations and context.

- Overall Risk Level: Calculated based on the total or weighted score.

- Mitigation Plan: Actions to reduce or eliminate risk

Use clear headings, consistent formatting, and data validation (e.g., drop-down lists for scores) to ensure data accuracy and ease of use.

5. Implement Formulas and Analysis

Leverage Excel’s built-in formulas to automate the assessment process:

- SUM: To calculate the total score for each supplier.

- AVERAGE: To calculate the average score for each risk category.

- IF: To automatically determine the overall risk level based on the total score (e.g., “Low,” “Medium,” “High”).

- Conditional Formatting: To visually highlight high-risk areas (e.g., using red shading for scores above a certain threshold).

6. Regularly Update and Review

Supplier risk assessment is not a one-time task. It’s an ongoing process that requires regular updates and reviews. Set up a schedule for reassessing your suppliers, and update your template with new information as it becomes available.

Best Practices for Effective Implementation

- Involve Stakeholders: Engage relevant departments (e.g., procurement, legal, IT) in the assessment process.

- Gather Supplier Information: Collect information through questionnaires, audits, and due diligence.

- Communicate with Suppliers: Inform suppliers about the assessment process and encourage transparency.

- Prioritize High-Risk Suppliers: Focus your efforts on the suppliers with the highest risk profiles.

- Develop Mitigation Plans: Create action plans to address identified risks and monitor their effectiveness.

- Document Everything: Maintain detailed records of your assessments, findings, and mitigation efforts.

Conclusion: Empowering Your Supply Chain Security

A well-designed Excel-based supplier risk assessment template is a powerful tool for any business seeking to proactively manage its supply chain risks. By following these steps, you can create a customized template that helps you identify vulnerabilities, assess potential impacts, and implement effective mitigation strategies. This proactive approach not only protects your business from disruptions but also enhances your overall supply chain resilience and strengthens your relationships with key suppliers.

FAQs About Supplier Risk Assessment Templates in Excel

Q1: How often should I conduct supplier risk assessments?

A: The frequency depends on the criticality of the supplier and the level of risk. For high-risk suppliers, assessments should be conducted more frequently (e.g., annually or even quarterly). For lower-risk suppliers, less frequent assessments (e.g., every two to three years) may suffice. It is also important to reassess after any significant changes, such as a change in the supplier’s ownership, a major shift in their business operations, or a significant event in their operating environment.

Q2: What if I don’t have the resources for a full audit of my suppliers?

A: Even without full audits, you can still gather valuable information through questionnaires, publicly available data (e.g., credit reports, news articles), and communication with your suppliers. Start with a basic assessment and gradually increase the level of detail as your resources allow.

Q3: Can I use this template for all types of suppliers?

A: Yes, the template can be adapted to assess various types of suppliers. However, you may need to customize the risk categories and assessment questions based on the specific nature of the goods or services provided. For example, a supplier of raw materials will require different considerations than a supplier of IT services.

Q4: How do I handle suppliers who are resistant to providing information?

A: Transparency is key. Communicate the importance of the assessment and the benefits to both parties (e.g., improved collaboration, reduced risk). If a supplier remains resistant, consider the implications for your business and weigh the risks against the potential benefits of continuing the relationship. You may need to re-evaluate the supplier’s overall risk profile and adjust your mitigation strategies accordingly.

Q5: What are some alternatives to using Excel?

A: While Excel is a good starting point, you can consider these alternatives as your needs grow:

- Google Sheets: Similar functionality to Excel, but with the benefit of cloud-based collaboration.

- Supplier Risk Management Software: More sophisticated solutions that automate many aspects of the assessment process, including data collection, analysis, and reporting.

- Dedicated Risk Management Platforms: Comprehensive platforms that can handle supplier risk assessment, compliance, and other risk management activities.