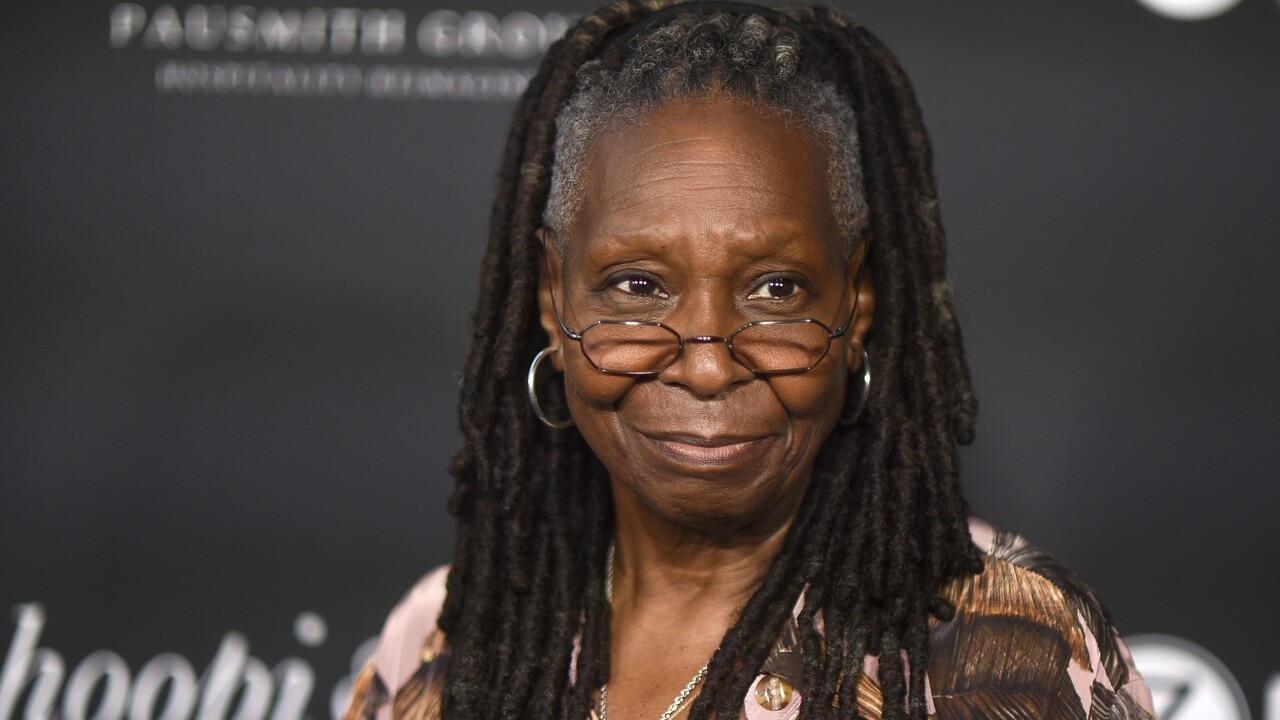

Whoopi Goldberg Doubles Down: High Bills Threaten Retirement Dreams

Whoopi Goldberg, the celebrated actress and comedian, has recently reiterated her concerns about the escalating cost of living and its devastating impact on retirement planning. Her outspoken comments highlight a crucial issue facing millions: the increasingly difficult reality of securing a comfortable retirement in the face of rising bills. This article delves into Goldberg’s stance, explores the broader context of retirement challenges, and offers insights into potential solutions.

Goldberg’s Vocal Advocacy for Retirement Security

Goldberg, known for her candidness, hasn’t shied away from expressing her anxieties about retirement. She’s publicly stated that the rising costs of essentials, from healthcare to housing, make achieving financial security in retirement a daunting, almost impossible task for many. This isn’t simply a personal observation; it reflects a widespread concern shared by a significant portion of the population. Her high profile allows her to amplify the voices of countless individuals struggling with similar financial anxieties.

The Crushing Weight of Rising Bills

The challenges Goldberg highlights are rooted in several key factors:

- Healthcare Costs: Medical expenses are a leading cause of financial strain, especially in retirement. The cost of insurance, medications, and long-term care can quickly deplete savings.

- Housing Expenses: Rent and mortgage payments continue to climb, placing a significant burden on retirees with fixed incomes. Property taxes also contribute to this growing financial pressure.

- Inflation: The persistent rise in the cost of goods and services erodes the purchasing power of savings and retirement income, making it harder to maintain a comfortable lifestyle.

- Stagnant Wages: For many, wages haven’t kept pace with the rising cost of living, leaving them with insufficient savings to support a comfortable retirement.

A National Retirement Crisis?

Goldberg’s concerns are not isolated. Many Americans face a similar predicament, leading to a growing sense of unease about retirement security. This isn’t just about luxury items; it’s about the basic necessities of life. The increasing difficulty of affording these essentials underscores a potential national retirement crisis. Experts are increasingly warning about the inadequacy of current retirement savings plans and the urgent need for systemic changes.

Potential Solutions and Pathways Forward

Addressing this crisis requires a multi-pronged approach:

- Increased Retirement Savings Incentives: Government policies could incentivize greater retirement savings through tax breaks and matching contributions.

- Affordable Healthcare Solutions: Reforming the healthcare system to make it more affordable and accessible is crucial for retirement security.

- Addressing Income Inequality: Policies aimed at reducing income inequality could help ensure that more people have the means to save adequately for retirement.

- Financial Literacy Programs: Educating the public about financial planning and responsible money management can empower individuals to better prepare for retirement.

Conclusion: A Shared Concern Demands Action

Whoopi Goldberg’s outspokenness on the rising cost of living and its impact on retirement highlights a critical issue demanding immediate attention. Her perspective underscores the need for a comprehensive national conversation about retirement security and the implementation of effective solutions. Ignoring this growing concern will only exacerbate the challenges faced by millions of Americans as they approach retirement.

Frequently Asked Questions (FAQs)

Q: What is the average retirement savings needed in the US? A: There’s no single answer, as needs vary based on lifestyle and location. However, many financial advisors suggest aiming for at least 80% of pre-retirement income.

Q: What are some ways to save more for retirement? A: Increase contributions to retirement accounts (401(k), IRA), reduce debt, create a budget, and explore additional income streams.

Q: What government programs assist retirees? A: Social Security, Medicare, and Medicaid are key government programs providing financial and healthcare support to retirees.

Q: How can I plan for rising healthcare costs in retirement? A: Consider long-term care insurance, explore Medicare Advantage plans, and maintain a healthy lifestyle to reduce healthcare needs.

Q: What is the impact of inflation on retirement savings? A: Inflation erodes the purchasing power of savings, meaning your money buys less over time. It’s crucial to account for inflation when planning for retirement.