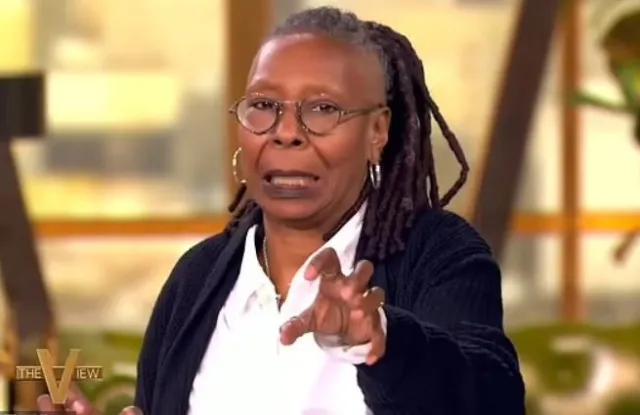

Whoopi Goldberg on Retirement: Fortune and the Failure of “Marrying Well”

Whoopi Goldberg, a name synonymous with Hollywood success, recently revealed a surprising truth about her financial situation: despite her decades-long career and considerable wealth, she can’t afford to retire. This revelation, coupled with her candid admission that her financial standing isn’t due to lavish spending but rather a lack of strategic financial planning and the absence of a wealthy spouse, has sparked a conversation about wealth, marriage, and the realities of financial security in Hollywood. This article delves into Goldberg’s comments, exploring the complexities of her situation and the broader implications for women in the entertainment industry.

The Reality of Hollywood Wealth and Personal Finances

Goldberg’s statement highlights a critical aspect often overlooked in discussions about celebrity wealth: the difference between earning potential and actual financial security. While she’s undoubtedly accumulated significant wealth through her acting, producing, and hosting roles, she’s emphasized that this doesn’t equate to a comfortable retirement. This underscores the importance of financial literacy and strategic planning, regardless of income level. Factors like investment choices, taxes, and unexpected expenses can significantly impact long-term financial stability.

The Myth of “Marrying Well” and Financial Independence

Goldberg’s comments directly challenge the societal expectation that women can achieve financial security through marriage to a wealthy partner. This antiquated notion, while still prevalent, ignores the realities of financial independence and personal responsibility. While a financially successful marriage can certainly contribute to wealth accumulation, it shouldn’t be the sole strategy for securing one’s future. Goldberg’s experience serves as a powerful reminder that financial planning and proactive management are crucial, regardless of marital status.

Lessons Learned from Whoopi Goldberg’s Experience

Several key takeaways emerge from Goldberg’s candid discussion:

- Financial literacy is paramount: Regardless of income, understanding investment strategies, tax implications, and budgeting is crucial for long-term financial security.

- Marriage shouldn’t be a financial strategy: Relying on a partner for financial stability is risky. Building independent financial security is essential for both men and women.

- Professional financial advice is invaluable: Consulting with financial advisors can provide personalized strategies for wealth management and retirement planning.

- Open conversations about finances are necessary: Discussing financial matters openly, particularly with family and financial professionals, is key to making informed decisions.

The Broader Implications for Women in Entertainment

Goldberg’s experience resonates with many women in the entertainment industry who often face unique financial challenges, including fluctuating income, periods of unemployment, and gender-based pay disparities. Her story serves as a call to action, encouraging women to prioritize financial planning and advocate for fair compensation.

Conclusion

Whoopi Goldberg’s honest assessment of her financial situation offers a valuable lesson: wealth and financial security are not always synonymous. Her experience emphasizes the importance of proactive financial planning, independent wealth building, and challenging societal expectations around women and financial dependence. Her story serves as a powerful reminder that achieving true financial freedom requires careful planning, sound financial literacy, and a long-term perspective.

Frequently Asked Questions (FAQs)

- How much is Whoopi Goldberg worth? While her exact net worth is not publicly known, various sources estimate it to be in the tens of millions of dollars.

- Why can’t Whoopi Goldberg afford to retire? She hasn’t explicitly stated a specific reason beyond implying a lack of strategic financial planning and not having a wealthy spouse to support her retirement.

- What kind of financial advice should someone seek? Seeking advice from a certified financial planner or advisor is recommended for personalized guidance based on individual circumstances.

- What are some key financial planning strategies? These include budgeting, investing, saving, understanding tax implications, and estate planning.

- Is it common for high-earning celebrities to struggle financially? While less common than for the average person, it’s not unheard of for celebrities to face financial difficulties due to factors like poor financial management, lavish spending, and unexpected expenses.